Region:Middle East

Author(s):Shubham

Product Code:KRAA0789

Pages:82

Published On:August 2025

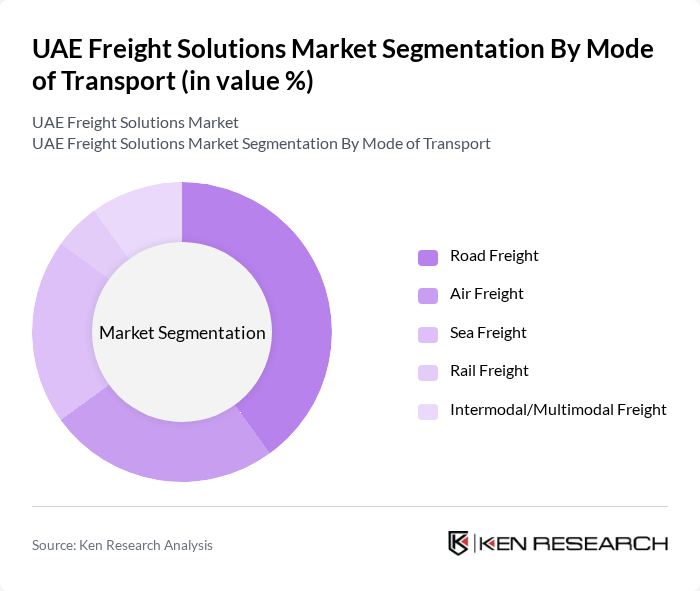

By Mode of Transport:The freight solutions market is segmented into various modes of transport, including road, air, sea, rail, and intermodal/multimodal freight. Each mode serves distinct logistical needs, with road freight being the most utilized due to its flexibility and accessibility. Air freight is preferred for time-sensitive deliveries, while sea freight is favored for bulk shipments. Rail freight offers cost-effective solutions for long-distance transport, and intermodal/multimodal freight combines multiple transport modes for efficiency .

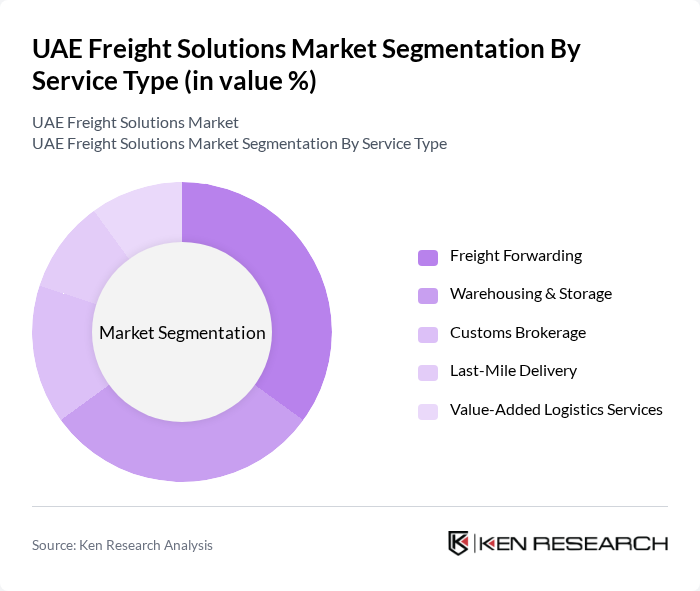

By Service Type:The service type segmentation includes freight forwarding, warehousing & storage, customs brokerage, last-mile delivery, and value-added logistics services. Freight forwarding is a dominant service due to its essential role in managing shipments across various transport modes. Warehousing & storage services are increasingly important as businesses seek to optimize inventory management. Last-mile delivery has gained traction with the rise of e-commerce, while customs brokerage ensures compliance with regulations, and value-added services enhance overall logistics efficiency .

The UAE Freight Solutions Market is characterized by a dynamic mix of regional and international players. Leading participants such as DP World, Aramex, Agility Logistics, Emirates Logistics, Abu Dhabi Ports, Gulf Agency Company (GAC), Kuehne + Nagel, DHL Global Forwarding, FedEx Express, Maersk, DB Schenker, CEVA Logistics, Emirates SkyCargo, UPS, and Bolloré Logistics contribute to innovation, geographic expansion, and service delivery in this space.

The future of the UAE freight solutions market appears promising, driven by ongoing investments in technology and infrastructure. As e-commerce continues to expand, logistics providers are likely to enhance their service offerings to meet consumer demands. Additionally, the integration of sustainable practices and smart technologies will play a crucial role in shaping the market. Companies that adapt to these trends will be better positioned to capitalize on emerging opportunities and navigate challenges effectively.

| Segment | Sub-Segments |

|---|---|

| By Mode of Transport | Road Freight Air Freight Sea Freight Rail Freight Intermodal/Multimodal Freight |

| By Service Type | Freight Forwarding Warehousing & Storage Customs Brokerage Last-Mile Delivery Value-Added Logistics Services |

| By End-User Industry | Oil & Gas Construction Retail & E-commerce Automotive Pharmaceuticals & Healthcare Food & Beverage Others |

| By Geographic Region | Dubai Abu Dhabi Sharjah Northern Emirates |

| By Delivery Mode | Standard Delivery Expedited Delivery Same-Day Delivery Scheduled Delivery |

| By Customer Type | B2B B2C Government Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Air Freight Services | 50 | Air Freight Managers, Operations Directors |

| Sea Freight Operations | 45 | Logistics Coordinators, Shipping Managers |

| Land Freight Solutions | 40 | Fleet Managers, Supply Chain Analysts |

| Customs Brokerage Services | 40 | Customs Compliance Officers, Trade Specialists |

| Freight Forwarding Trends | 50 | Business Development Managers, Market Analysts |

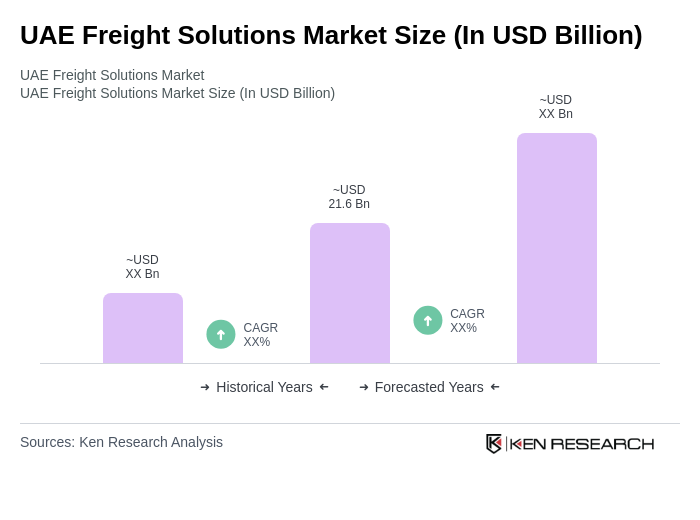

The UAE Freight Solutions Market is valued at approximately USD 21.6 billion, driven by the growth of e-commerce, increased trade activities, and significant investments in logistics infrastructure.