Region:Europe

Author(s):Shubham

Product Code:KRAA0734

Pages:99

Published On:August 2025

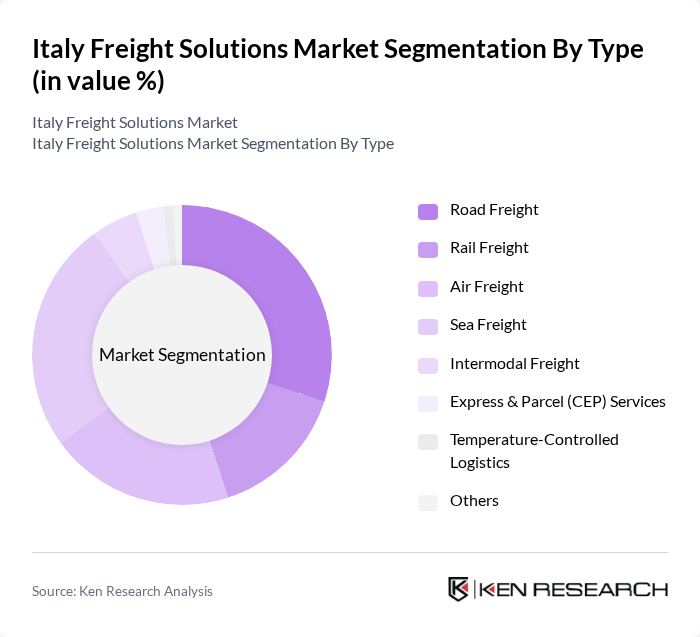

By Type:The freight solutions market is segmented by Road Freight, Rail Freight, Air Freight, Sea Freight, Intermodal Freight, Express & Parcel (CEP) Services, Temperature-Controlled Logistics, and Others. Each segment addresses specific logistics needs: Road Freight dominates domestic distribution; Rail Freight is essential for bulk and long-haul shipments; Air Freight serves high-value and time-sensitive cargo; Sea Freight is critical for international trade; Intermodal Freight integrates multiple transport modes for efficiency; Express & Parcel (CEP) Services cater to e-commerce and last-mile delivery; Temperature-Controlled Logistics supports food and pharmaceutical supply chains; and Others cover specialized and niche logistics services .

By End-User:The end-user segmentation includes Retail & E-commerce, Manufacturing, Automotive, Pharmaceuticals & Healthcare, Food & Beverage, Agriculture, Fishing & Forestry, Construction, Oil, Gas, Mining & Quarrying, and Others. Retail & E-commerce drives demand for express and last-mile logistics; Manufacturing and Automotive sectors require integrated supply chain solutions; Pharmaceuticals & Healthcare depend on temperature-controlled and secure transport; Food & Beverage needs both bulk and temperature-controlled logistics; Agriculture, Fishing & Forestry rely on bulk and seasonal logistics; Construction demands heavy and project cargo services; Oil, Gas, Mining & Quarrying require specialized and hazardous material logistics; Others include niche and emerging sectors .

The Italy Freight Solutions Market is characterized by a dynamic mix of regional and international players. Leading participants such as DHL Supply Chain, Kuehne + Nagel, DB Schenker, DSV, XPO Logistics, Geodis, CEVA Logistics, UPS Supply Chain Solutions, FedEx Express, Poste Italiane, Arcese Group, Fercam, FS Italiane (Mercitalia Logistics), Bartolini (BRT), SDA Express Courier contribute to innovation, geographic expansion, and service delivery in this space .

The future of the Italy freight solutions market appears promising, driven by ongoing technological advancements and increasing e-commerce activity. As logistics providers embrace digital transformation, the integration of AI and IoT will enhance operational efficiency and customer satisfaction. Furthermore, the government's commitment to infrastructure development will facilitate smoother freight operations. However, companies must navigate regulatory challenges and rising costs to remain competitive. Overall, the market is poised for growth, adapting to evolving consumer demands and sustainability goals.

| Segment | Sub-Segments |

|---|---|

| By Type | Road Freight Rail Freight Air Freight Sea Freight Intermodal Freight Express & Parcel (CEP) Services Temperature-Controlled Logistics Others |

| By End-User | Retail & E-commerce Manufacturing Automotive Pharmaceuticals & Healthcare Food & Beverage Agriculture, Fishing & Forestry Construction Oil, Gas, Mining & Quarrying Others |

| By Service Type | Freight Forwarding Warehousing & Distribution Customs Brokerage Supply Chain Management Last-Mile Delivery Temperature-Controlled Services Others |

| By Cargo Type | General Cargo Hazardous Materials Perishable Goods Heavy Machinery Bulk Commodities Others |

| By Distribution Mode | Direct Distribution Third-Party Logistics (3PL) Freight Brokers Others |

| By Pricing Model | Fixed Pricing Variable Pricing Subscription-Based Pricing Others |

| By Customer Type | B2B B2C Government & Public Sector Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Road Freight Services | 100 | Logistics Managers, Fleet Operations Directors |

| Rail Freight Operations | 60 | Railway Operations Managers, Supply Chain Analysts |

| Air Cargo Logistics | 40 | Air Freight Managers, Customs Compliance Officers |

| Maritime Freight Solutions | 50 | Port Operations Managers, Shipping Coordinators |

| Last-Mile Delivery Services | 50 | Last-Mile Operations Managers, E-commerce Logistics Heads |

The Italy Freight Solutions Market is valued at approximately USD 125 billion, driven by the increasing demand for logistics services, particularly due to the growth of e-commerce and the modernization of logistics infrastructure.