Region:Central and South America

Author(s):Dev

Product Code:KRAA0420

Pages:96

Published On:August 2025

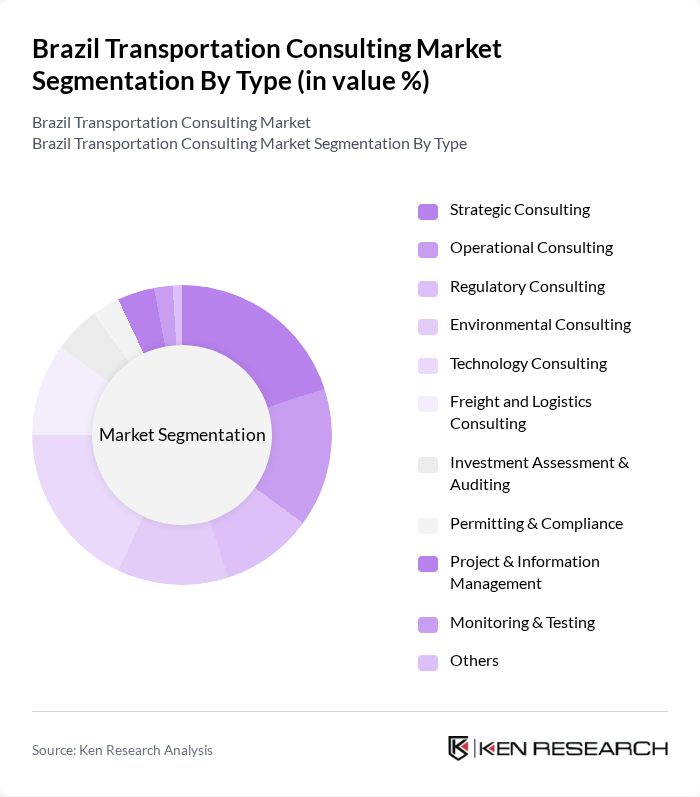

By Type:The market is segmented into various types of consulting services, including Strategic Consulting, Operational Consulting, Regulatory Consulting, Environmental Consulting, Technology Consulting, Freight and Logistics Consulting, Investment Assessment & Auditing, Permitting & Compliance, Project & Information Management, Monitoring & Testing, and Others. Each of these sub-segments plays a crucial role in addressing specific client needs, such as digital transformation, regulatory compliance, sustainability integration, and operational efficiency, thereby enhancing the overall effectiveness of transportation systems .

By End-User:The end-user segmentation includes Government Agencies, Private Corporations, Non-Governmental Organizations, Transportation Authorities, Infrastructure Developers, Logistics Companies, E-commerce Companies, and Others. Each of these segments has unique requirements, such as public policy compliance, digital logistics optimization, or sustainability reporting, and contributes to the overall demand for transportation consulting services .

The Brazil Transportation Consulting Market is characterized by a dynamic mix of regional and international players. Leading participants such as Deloitte, PwC, KPMG, EY, Accenture, AECOM, WSP Global, Jacobs Engineering, Arup Group, Golder Associates, Ramboll, FTI Consulting, Hatch Ltd., BCG, Roland Berger, McKinsey & Company, LOGIT Engenharia Consultiva, TRENDS Engenharia e Consultoria, Systra, Mott MacDonald contribute to innovation, geographic expansion, and service delivery in this space.

The Brazil Transportation Consulting Market is poised for significant evolution as urbanization accelerates and government investments in infrastructure continue. The integration of advanced technologies, such as AI and smart city initiatives, will reshape transportation planning and operations. Additionally, the increasing focus on sustainability will drive demand for innovative consulting solutions. Firms that can adapt to these trends and provide strategic insights will be well-positioned to capitalize on emerging opportunities in the evolving market landscape.

| Segment | Sub-Segments |

|---|---|

| By Type | Strategic Consulting Operational Consulting Regulatory Consulting Environmental Consulting Technology Consulting Freight and Logistics Consulting Investment Assessment & Auditing Permitting & Compliance Project & Information Management Monitoring & Testing Others |

| By End-User | Government Agencies Private Corporations Non-Governmental Organizations Transportation Authorities Infrastructure Developers Logistics Companies E-commerce Companies Others |

| By Service Area | Urban Transportation Freight and Logistics Public Transit Systems Road Infrastructure Rail Systems Aviation Services Maritime & Port Operations Others |

| By Project Type | Feasibility Studies Project Management Environmental Impact Assessments Traffic Studies Policy Development Digital Transformation Projects Others |

| By Geographic Focus | Metropolitan Areas Rural Areas Regional Development Projects National Infrastructure Projects Cross-Border Projects Others |

| By Client Type | Public Sector Clients Private Sector Clients International Organizations Local Businesses Multinational Corporations Others |

| By Consulting Model | Full-Service Consulting Specialized Consulting Project-Based Consulting Retainer-Based Consulting Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Urban Transportation Planning | 60 | City Planners, Transportation Engineers |

| Logistics Optimization Consulting | 50 | Logistics Managers, Supply Chain Analysts |

| Infrastructure Development Projects | 40 | Project Managers, Civil Engineers |

| Regulatory Compliance Advisory | 40 | Compliance Officers, Legal Advisors |

| Public Transport System Consulting | 50 | Transit Authority Officials, Operations Managers |

The Brazil Transportation Consulting Market is valued at approximately USD 1.1 billion, driven by infrastructure investments, urbanization, and the need for efficient transportation systems. This market is expected to grow as demand for consulting services increases across public and private sectors.