Region:Global

Author(s):Shubham

Product Code:KRAA1085

Pages:95

Published On:August 2025

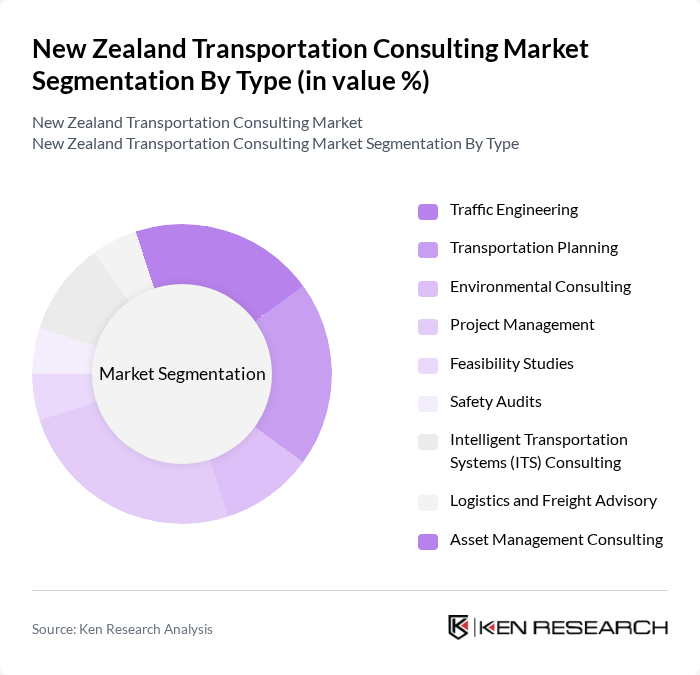

By Type:The market is segmented into various types of consulting services that cater to different aspects of transportation. The subsegments include Traffic Engineering, Transportation Planning, Environmental Consulting, Project Management, Feasibility Studies, Safety Audits, Intelligent Transportation Systems (ITS) Consulting, Logistics and Freight Advisory, and Asset Management Consulting. Each of these subsegments plays a crucial role in addressing specific needs within the transportation sector, with growing emphasis on ITS and environmental consulting due to sustainability and smart city initiatives.

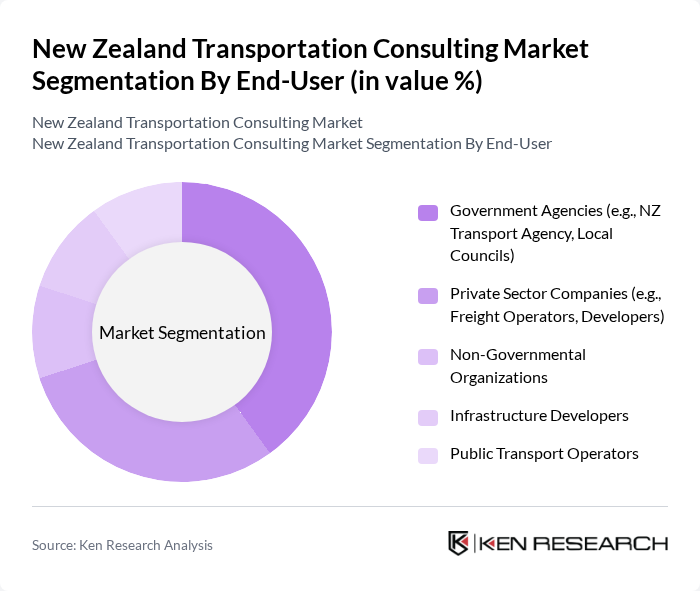

By End-User:The end-user segmentation includes Government Agencies, Private Sector Companies, Non-Governmental Organizations, Infrastructure Developers, and Public Transport Operators. Each of these groups has distinct needs and requirements for transportation consulting services, influencing the overall market dynamics. Government agencies and infrastructure developers remain the largest consumers, driven by ongoing public investments and regulatory compliance requirements.

The New Zealand Transportation Consulting Market is characterized by a dynamic mix of regional and international players. Leading participants such as Beca Group, Aurecon, WSP New Zealand, Stantec, GHD Group, Jacobs Engineering, Tonkin + Taylor, AECOM, Harrison Grierson, Mott MacDonald, Boffa Miskell, Golder Associates, RPS Group, Abley, and Flow Transportation Specialists contribute to innovation, geographic expansion, and service delivery in this space.

The New Zealand transportation consulting market is poised for significant evolution, driven by ongoing infrastructure investments and technological advancements. As urbanization accelerates, the demand for innovative transportation solutions will grow, prompting firms to adapt to new market dynamics. Additionally, the focus on sustainability will shape consulting practices, encouraging firms to integrate eco-friendly solutions into their projects. Overall, the market is expected to thrive as it embraces these transformative trends and responds to emerging challenges.

| Segment | Sub-Segments |

|---|---|

| By Type | Traffic Engineering Transportation Planning Environmental Consulting Project Management Feasibility Studies Safety Audits Intelligent Transportation Systems (ITS) Consulting Logistics and Freight Advisory Asset Management Consulting |

| By End-User | Government Agencies (e.g., NZ Transport Agency, Local Councils) Private Sector Companies (e.g., Freight Operators, Developers) Non-Governmental Organizations Infrastructure Developers Public Transport Operators |

| By Service Model | Consultancy Services Project Management Services Technical Advisory Services Design & Engineering Services |

| By Project Size | Small Scale Projects (e.g., local intersection upgrades) Medium Scale Projects (e.g., urban corridor improvements) Large Scale Projects (e.g., national highway, rail, or port projects) |

| By Geographic Focus | Urban Areas (Auckland, Wellington, Christchurch, etc.) Rural Areas Regional Transport Networks |

| By Funding Source | Government Funding Private Investment International Aid Public-Private Partnerships (PPP) |

| By Policy Support | Subsidies for Sustainable Transport Tax Incentives for Infrastructure Development Grants for Research and Development Regulatory Mandates (e.g., emissions, safety) |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Urban Transportation Planning | 60 | City Planners, Urban Development Officers |

| Traffic Engineering Services | 50 | Traffic Engineers, Project Managers |

| Environmental Impact Assessments | 40 | Environmental Consultants, Policy Advisors |

| Public Transport Consulting | 55 | Public Transport Authorities, Operations Managers |

| Infrastructure Development Projects | 45 | Construction Managers, Infrastructure Planners |

The New Zealand Transportation Consulting Market is valued at approximately USD 160 million, driven by increased infrastructure investments, urbanization, and the adoption of intelligent transportation systems aimed at enhancing efficiency and safety in transport networks.