Region:Asia

Author(s):Geetanshi

Product Code:KRAA0285

Pages:95

Published On:August 2025

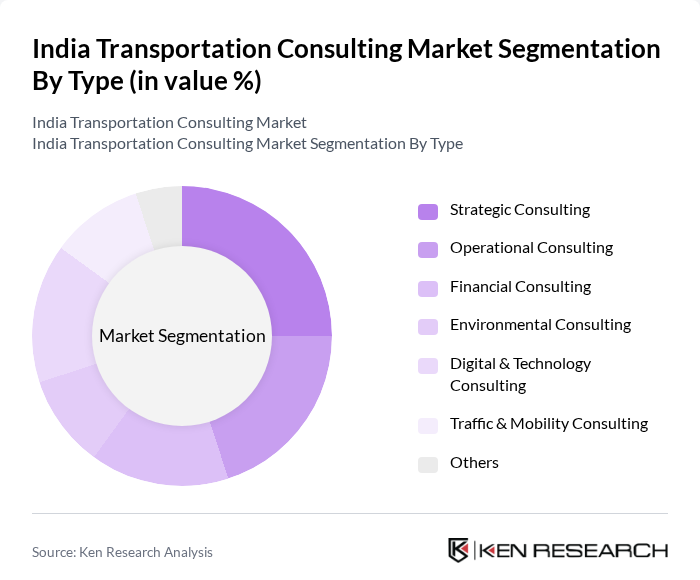

By Type:The market is segmented into various types of consulting services, including Strategic Consulting, Operational Consulting, Financial Consulting, Environmental Consulting, Digital & Technology Consulting, Traffic & Mobility Consulting, and Others. Each segment addresses specific requirements within the transportation sector, such as policy formulation, operational optimization, financial structuring, environmental compliance, digital transformation, and mobility planning .

The Strategic Consulting segment is currently dominating the market due to the increasing complexity of transportation projects and the need for long-term planning and policy formulation. This segment focuses on high-level decision-making, aligning transportation strategies with national and regional development goals. As cities expand and transportation needs evolve, strategic consultants are sought for their expertise in creating sustainable and efficient transport systems. The demand for strategic insights is further fueled by government initiatives aimed at improving urban mobility and infrastructure .

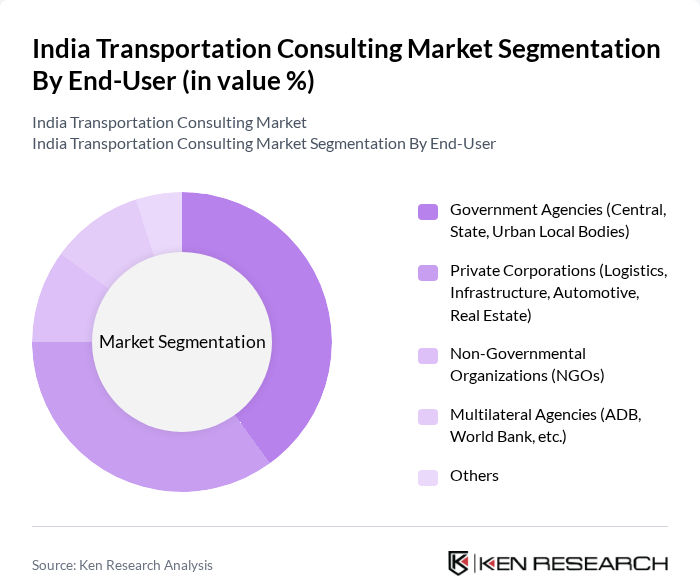

By End-User:The market is segmented by end-users, including Government Agencies (Central, State, Urban Local Bodies), Private Corporations (Logistics, Infrastructure, Automotive, Real Estate), Non-Governmental Organizations (NGOs), Multilateral Agencies (ADB, World Bank, etc.), and Others. Each end-user category has distinct requirements and influences the demand for consulting services .

Government Agencies are the leading end-users in the transportation consulting market, primarily due to their significant role in infrastructure development and urban planning. These agencies require consulting services to implement national policies, manage public transport systems, and ensure compliance with environmental regulations. The increasing focus on sustainable transportation solutions and smart city initiatives has further amplified the demand for consulting services from government bodies, making them a key driver of market growth .

The India Transportation Consulting Market is characterized by a dynamic mix of regional and international players. Leading participants such as AECOM India, RITES Ltd., Feedback Infra, Tata Consulting Engineers, SYSTRA India, WSP India, Egis India, Louis Berger (WSP Group), McKinsey & Company, Deloitte India, KPMG India, Ernst & Young (EY) India, PwC India, Accenture India, and COWI India contribute to innovation, geographic expansion, and service delivery in this space.

The future of the India transportation consulting market appears promising, driven by ongoing urbanization and government initiatives aimed at infrastructure development. As cities expand, the demand for efficient transportation solutions will increase, necessitating expert consulting services. Additionally, the focus on sustainable practices and smart city projects will create new avenues for growth. Firms that leverage technology and data analytics will be well-positioned to capitalize on these trends, ensuring they meet the evolving needs of urban transportation systems.

| Segment | Sub-Segments |

|---|---|

| By Type | Strategic Consulting Operational Consulting Financial Consulting Environmental Consulting Digital & Technology Consulting Traffic & Mobility Consulting Others |

| By End-User | Government Agencies (Central, State, Urban Local Bodies) Private Corporations (Logistics, Infrastructure, Automotive, Real Estate) Non-Governmental Organizations (NGOs) Multilateral Agencies (ADB, World Bank, etc.) Others |

| By Region | North India South India East India West India Central India |

| By Service Offering | Feasibility Studies Project Management & Implementation Support Risk Assessment & Regulatory Advisory Traffic Impact Assessment Technology Integration & Digital Transformation Others |

| By Project Type | Urban Transport Projects (Metro, BRT, City Bus, NMT) Freight and Logistics Projects (Multi-Modal Logistics Parks, Warehousing, Cold Chain) Infrastructure Development Projects (Roads, Railways, Airports, Ports) Smart Transportation & ITS Projects Others |

| By Client Type | Public Sector Clients Private Sector Clients International Clients Others |

| By Duration of Engagement | Short-term Projects Long-term Projects Ongoing Consulting Services Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Road Transportation Services | 120 | Fleet Managers, Operations Managers |

| Rail Freight Operations | 60 | Logistics Coordinators, Rail Operations Planners |

| Air Cargo Management | 40 | Air Cargo Managers, Freight Forwarders |

| Waterway Transport Solutions | 40 | Port Authorities, Shipping Line Managers |

| Urban Mobility Services | 50 | City Transport Planners, Mobility Service Managers |

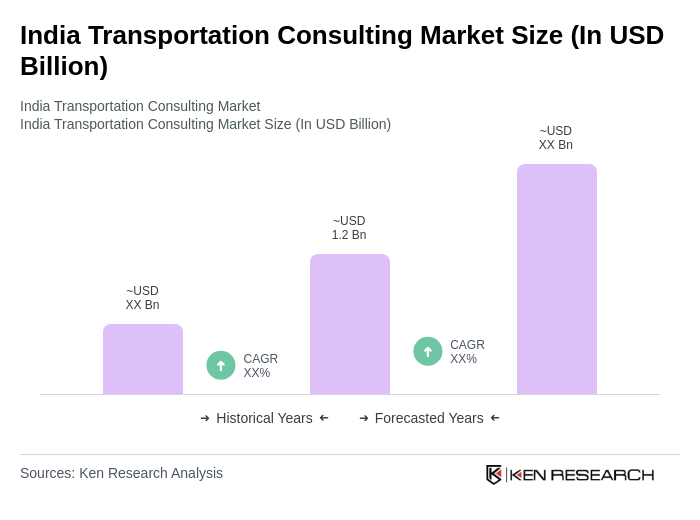

The India Transportation Consulting Market is valued at approximately USD 1.2 billion, driven by rapid urbanization, increased demand for efficient transportation systems, and significant investments in infrastructure development.