Region:Central and South America

Author(s):Geetanshi

Product Code:KRAA0238

Pages:90

Published On:August 2025

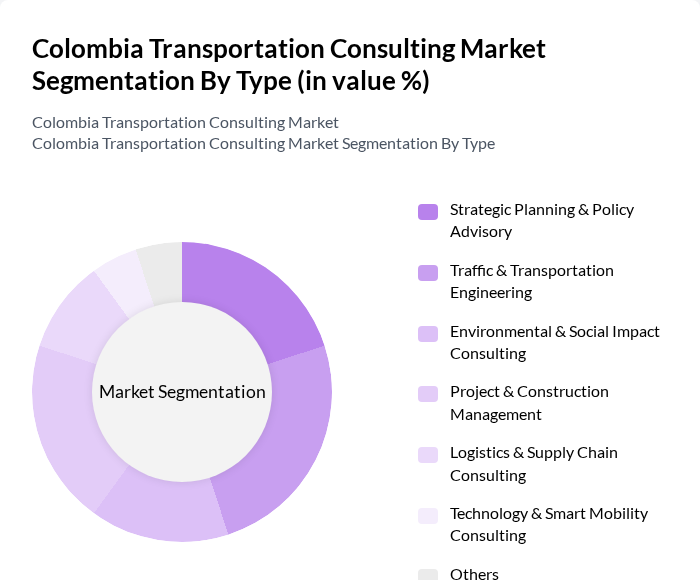

By Type:The market is segmented into Strategic Planning & Policy Advisory, Traffic & Transportation Engineering, Environmental & Social Impact Consulting, Project & Construction Management, Logistics & Supply Chain Consulting, Technology & Smart Mobility Consulting, and Others. Each segment addresses specific needs across Colombia’s transportation ecosystem, from regulatory compliance and sustainability to digital transformation and operational efficiency .

The Traffic & Transportation Engineering segment leads the market, driven by the increasing complexity of urban transportation systems and the urgent need for efficient traffic management and safety solutions. This segment is characterized by growing demand for advanced engineering approaches that enhance road safety, reduce congestion, and improve multimodal connectivity. As urban populations expand, expert consulting in traffic engineering becomes critical, prompting substantial investments in this area .

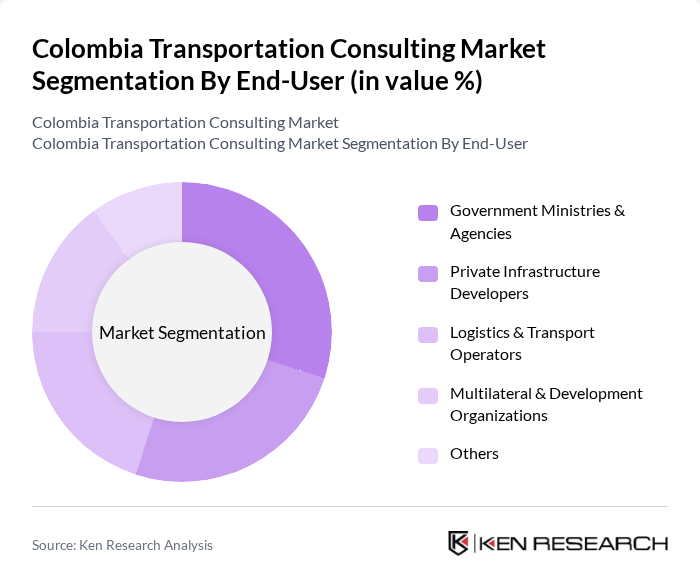

By End-User:The market is segmented by end-users, including Government Ministries & Agencies, Private Infrastructure Developers, Logistics & Transport Operators, Multilateral & Development Organizations, and Others. Each end-user group has unique requirements, shaping the demand for specialized transportation consulting services .

The Government Ministries & Agencies segment dominates the market, propelled by substantial public investments in infrastructure and transportation projects. These agencies are responsible for policy formulation, regulatory oversight, and the implementation of large-scale mobility initiatives, thus requiring comprehensive consulting support for compliance, sustainability, and modernization. The ongoing focus on sustainable development and public transport improvements further amplifies demand for expert consulting services in this segment .

The Colombia Transportation Consulting Market is characterized by a dynamic mix of regional and international players. Leading participants such as Steer Colombia, IDOM Colombia, SYSTRA Colombia, Arup, Deloitte Colombia, PwC Colombia, KPMG Colombia, EY Colombia, AECOM, Golder Associates, Jacobs Engineering, INGEROP, Fichtner, WSP Colombia, and C&M Consultores contribute to innovation, geographic expansion, and service delivery in this space.

The Colombia transportation consulting market is poised for significant transformation, driven by urbanization and technological advancements. As cities expand, the demand for innovative transportation solutions will increase, particularly in smart mobility and public transport systems. The government's commitment to infrastructure investment will create opportunities for consulting firms to engage in large-scale projects. Additionally, the focus on sustainability will drive the adoption of electric vehicles and multimodal transport solutions, reshaping the market landscape in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Strategic Planning & Policy Advisory Traffic & Transportation Engineering Environmental & Social Impact Consulting Project & Construction Management Logistics & Supply Chain Consulting Technology & Smart Mobility Consulting Others |

| By End-User | Government Ministries & Agencies Private Infrastructure Developers Logistics & Transport Operators Multilateral & Development Organizations Others |

| By Service Delivery Model | Advisory/Consultancy Services Project-Based Implementation Retainer-Based Services Digital/Remote Consulting Others |

| By Geographic Focus | Major Urban Centers (e.g., Bogotá, Medellín, Cali) Secondary Cities Rural & Regional Development Corridors Cross-Border/International Projects Others |

| By Project Type | Infrastructure Development (Road, Rail, Ports, Airports) Urban Mobility & Public Transport Freight & Logistics Optimization Sustainability & Green Transport Initiatives Feasibility & Impact Studies Others |

| By Client Type | Public Sector Private Sector International Agencies/NGOs Others |

| By Duration of Engagement | Short-Term (<1 year) Medium-Term (1-3 years) Long-Term (>3 years) Ongoing/Framework Agreements Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Road Transportation Services | 100 | Fleet Managers, Logistics Coordinators |

| Rail Freight Operations | 50 | Railway Operations Managers, Supply Chain Analysts |

| Air Cargo Services | 40 | Airline Cargo Managers, Freight Forwarders |

| Maritime Shipping Logistics | 40 | Port Authorities, Shipping Line Executives |

| Urban Transportation Solutions | 60 | City Planners, Transportation Policy Makers |

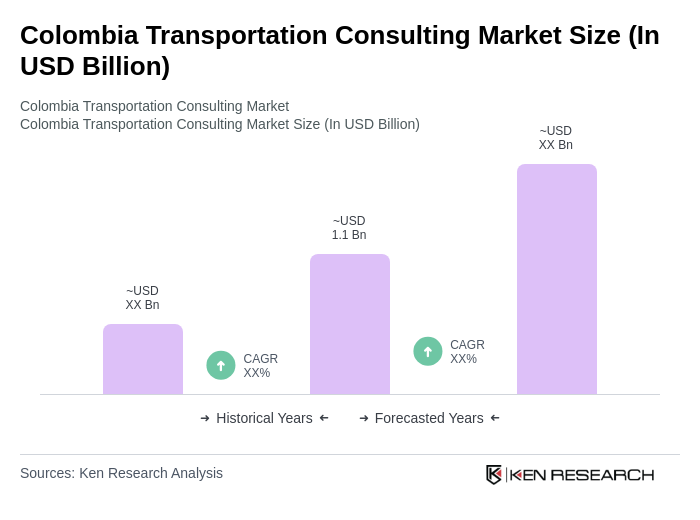

The Colombia Transportation Consulting Market is valued at approximately USD 1.1 billion, reflecting significant growth driven by infrastructure modernization, urbanization, and the demand for sustainable transportation solutions.