Region:Central and South America

Author(s):Geetanshi

Product Code:KRAA0247

Pages:99

Published On:August 2025

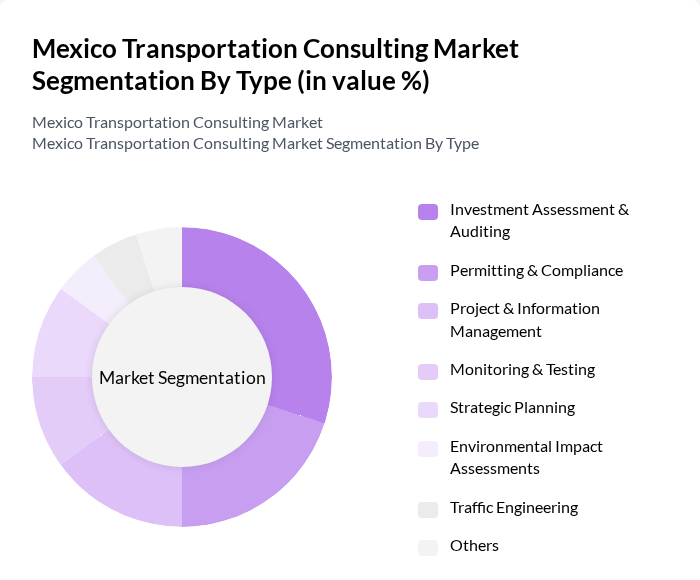

By Type:The market is segmented into various types of consulting services, including Investment Assessment & Auditing, Permitting & Compliance, Project & Information Management, Monitoring & Testing, Strategic Planning, Environmental Impact Assessments, Traffic Engineering, and Others. Among these, Investment Assessment & Auditing is the leading sub-segment, driven by the increasing need for financial viability, risk management, and alignment with sustainability goals in transportation projects. The demand for thorough assessments ensures that projects are not only feasible but also comply with evolving regulatory requirements and stakeholder expectations .

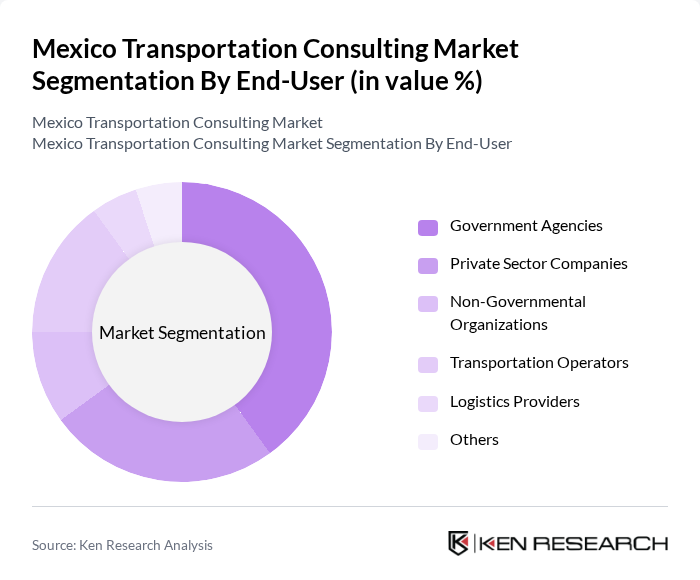

By End-User:The end-user segmentation includes Government Agencies, Private Sector Companies, Non-Governmental Organizations, Transportation Operators, Logistics Providers, and Others. Government Agencies are the dominant end-user, as they are responsible for the majority of transportation infrastructure projects and regulatory compliance. Their need for expert consulting services to navigate complex regulations, implement digital transformation, and ensure public safety drives significant demand in this segment .

The Mexico Transportation Consulting Market is characterized by a dynamic mix of regional and international players. Leading participants such as Deloitte Mexico, PwC Mexico, KPMG Mexico, EY Mexico, Accenture Mexico, GHD Group, AECOM, Jacobs Engineering, Arup Group, WSP Global, TransConsult, COWI, IDOM, SYSTRA, Fichtner, Steer Mexico, SENER Mexico, TPF Getinsa Euroestudios, Egis Group, WSP Mexico contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Mexico transportation consulting market appears promising, driven by urbanization and government investments in infrastructure. As cities expand, the need for innovative transportation solutions will grow, particularly in sustainable practices and smart technologies. Additionally, the integration of AI in transportation planning is expected to enhance efficiency and decision-making. Firms that adapt to these trends and leverage technology will likely find significant opportunities for growth and collaboration in the evolving landscape.

| Segment | Sub-Segments |

|---|---|

| By Type | Investment Assessment & Auditing Permitting & Compliance Project & Information Management Monitoring & Testing Strategic Planning Environmental Impact Assessments Traffic Engineering Others |

| By End-User | Government Agencies Private Sector Companies Non-Governmental Organizations Transportation Operators Logistics Providers Others |

| By Service Type | Feasibility Studies Project Management Smart Mobility & Digital Solutions Consulting Sustainability & Emissions Consulting Risk Management & Safety Consulting Others |

| By Project Size | Small Scale Projects Medium Scale Projects Large Scale Projects Mega Projects Others |

| By Geographic Focus | Urban Areas Rural Areas Cross-Border Projects Industrial Corridors Others |

| By Client Type | Public Sector Clients Private Sector Clients International Clients Multilateral Organizations Others |

| By Duration of Engagement | Short-Term Engagements Long-Term Engagements Project-Based Engagements Framework Agreements Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Public Transportation Systems | 60 | City Transport Officials, Public Transit Managers |

| Freight and Logistics Services | 50 | Logistics Coordinators, Supply Chain Managers |

| Infrastructure Development Projects | 40 | Project Managers, Civil Engineers |

| Urban Mobility Solutions | 40 | Urban Planners, Mobility Consultants |

| Last-Mile Delivery Services | 50 | Operations Managers, Delivery Service Providers |

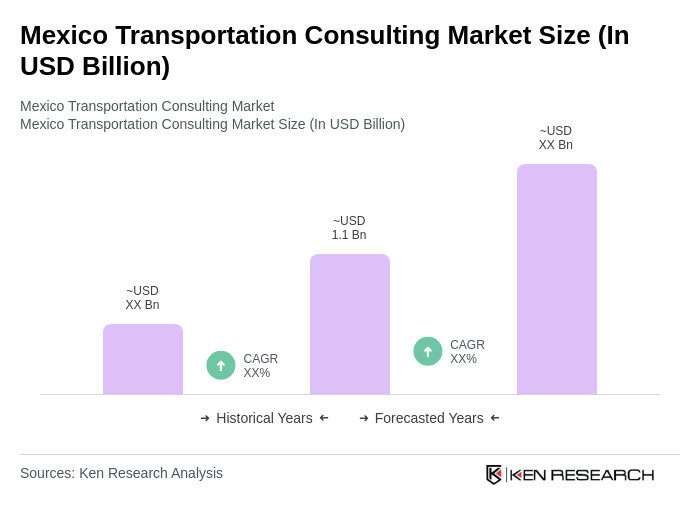

The Mexico Transportation Consulting Market is valued at approximately USD 1.1 billion, reflecting significant growth driven by infrastructure modernization, urbanization, and advanced mobility solutions over the past five years.