Region:North America

Author(s):Shubham

Product Code:KRAA0682

Pages:93

Published On:August 2025

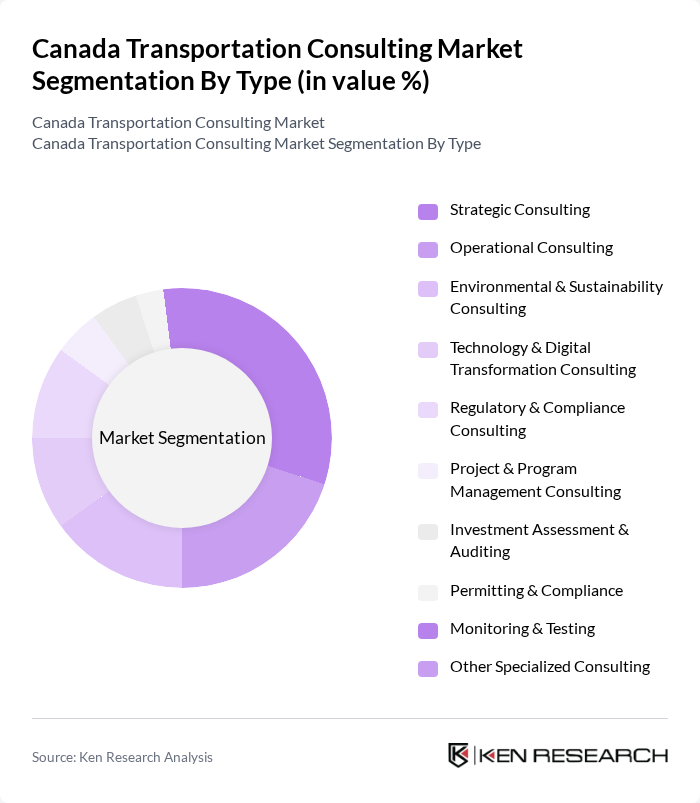

By Type:The market is segmented into various types of consulting services, including Strategic Consulting, Operational Consulting, Environmental & Sustainability Consulting, Technology & Digital Transformation Consulting, Regulatory & Compliance Consulting, Project & Program Management Consulting, Investment Assessment & Auditing, Permitting & Compliance, Monitoring & Testing, and Other Specialized Consulting. Among these, Strategic Consulting is currently the leading sub-segment, driven by the need for long-term planning and strategic initiatives to address transportation challenges. Clients are increasingly seeking expert guidance to navigate complex regulatory environments and optimize their transportation systems .

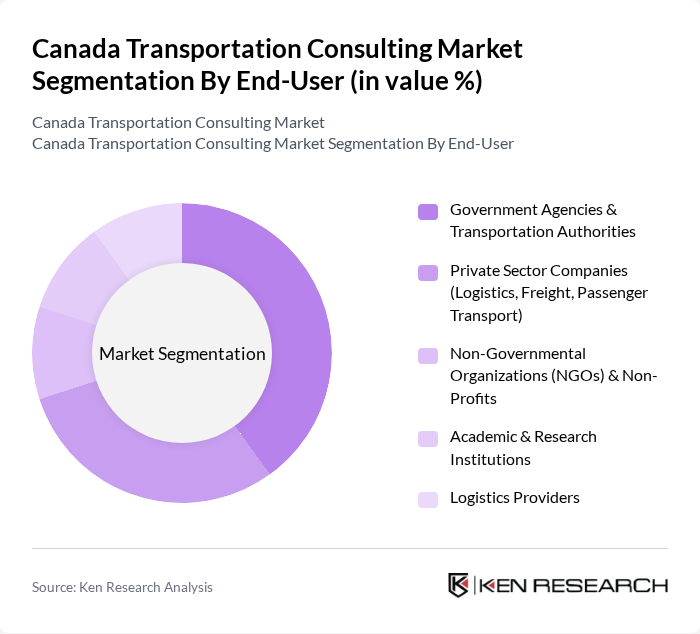

By End-User:The end-user segmentation includes Government Agencies & Transportation Authorities, Private Sector Companies (Logistics, Freight, Passenger Transport), Non-Governmental Organizations (NGOs) & Non-Profits, Academic & Research Institutions, and Logistics Providers. Government Agencies & Transportation Authorities are the dominant end-users, as they are responsible for planning, funding, and implementing transportation projects. Their need for expert consulting services to ensure compliance with regulations and to optimize public transportation systems drives significant demand in this segment .

The Canada Transportation Consulting Market is characterized by a dynamic mix of regional and international players. Leading participants such as AECOM, WSP Global Inc., Stantec, Golder Associates, Hatch Ltd., SNC-Lavalin, IBI Group, Dillon Consulting Limited, Urban Systems, CIMA+, Tetra Tech, KPMG, Deloitte, PwC, Ernst & Young contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Canada transportation consulting market appears promising, driven by ongoing infrastructure investments and a strong push for sustainable practices. As the government continues to prioritize green initiatives, consulting firms will play a crucial role in guiding organizations through the transition to eco-friendly solutions. Additionally, the rise of smart technologies will create new avenues for consulting services, emphasizing the need for data-driven strategies and innovative approaches to enhance transportation efficiency and safety.

| Segment | Sub-Segments |

|---|---|

| By Type | Strategic Consulting Operational Consulting Environmental & Sustainability Consulting Technology & Digital Transformation Consulting Regulatory & Compliance Consulting Project & Program Management Consulting Investment Assessment & Auditing Permitting & Compliance Monitoring & Testing Other Specialized Consulting |

| By End-User | Government Agencies & Transportation Authorities Private Sector Companies (Logistics, Freight, Passenger Transport) Non-Governmental Organizations (NGOs) & Non-Profits Academic & Research Institutions Logistics Providers |

| By Service Delivery Model | On-Site Consulting Remote Consulting Hybrid Consulting |

| By Project Type | Infrastructure Development (Road, Rail, Transit, Ports, Airports) Policy & Regulatory Development Environmental Impact Assessments Feasibility & Market Studies Smart Mobility & Technology Implementation |

| By Geographic Focus | Urban Transportation Rural & Remote Transportation Intercity & Cross-Border Transportation |

| By Client Size | Large Enterprises Medium Enterprises Small Enterprises |

| By Industry Vertical | Freight & Cargo Passenger Travel & Public Transit Healthcare & Emergency Services Retail & E-commerce Logistics Construction & Infrastructure Other Sectors |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Urban Transportation Planning | 60 | City Planners, Transportation Engineers |

| Freight and Logistics Consulting | 50 | Logistics Managers, Supply Chain Analysts |

| Public Transit Systems | 40 | Transit Authority Officials, Operations Managers |

| Infrastructure Development Projects | 50 | Project Managers, Civil Engineers |

| Environmental Impact Assessments | 40 | Environmental Consultants, Regulatory Affairs Specialists |

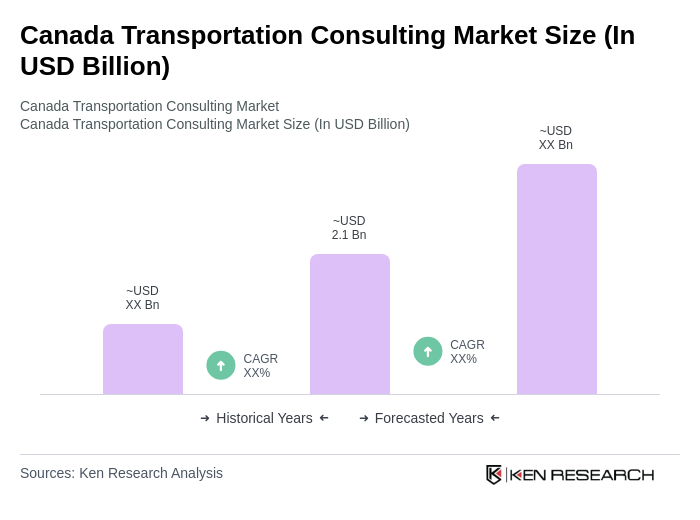

The Canada Transportation Consulting Market is valued at approximately USD 2.1 billion, driven by infrastructure investments, urbanization, and the demand for sustainable transportation solutions. This market has experienced significant growth due to the increasing complexity of transportation challenges.