Region:Central and South America

Author(s):Shubham

Product Code:KRAA1052

Pages:87

Published On:August 2025

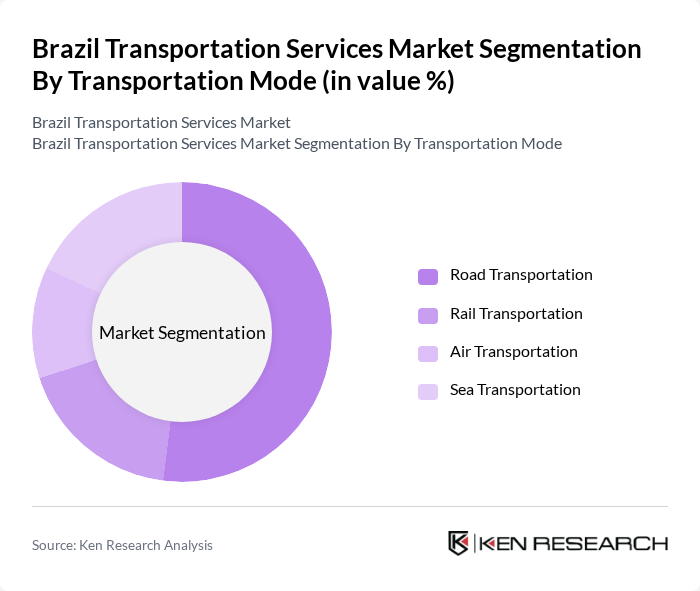

By Transportation Mode:The transportation mode segmentation includes various methods of moving goods and passengers. The primary modes are road, rail, air, and sea transportation. Road transportation is the most widely used due to its flexibility and extensive network, accounting for the largest share of freight and passenger movement. Rail transportation is crucial for bulk freight, especially for commodities such as minerals and agricultural products. Air transportation is essential for time-sensitive deliveries and high-value cargo, while sea transportation plays a vital role in international trade, particularly for exports of agricultural and mining products .

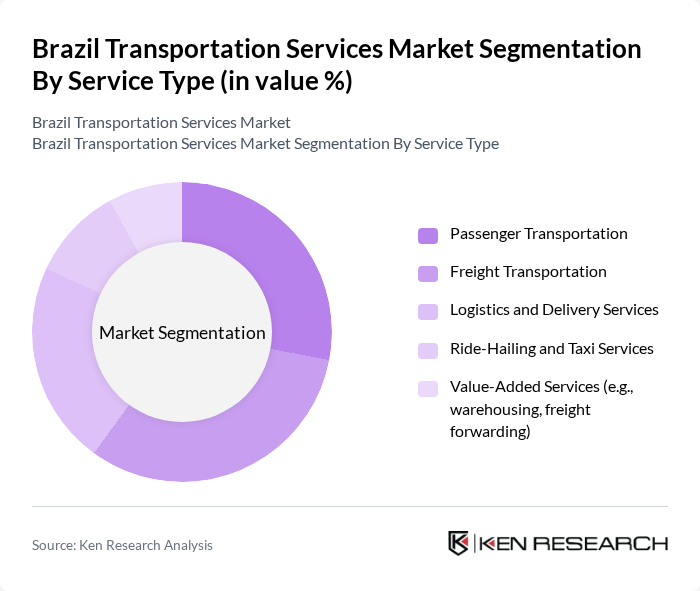

By Service Type:The service type segmentation encompasses various offerings within the transportation sector. This includes passenger transportation, freight transportation, logistics and delivery services, ride-hailing and taxi services, and value-added services such as warehousing and freight forwarding. The rise of e-commerce has significantly boosted logistics and delivery services, while ride-hailing has transformed urban mobility and increased access to on-demand transportation .

The Brazil Transportation Services Market is characterized by a dynamic mix of regional and international players. Leading participants such as Grupo CCR, Movida, 99 (Didi Chuxing), Uber Brasil, Rappi, Loggi, JSL S.A., Transpetro, Vale S.A., Viação Cometa, Expresso São Miguel, Buser, Localiza, ViaQuatro, Tembici, RTE Rodonaves, DHL Group (Brazil), A.P. Moller-Maersk (Brazil), GOL Linhas Aéreas, LATAM Airlines Brasil contribute to innovation, geographic expansion, and service delivery in this space .

The Brazil transportation services market is poised for significant transformation driven by technological advancements and evolving consumer preferences. The integration of smart transportation solutions, such as AI and IoT, is expected to enhance operational efficiency and safety. Additionally, the shift towards electric vehicles will likely gain momentum, supported by government incentives. As urbanization continues, the demand for sustainable and efficient transportation options will shape the future landscape, presenting both challenges and opportunities for industry stakeholders.

| Segment | Sub-Segments |

|---|---|

| By Transportation Mode | Road Transportation Rail Transportation Air Transportation Sea Transportation |

| By Service Type | Passenger Transportation Freight Transportation Logistics and Delivery Services Ride-Hailing and Taxi Services Value-Added Services (e.g., warehousing, freight forwarding) |

| By Industry Vertical | Automotive Retail & E-commerce Healthcare & Pharmaceuticals Consumer Goods Construction & Manufacturing Agriculture Others |

| By Distance | Long Haul Short Haul / Last-Mile |

| By Geographic Coverage | Urban Areas Rural Areas |

| By Customer Segment | Individual Consumers Businesses Government Agencies Non-Profit Organizations |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Road Transportation Services | 120 | Fleet Managers, Logistics Coordinators |

| Rail Freight Services | 60 | Operations Managers, Rail Network Planners |

| Air Cargo Services | 40 | Airline Cargo Managers, Freight Forwarders |

| Maritime Shipping Services | 40 | Port Authorities, Shipping Line Executives |

| Last-Mile Delivery Services | 50 | eCommerce Logistics Managers, Delivery Service Operators |

The Brazil Transportation Services Market is valued at approximately USD 117 billion, reflecting significant growth driven by urbanization, infrastructure investments, and increased demand for logistics solutions, particularly in e-commerce and rapid delivery services.