Region:Africa

Author(s):Shubham

Product Code:KRAA1011

Pages:92

Published On:August 2025

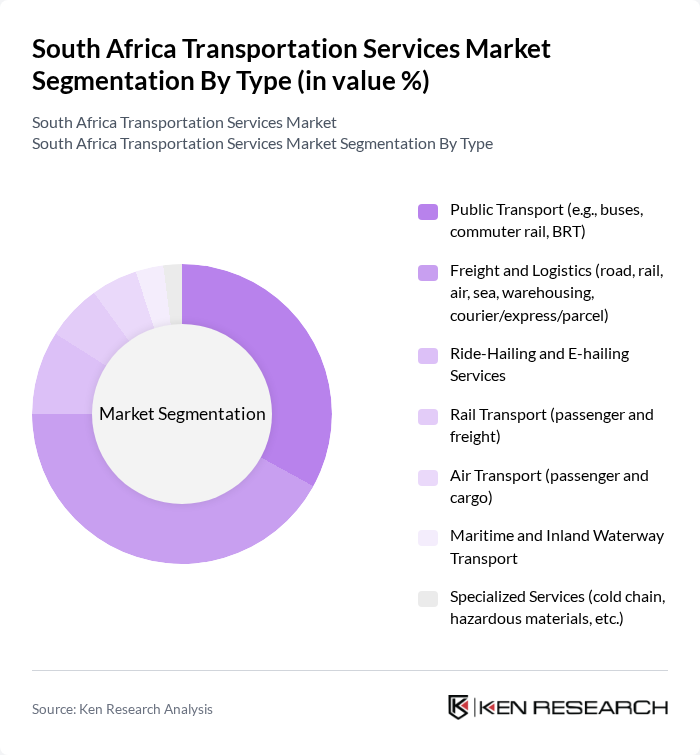

By Type:The transportation services market in South Africa is segmented into public transport, freight and logistics, ride-hailing and e-hailing services, rail transport, air transport, maritime and inland waterway transport, and specialized services. Public transport and freight/logistics remain the most significant segments, driven by urbanization, economic activity, and the growing demand for efficient movement of goods and people .

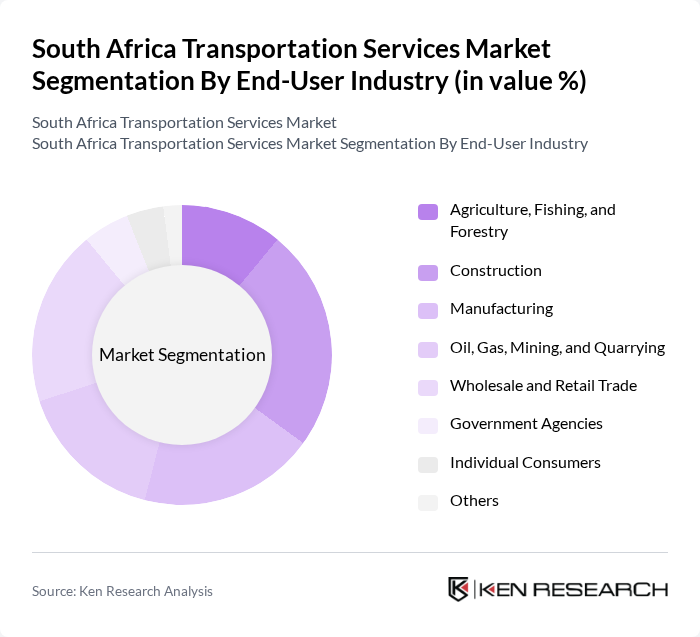

By End-User Industry:The end-user industries for transportation services in South Africa include agriculture, fishing, and forestry; construction; manufacturing; oil, gas, mining, and quarrying; wholesale and retail trade; government agencies; individual consumers; and others. Construction and wholesale/retail trade sectors are particularly significant, reflecting the demand for efficient and reliable transport solutions in these industries .

The South Africa Transportation Services Market is characterized by a dynamic mix of regional and international players. Leading participants such as Transnet SOC Ltd, Uber South Africa, Bolt South Africa, Gautrain Management Agency, Metrorail (PRASA), DHL Supply Chain South Africa, FedEx Express South Africa, Imperial Logistics (DP World Logistics South Africa), Bidvest International Logistics, Greyhound (rebranded/intercity bus operator), City of Cape Town Transport, Metrobus (Johannesburg), Uber Freight South Africa, South African Airways (SAA), Translux (Passenger Bus Services) contribute to innovation, geographic expansion, and service delivery in this space.

The South African transportation services market is poised for transformation, driven by technological advancements and a focus on sustainability. As urbanization continues, the demand for efficient public transport systems will grow, prompting investments in smart transportation solutions. Additionally, the integration of artificial intelligence in logistics is expected to enhance operational efficiency. The government's commitment to green initiatives will further shape the market, encouraging the adoption of eco-friendly transportation options and fostering partnerships with technology providers to innovate service delivery.

| Segment | Sub-Segments |

|---|---|

| By Type | Public Transport (e.g., buses, commuter rail, BRT) Freight and Logistics (road, rail, air, sea, warehousing, courier/express/parcel) Ride-Hailing and E-hailing Services Rail Transport (passenger and freight) Air Transport (passenger and cargo) Maritime and Inland Waterway Transport Specialized Services (cold chain, hazardous materials, etc.) |

| By End-User Industry | Agriculture, Fishing, and Forestry Construction Manufacturing Oil, Gas, Mining, and Quarrying Wholesale and Retail Trade Government Agencies Individual Consumers Others |

| By Service Model | B2B Transportation Services B2C Transportation Services C2C Transportation Services |

| By Payment Method | Cash Payments Mobile Payments Credit/Debit Card Payments |

| By Vehicle Type | Buses Trucks Motorcycles Cars Rail Wagons/Locomotives Aircraft Ships/Vessels |

| By Geographic Coverage | Urban Areas Suburban Areas Rural Areas |

| By Customer Segment | Corporate Clients Government Contracts Individual Users |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Public Transport Services | 100 | Transport Authority Officials, Operations Managers |

| Logistics and Freight Services | 90 | Logistics Coordinators, Supply Chain Managers |

| Private Vehicle Services | 60 | Fleet Managers, Customer Service Representatives |

| Rail Transport Operations | 50 | Railway Operations Managers, Safety Officers |

| Maritime Transport Sector | 40 | Port Authority Officials, Shipping Line Executives |

The South Africa Transportation Services Market is valued at approximately USD 13 billion, driven by urbanization, logistics demand, and government infrastructure investments. This market plays a crucial role in the country's economic landscape, supporting various sectors and facilitating trade.