Region:Central and South America

Author(s):Shubham

Product Code:KRAA1122

Pages:99

Published On:August 2025

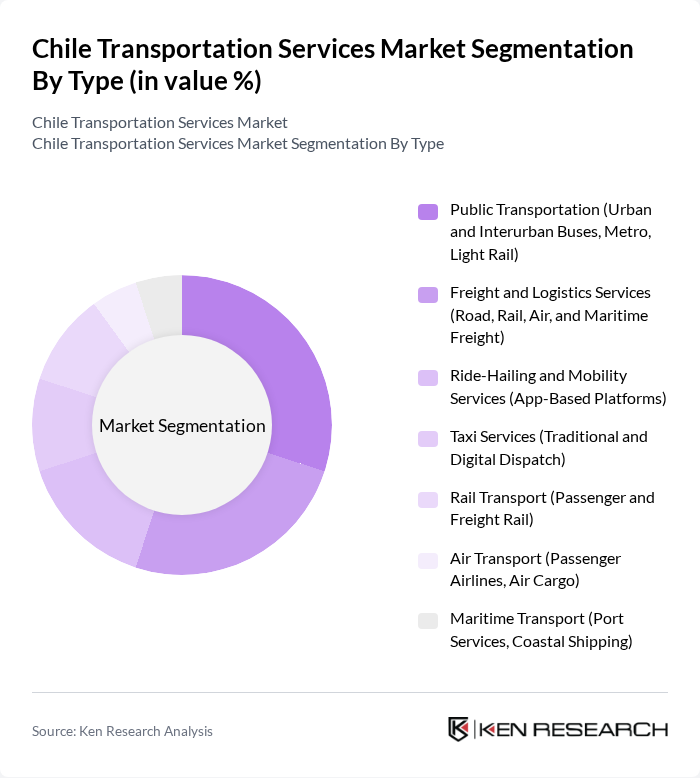

By Type:The Chile Transportation Services Market can be segmented into several key categories: Public Transportation (urban and interurban buses, metro, light rail), Freight and Logistics Services (road, rail, air, and maritime freight), Ride-Hailing and Mobility Services (app-based platforms), Taxi Services (traditional and digital dispatch), Rail Transport (passenger and freight rail), Air Transport (passenger airlines, air cargo), and Maritime Transport (port services, coastal shipping). Each segment addresses specific transportation needs for both consumers and businesses, reflecting the diverse modal landscape and the importance of multimodal integration in Chile’s transport sector .

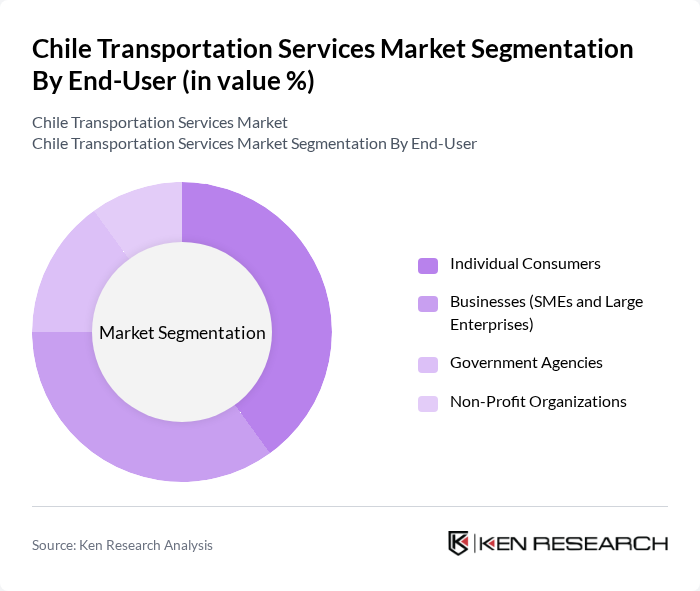

By End-User:The market can also be segmented by end-user categories, including Individual Consumers, Businesses (SMEs and Large Enterprises), Government Agencies, and Non-Profit Organizations. Each segment has distinct transportation requirements: individual consumers prioritize convenience and affordability, businesses focus on reliability and efficiency for supply chain operations, government agencies emphasize public service and regulatory compliance, while non-profit organizations often require specialized logistics for humanitarian and community services .

The Chile Transportation Services Market is characterized by a dynamic mix of regional and international players. Leading participants such as LATAM Airlines, Turbus, Metro de Santiago, Buses Vule, Uber Chile, Easy Taxi, Pullman Bus, Transportes Nazar, Transantiago (now Red Metropolitana de Movilidad), DHL Express Chile, Correos de Chile, Rappi Chile, Falabella Logística, Cencosud Logística, and SAAM Logistics contribute to innovation, geographic expansion, and service delivery in this space.

The Chile transportation services market is poised for significant transformation, driven by technological advancements and a growing emphasis on sustainability. The integration of smart transportation solutions, such as real-time tracking and digital payment systems, is expected to enhance operational efficiency. Additionally, the shift towards electric vehicles will likely gain momentum, supported by government incentives and consumer demand for greener options. These trends will shape the future landscape of transportation services in Chile, fostering innovation and improved service delivery.

| Segment | Sub-Segments |

|---|---|

| By Type | Public Transportation (Urban and Interurban Buses, Metro, Light Rail) Freight and Logistics Services (Road, Rail, Air, and Maritime Freight) Ride-Hailing and Mobility Services (App-Based Platforms) Taxi Services (Traditional and Digital Dispatch) Rail Transport (Passenger and Freight Rail) Air Transport (Passenger Airlines, Air Cargo) Maritime Transport (Port Services, Coastal Shipping) |

| By End-User | Individual Consumers Businesses (SMEs and Large Enterprises) Government Agencies Non-Profit Organizations |

| By Service Model | On-Demand Services Subscription Services Pay-Per-Use Services |

| By Vehicle Type | Buses Vans Trucks (Light, Medium, Heavy) Motorcycles Cars |

| By Payment Method | Cash Credit/Debit Cards Mobile Payments Digital Wallets and Others |

| By Geographic Coverage | Urban Areas Suburban Areas Rural Areas |

| By Customer Segment | Corporate Clients Government Contracts Individual Users |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Road Transportation Services | 100 | Fleet Managers, Logistics Coordinators |

| Rail Freight Services | 60 | Operations Managers, Rail Network Planners |

| Air Cargo Services | 40 | Airline Cargo Managers, Freight Forwarders |

| Maritime Shipping Services | 40 | Port Authorities, Shipping Line Executives |

| Last-Mile Delivery Services | 50 | eCommerce Logistics Managers, Delivery Service Operators |

The Chile Transportation Services Market is valued at approximately USD 12.6 billion, reflecting significant growth driven by urbanization, infrastructure investments, and the demand for efficient logistics solutions.