Region:Global

Author(s):Shubham

Product Code:KRAA0924

Pages:90

Published On:August 2025

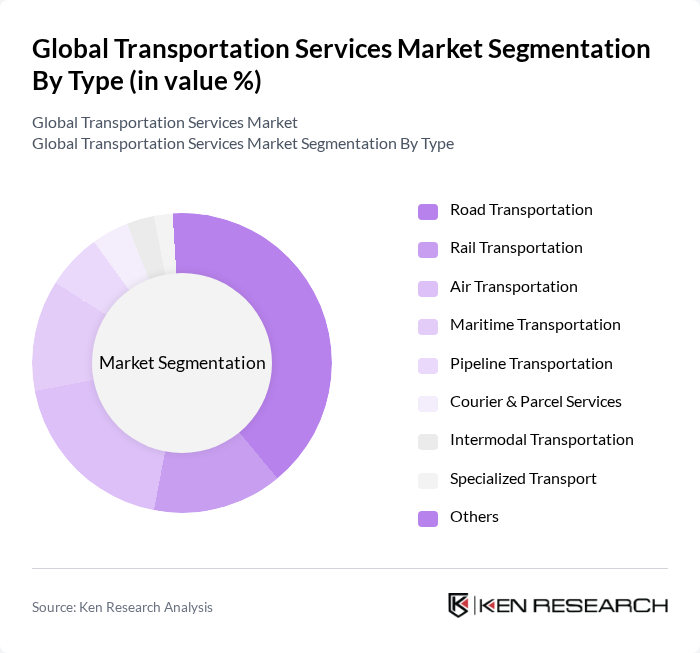

By Type:The transportation services market is segmented into various types, including Road Transportation, Rail Transportation, Air Transportation, Maritime Transportation, Pipeline Transportation, Courier & Parcel Services, Intermodal Transportation, Specialized Transport, and Others. Among these, Road Transportation is the most dominant segment, driven by the increasing demand for last-mile delivery services, the expansion of logistics networks, and the growth of e-commerce and on-demand mobility. The convenience, flexibility, and scalability offered by road transport make it a preferred choice for many businesses, especially in urban and peri-urban areas .

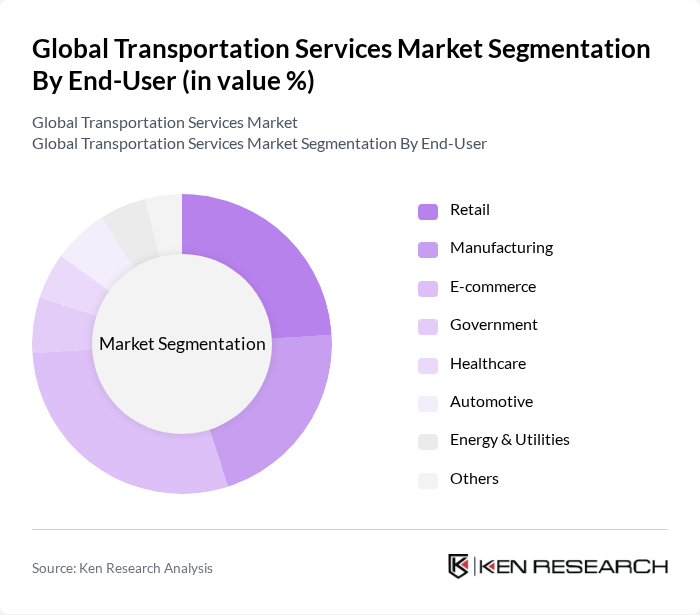

By End-User:The market is also segmented by end-user, which includes Retail, Manufacturing, E-commerce, Government, Healthcare, Automotive, Energy & Utilities, and Others. The E-commerce segment is currently leading the market due to the exponential growth of online shopping, which has increased the demand for efficient and reliable transportation services, especially for last-mile and express delivery. Retail and Manufacturing also contribute significantly, as they require robust logistics solutions to manage their supply chains effectively and ensure timely delivery to customers and distributors .

The Global Transportation Services Market is characterized by a dynamic mix of regional and international players. Leading participants such as DHL Supply Chain & Global Forwarding, FedEx Corporation, UPS (United Parcel Service), Maersk Line, XPO Logistics, DB Schenker, SNCF Logistics, Kuehne + Nagel International AG, C.H. Robinson Worldwide, Inc., J.B. Hunt Transport Services, Inc., Ryder System, Inc., DSV A/S, Geodis SA, Nippon Express Holdings, Bolloré Logistics contribute to innovation, geographic expansion, and service delivery in this space.

The future of the transportation services market is poised for transformation, driven by technological integration and sustainability initiatives. As urbanization continues, cities will increasingly adopt smart transportation solutions, enhancing efficiency and reducing congestion. Furthermore, the shift towards electric and autonomous vehicles will reshape logistics operations, promoting environmentally friendly practices. Companies that embrace these trends will likely gain a competitive edge, positioning themselves favorably in a rapidly evolving market landscape.

| Segment | Sub-Segments |

|---|---|

| By Type | Road Transportation Rail Transportation Air Transportation Maritime Transportation Pipeline Transportation Courier & Parcel Services Intermodal Transportation Specialized Transport Others |

| By End-User | Retail Manufacturing E-commerce Government Healthcare Automotive Energy & Utilities Others |

| By Mode of Transport | Road Rail Air Sea Intermodal Pipeline Others |

| By Service Type | Third-Party Logistics (3PL) Fourth-Party Logistics (4PL) Warehousing Express Delivery Scheduled Services On-Demand Services Contract Services Charter Services Others |

| By Customer Type | B2B B2C C2C Others |

| By Pricing Model | Fixed Pricing Dynamic Pricing Subscription-Based Pricing Others |

| By Geographic Coverage | Local Regional National International Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Road Transportation Services | 120 | Fleet Managers, Logistics Coordinators |

| Air Freight Services | 60 | Air Cargo Managers, Operations Executives |

| Maritime Shipping Services | 50 | Shipping Line Executives, Port Authorities |

| Rail Freight Services | 40 | Rail Operations Managers, Supply Chain Analysts |

| Last-Mile Delivery Solutions | 45 | Last-Mile Delivery Managers, E-commerce Logistics Heads |

The Global Transportation Services Market is valued at approximately USD 8.5 trillion, reflecting significant growth driven by the demand for efficient logistics solutions, the rise of e-commerce, and advancements in technology such as automation and real-time tracking.