Region:Asia

Author(s):Shubham

Product Code:KRAA1154

Pages:92

Published On:August 2025

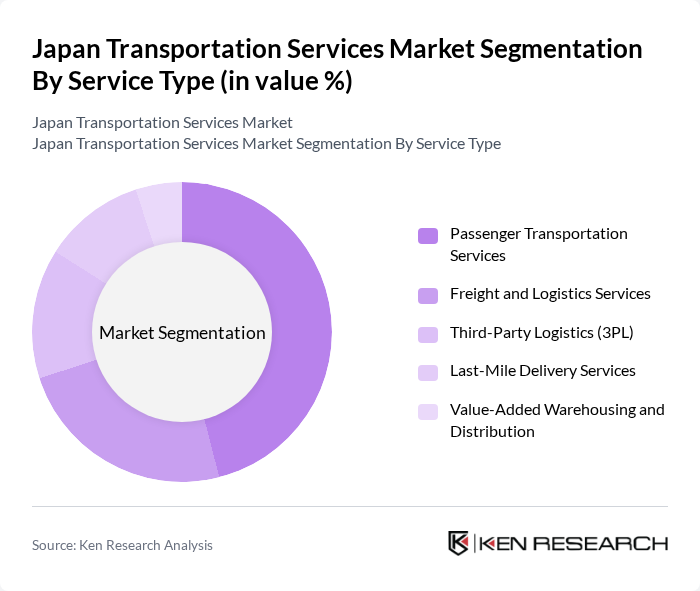

By Service Type:The service type segmentation includes passenger transportation services, freight and logistics services, third-party logistics (3PL), last-mile delivery services, and value-added warehousing and distribution. Passenger transportation services hold the largest share, driven by the high volume of daily commuters in urban areas and a strong preference for public transport over private vehicles. The demand for efficient, reliable, and technologically advanced transportation options is rising, supported by urbanization, demographic shifts, and digitalization of mobility services .

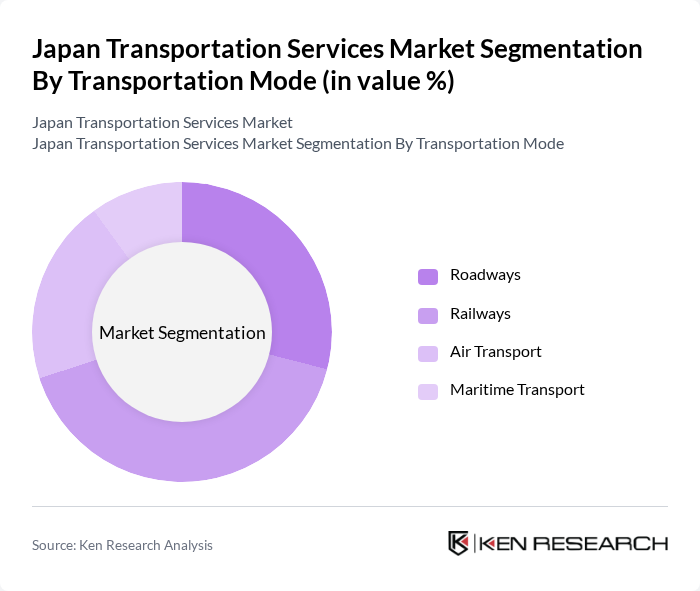

By Transportation Mode:The transportation mode segmentation encompasses roadways, railways, air transport, and maritime transport. Railways remain the leading mode of transportation in Japan, supported by the extensive and efficient rail network, including the Shinkansen (bullet trains). This mode is preferred for its speed, reliability, and ability to handle large volumes of passengers and freight, making it a critical component of the country’s transportation infrastructure. Roadways and air transport are also significant, particularly for last-mile delivery and international connectivity .

The Japan Transportation Services Market is characterized by a dynamic mix of regional and international players. Leading participants such as Japan Railways Group (JR Group), East Japan Railway Company (JR East), West Japan Railway Company (JR West), Central Japan Railway Company (JR Central), All Nippon Airways (ANA Holdings), Japan Airlines (JAL), Nippon Express Holdings, Yamato Holdings, Seino Holdings, Japan Post Holdings, Hitachi Transport System, Kintetsu Group Holdings, Keikyu Corporation, Tokyu Corporation, and Uber Japan contribute to innovation, geographic expansion, and service delivery in this space .

The future of Japan's transportation services market appears promising, driven by ongoing urbanization and technological advancements. In future, the integration of smart transportation systems and the expansion of electric vehicle infrastructure are expected to reshape the landscape. Additionally, the rise of Mobility-as-a-Service (MaaS) will enhance user experience, making transportation more accessible. As the government continues to invest in infrastructure, the market is likely to see improved efficiency and sustainability, positioning Japan as a leader in innovative transportation solutions.

| Segment | Sub-Segments |

|---|---|

| By Service Type | Passenger Transportation Services Freight and Logistics Services Third-Party Logistics (3PL) Last-Mile Delivery Services Value-Added Warehousing and Distribution |

| By Transportation Mode | Roadways Railways Air Transport Maritime Transport |

| By End-User Industry | Retail & E-commerce Manufacturing & Automotive Healthcare & Pharmaceuticals Food & Beverages Construction Government & Public Sector |

| By Service Model | Subscription-Based Services Pay-Per-Use Services Contractual Services |

| By Distribution Channel | Online Platforms Offline Agencies Mobile Applications |

| By Vehicle Type | Buses Trucks Cars Motorcycles |

| By Payment Method | Cash Credit/Debit Cards Mobile Payments |

| By Customer Segment | Corporate Clients Government Contracts General Public |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Road Transportation Services | 60 | Fleet Managers, Logistics Coordinators |

| Rail Freight Operations | 40 | Railway Operations Managers, Supply Chain Analysts |

| Air Cargo Services | 45 | Airline Cargo Managers, Freight Forwarders |

| Maritime Shipping Logistics | 40 | Port Operations Managers, Shipping Coordinators |

| Last-Mile Delivery Solutions | 50 | Last-Mile Delivery Managers, E-commerce Logistics Heads |

The Japan Transportation Services Market is valued at approximately USD 115 billion, reflecting a robust growth driven by urbanization, demand for efficient logistics, and advancements in technology across various transportation modes.