Region:Europe

Author(s):Shubham

Product Code:KRAA0838

Pages:91

Published On:August 2025

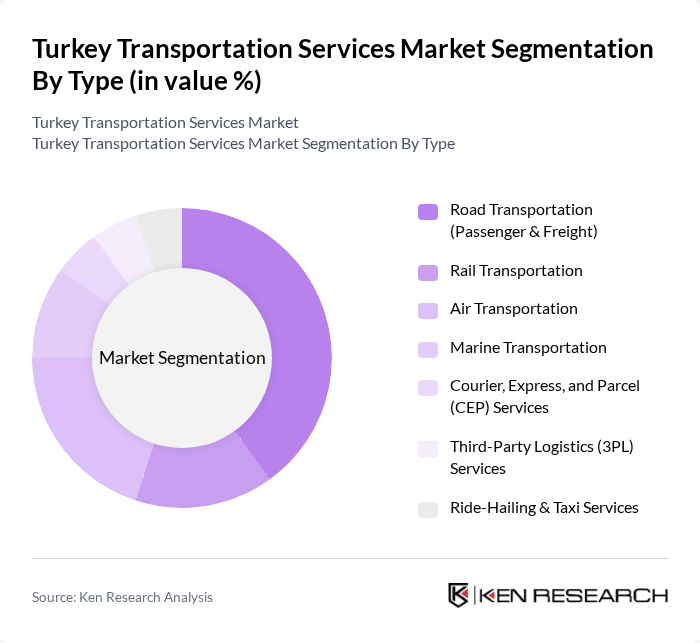

By Type:The Turkey Transportation Services Market can be segmented into various types, including Road Transportation (Passenger & Freight), Rail Transportation, Air Transportation, Marine Transportation, Courier, Express, and Parcel (CEP) Services, Third-Party Logistics (3PL) Services, and Ride-Hailing & Taxi Services. Each of these segments plays a vital role in the overall transportation ecosystem, catering to different consumer needs and preferences .

The Road Transportation segment, particularly Passenger & Freight, dominates the market due to the extensive and well-developed road network in Turkey, which enables efficient movement of goods and people. The growing reliance on road transport for both personal and commercial purposes, combined with the rapid expansion of e-commerce and last-mile delivery, has led to a significant rise in demand for logistics and freight services. The flexibility and convenience offered by road transportation continue to make it the preferred choice among consumers and businesses .

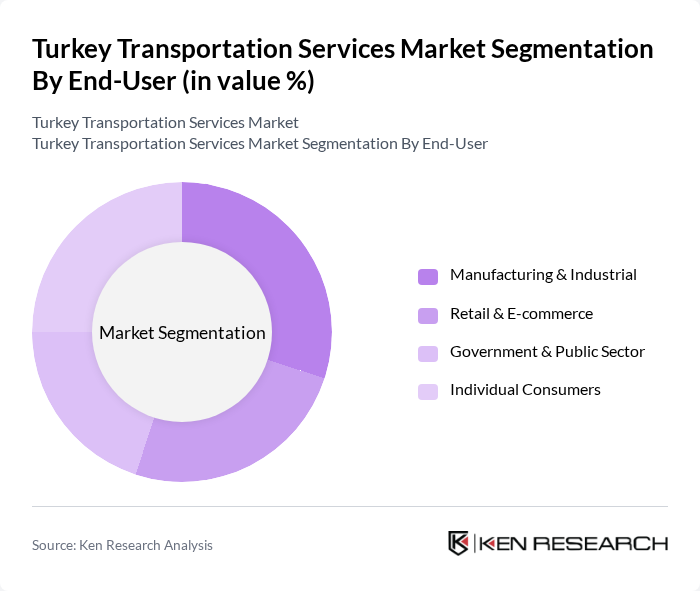

By End-User:The market can also be segmented by end-user categories, including Manufacturing & Industrial, Retail & E-commerce, Government & Public Sector, and Individual Consumers. Each of these segments has unique transportation needs that drive demand for various services .

The Manufacturing & Industrial segment is a key driver in the Turkey Transportation Services Market, as it requires robust logistics solutions for the movement of raw materials and finished goods. The ongoing growth of the manufacturing sector, coupled with increasing demand for timely and reliable deliveries, has led to a significant reliance on transportation services. The Retail & E-commerce segment is also expanding rapidly, further elevating the demand for efficient and technology-driven transportation solutions .

The Turkey Transportation Services Market is characterized by a dynamic mix of regional and international players. Leading participants such as Turkish Airlines, TCDD (Turkish State Railways), ?ETT (Istanbul Electric Tram and Tunnel Enterprises), Pegasus Airlines, AnadoluJet, Kamil Koç, Metro Turizm, DHL Turkey, Aras Kargo, PTT (Post and Telegraph Organization), Maersk Turkey, DB Schenker Arkas, Borusan Lojistik, Getir, BiTaksi, Yandex.Taxi, Hepsijet, and CEVA Logistics Turkey contribute to innovation, geographic expansion, and service delivery in this space .

The Turkey transportation services market is poised for significant transformation, driven by technological advancements and evolving consumer preferences. The integration of smart transportation solutions, such as AI-driven logistics and electric vehicles, is expected to enhance operational efficiency and reduce environmental impact. Furthermore, the increasing focus on safety and security measures will likely shape the future landscape, ensuring that transportation services meet the demands of a growing urban population while addressing sustainability concerns.

| Segment | Sub-Segments |

|---|---|

| By Type | Road Transportation (Passenger & Freight) Rail Transportation Air Transportation Marine Transportation Courier, Express, and Parcel (CEP) Services Third-Party Logistics (3PL) Services Ride-Hailing & Taxi Services |

| By End-User | Manufacturing & Industrial Retail & E-commerce Government & Public Sector Individual Consumers |

| By Service Model | Domestic Transportation International Transportation Value-Added Logistics Services |

| By Vehicle Type | Trucks & LCVs Buses & Coaches Railcars & Locomotives Aircraft Ships & Ferries |

| By Payment Method | Cash Credit/Debit Cards Mobile Payments |

| By Geographic Coverage | Urban Areas Suburban Areas Rural Areas |

| By Customer Segment | Corporate Clients Government Contracts Individual Users |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Road Transportation Services | 100 | Logistics Managers, Fleet Operators |

| Rail Freight Services | 60 | Railway Operations Managers, Freight Coordinators |

| Air Cargo Services | 40 | Airline Cargo Managers, Supply Chain Managers |

| Maritime Shipping Services | 40 | Port Authorities, Shipping Line Executives |

| Public Transportation Systems | 50 | Transit Authority Officials, Urban Planners |

The Turkey Transportation Services Market is valued at approximately USD 13 billion, reflecting significant growth driven by urbanization, infrastructure investments, and increased e-commerce activities, which have heightened the demand for efficient transportation solutions across the country.