Region:North America

Author(s):Geetanshi

Product Code:KRAA8007

Pages:95

Published On:September 2025

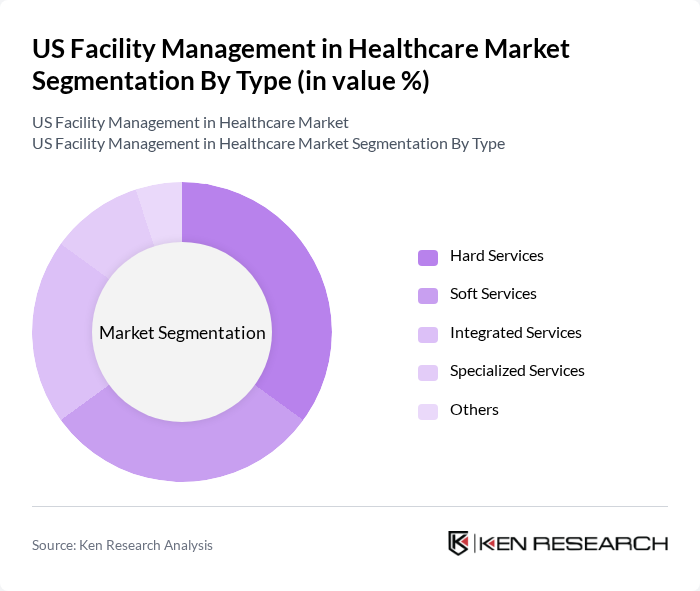

By Type:The facility management market in healthcare is segmented into various types, including Hard Services, Soft Services, Integrated Services, Specialized Services, and Others. Hard Services encompass essential maintenance and repair tasks, while Soft Services focus on non-core activities such as cleaning and catering. Integrated Services combine both hard and soft services for a holistic approach, and Specialized Services cater to specific needs like security and waste management. Each type plays a crucial role in ensuring the smooth operation of healthcare facilities.

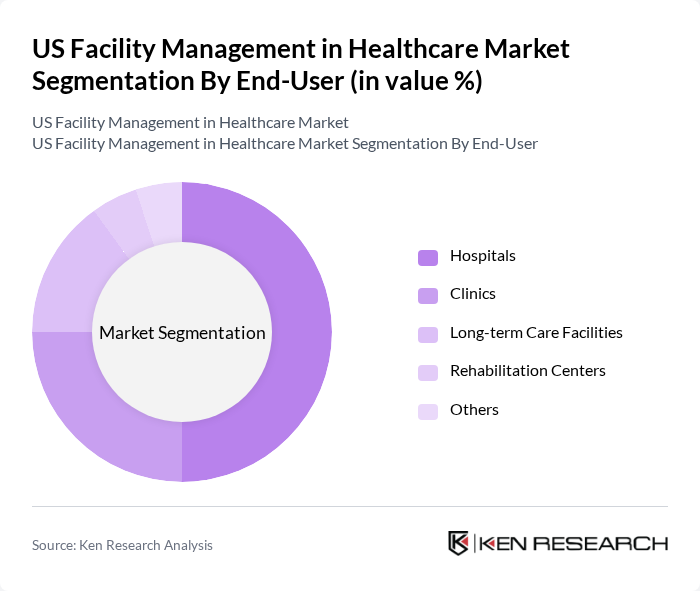

By End-User:The end-user segmentation of the facility management market in healthcare includes Hospitals, Clinics, Long-term Care Facilities, Rehabilitation Centers, and Others. Hospitals are the largest end-users due to their extensive operational needs, followed by clinics that require efficient management of patient flow and services. Long-term care facilities and rehabilitation centers also contribute significantly, as they focus on maintaining a conducive environment for patient recovery and care.

The US Facility Management in Healthcare Market is characterized by a dynamic mix of regional and international players. Leading participants such as CBRE Group, Inc., Jones Lang LaSalle Incorporated, Cushman & Wakefield plc, ISS A/S, Aramark Corporation, Sodexo S.A., ABM Industries Incorporated, GDI Integrated Facility Services, EMCOR Group, Inc., Mitie Group plc, Serco Group plc, C&W Services, HSS Hire Group plc, OCS Group Limited, VWR International, LLC contribute to innovation, geographic expansion, and service delivery in this space.

The future of facility management in healthcare is poised for significant transformation, driven by technological advancements and evolving patient expectations. As healthcare facilities increasingly adopt smart technologies, operational efficiency will improve, leading to enhanced patient care. Additionally, the focus on sustainability will drive investments in eco-friendly practices, aligning with regulatory requirements and societal expectations. The integration of data analytics will further empower facility managers to make informed decisions, optimizing resource allocation and improving overall service delivery.

| Segment | Sub-Segments |

|---|---|

| By Type | Hard Services Soft Services Integrated Services Specialized Services Others |

| By End-User | Hospitals Clinics Long-term Care Facilities Rehabilitation Centers Others |

| By Service Model | Outsourced Services In-house Services Hybrid Services |

| By Facility Type | Acute Care Facilities Ambulatory Care Facilities Specialty Care Facilities |

| By Geographic Coverage | Urban Areas Suburban Areas Rural Areas |

| By Contract Type | Fixed-Price Contracts Cost-Plus Contracts Time and Materials Contracts |

| By Technology Integration | Building Management Systems IoT Solutions Energy Management Systems Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Hospital Facility Management | 150 | Facility Managers, Operations Directors |

| Outpatient Clinic Management | 100 | Clinic Administrators, Maintenance Supervisors |

| Healthcare Technology Integration | 80 | IT Managers, Facility Coordinators |

| Emergency Services Facility Management | 70 | Emergency Department Managers, Safety Officers |

| Long-term Care Facility Operations | 60 | Facility Directors, Care Home Managers |

The US Facility Management in Healthcare Market is valued at approximately USD 405 billion, driven by increasing healthcare service demands, technological advancements, and a focus on operational efficiency and patient satisfaction.