Region:North America

Author(s):Geetanshi

Product Code:KRAA0237

Pages:89

Published On:August 2025

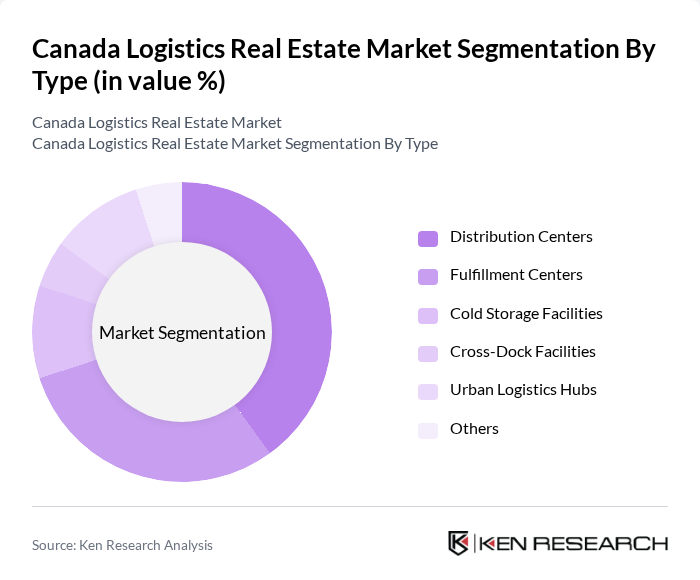

By Type:The logistics real estate market is segmented into Distribution Centers, Fulfillment Centers, Cold Storage Facilities, Cross-Dock Facilities, Urban Logistics Hubs, and Others. Distribution Centers are currently leading the market, driven by the need for efficient storage and rapid distribution to meet consumer expectations for fast delivery. The rise of e-commerce has significantly influenced consumer behavior, increasing demand for strategically located distribution centers. Fulfillment Centers are also gaining traction, catering specifically to e-commerce businesses with tailored solutions for order processing and shipping .

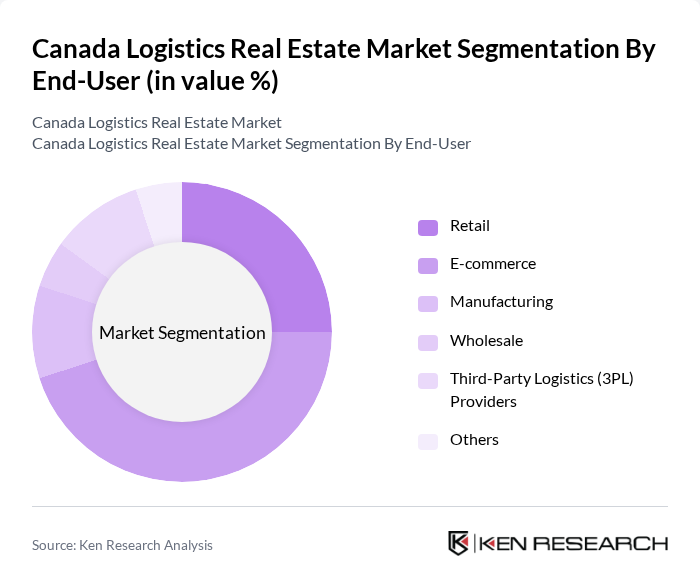

By End-User:The end-user segmentation of the logistics real estate market includes Retail, E-commerce, Manufacturing, Wholesale, Third-Party Logistics (3PL) Providers, and Others. The E-commerce sector is the dominant end-user, driven by the rapid growth of online shopping and the need for efficient logistics solutions to meet consumer expectations for fast delivery. Retail also plays a significant role, as traditional brick-and-mortar stores adapt to the changing landscape by integrating logistics capabilities to support their online sales channels. Demand from 3PL providers is increasing as businesses seek to outsource logistics operations for greater flexibility and cost efficiency .

The Canada Logistics Real Estate Market is characterized by a dynamic mix of regional and international players. Leading participants such as Prologis, Brookfield Properties, Oxford Properties, Dream Industrial REIT, Granite REIT, Pure Industrial (PIRET), Triovest, GWL Realty Advisors, BentallGreenOak, Summit Industrial Income REIT, Slate Asset Management, Blackstone (Canada Industrial Portfolio), Colliers International, CBRE Group, and JLL (Jones Lang LaSalle) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Canada logistics real estate market appears promising, driven by the ongoing growth of e-commerce and urbanization. As businesses increasingly prioritize efficient supply chains, the demand for strategically located logistics facilities will continue to rise. Additionally, the integration of sustainable practices and technological advancements will shape the market, encouraging investments in innovative solutions. Overall, the logistics sector is poised for transformation, with opportunities for growth in both urban and suburban areas as companies adapt to changing consumer behaviors.

| Segment | Sub-Segments |

|---|---|

| By Type | Distribution Centers Fulfillment Centers Cold Storage Facilities Cross-Dock Facilities Urban Logistics Hubs Others |

| By End-User | Retail E-commerce Manufacturing Wholesale Third-Party Logistics (3PL) Providers Others |

| By Region | Ontario Quebec British Columbia Alberta Manitoba Saskatchewan Atlantic Canada Others |

| By Facility Size | Small (<50,000 sq ft) Medium (50,000 - 200,000 sq ft) Large (>200,000 sq ft) Mega (>500,000 sq ft) Others |

| By Ownership Type | Owner-Occupied Leased Joint Ventures REIT-Owned Others |

| By Investment Type | Private Equity Institutional Investment Public Funding Pension Funds Others |

| By Technology Integration | Automated Warehousing IoT-Enabled Logistics Blockchain for Supply Chain Robotics and AI Solutions Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Warehouse Space Utilization | 100 | Facility Managers, Operations Directors |

| Distribution Center Efficiency | 80 | Logistics Coordinators, Supply Chain Analysts |

| Cold Storage Requirements | 60 | Food Supply Chain Managers, Temperature-Controlled Logistics Experts |

| Last-Mile Delivery Solutions | 50 | Last-Mile Operations Managers, Urban Logistics Planners |

| Real Estate Investment Trends | 40 | Real Estate Investors, Asset Managers |

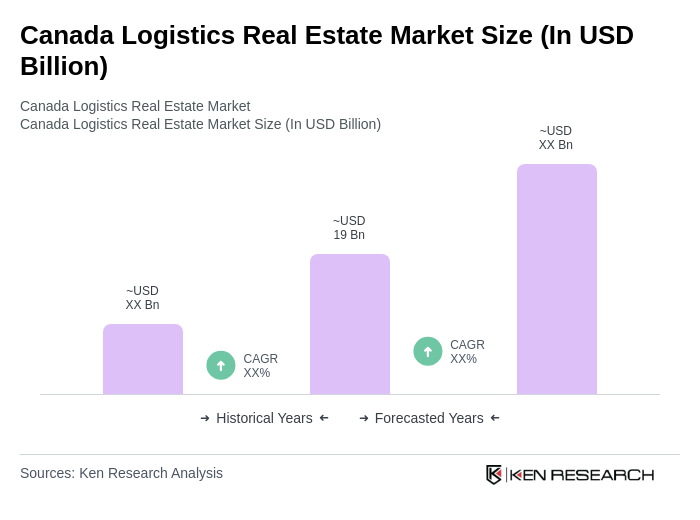

The Canada Logistics Real Estate Market is valued at approximately USD 19 billion, driven by the growth of e-commerce, demand for efficient supply chain solutions, and infrastructure investments across the country.