Region:Europe

Author(s):Shubham

Product Code:KRAA1106

Pages:91

Published On:August 2025

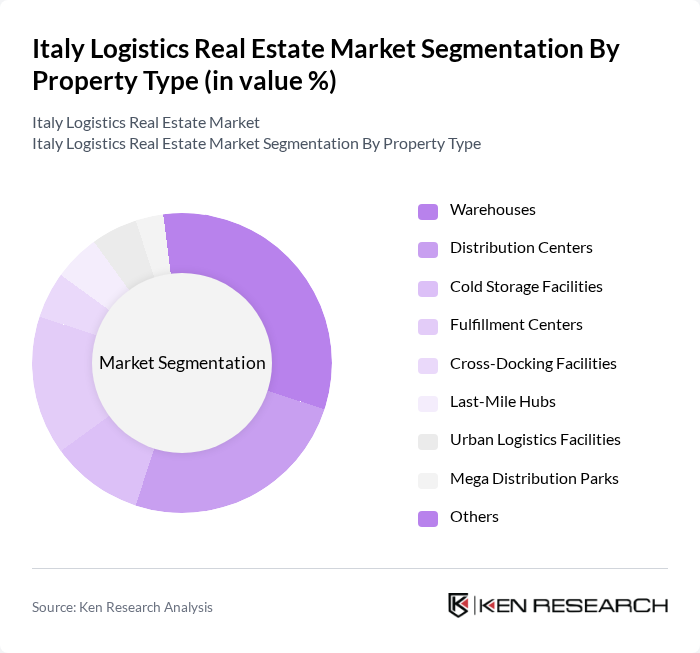

By Property Type:The property type segmentation includes categories such as warehouses, distribution centers, cold storage facilities, fulfillment centers, cross-docking facilities, last-mile hubs, urban logistics facilities, mega distribution parks, and others. Each of these subsegments plays a crucial role in the logistics ecosystem, catering to different operational needs and consumer demands .

The warehouses segment is currently dominating the market due to the increasing need for storage solutions driven by e-commerce growth. As online shopping continues to rise, businesses require more warehouse space to store inventory closer to urban centers, facilitating quicker delivery times. Additionally, the trend towards omnichannel retailing has led to a surge in demand for warehouses that can accommodate both traditional and online sales channels. This segment's adaptability to various industries further solidifies its leadership in the logistics real estate market .

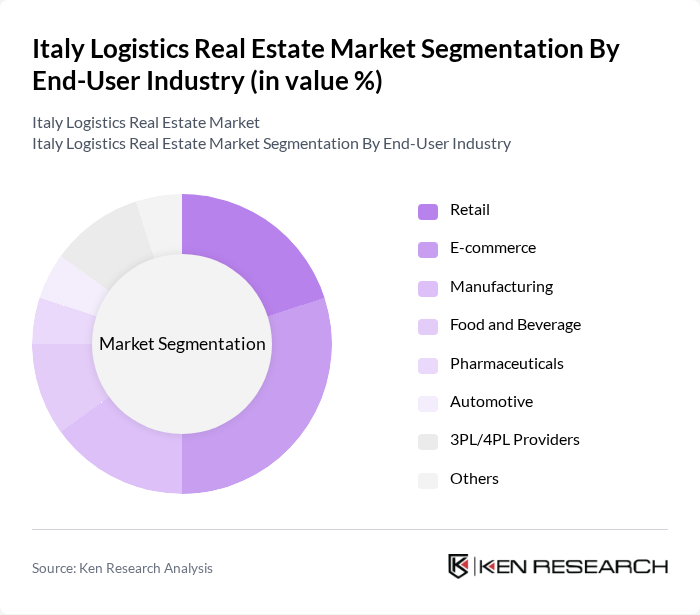

By End-User Industry:The end-user industry segmentation encompasses sectors including retail, e-commerce, manufacturing, food and beverage, pharmaceuticals, automotive, 3PL/4PL providers, and others. Each industry has unique logistics requirements, influencing the demand for specific types of logistics facilities .

The e-commerce sector is the leading end-user industry, significantly impacting the logistics real estate market. The rapid growth of online shopping has necessitated the establishment of extensive logistics networks, including fulfillment centers and last-mile hubs, to ensure timely delivery. Retailers are increasingly investing in logistics capabilities to enhance customer experience, leading to a surge in demand for logistics facilities tailored to e-commerce operations. This trend is expected to continue as consumer preferences shift towards online purchasing .

The Italy Logistics Real Estate Market is characterized by a dynamic mix of regional and international players. Leading participants such as Prologis, Segro, Goodman Group, Vailog (SEGRO Italy), GLP (formerly Gazeley), Logicor, Blackstone (Mileway), Savills Investment Management, CBRE Investment Management, Hines, Kryalos SGR, DeA Capital Real Estate SGR, DHL Supply Chain, Kuehne + Nagel, XPO Logistics, CEVA Logistics, Panattoni contribute to innovation, geographic expansion, and service delivery in this space.

The future of Italy's logistics real estate market appears promising, driven by ongoing e-commerce growth and infrastructure investments. As companies increasingly prioritize sustainability, the demand for green logistics solutions is expected to rise. Additionally, advancements in technology will continue to reshape logistics operations, enhancing efficiency and reducing costs. The market is likely to see a shift towards flexible warehousing solutions, catering to the evolving needs of businesses in a dynamic economic landscape.

| Segment | Sub-Segments |

|---|---|

| By Property Type | Warehouses Distribution Centers Cold Storage Facilities Fulfillment Centers Cross-Docking Facilities Last-Mile Hubs Urban Logistics Facilities Mega Distribution Parks Others |

| By End-User Industry | Retail E-commerce Manufacturing Food and Beverage Pharmaceuticals Automotive PL/4PL Providers Others |

| By Location | Urban Areas Suburban Areas Industrial Zones Proximity to Major Highways Port Proximity (e.g., Genoa, Trieste, Naples) Airport Proximity (e.g., Milan Malpensa, Rome Fiumicino) Inland Logistics Hubs Others |

| By Facility Size | Small (<10,000 sqm) Medium (10,000 - 50,000 sqm) Large (>50,000 sqm) Mega (>100,000 sqm) Others |

| By Ownership Structure | Owned Leased Managed Joint Ventures REITs Others |

| By Investment Type | Private Equity Institutional Investment Public Funding Foreign Direct Investment Others |

| By Lease Type | Short-Term Leases Long-Term Leases Flexible Leases Build-to-Suit Leases Others |

| By Logistics Model | PL (Second-Party Logistics) PL (Third-Party Logistics) PL (Fourth-Party Logistics) Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Warehouse Space Utilization | 100 | Facility Managers, Operations Directors |

| Distribution Center Development | 80 | Real Estate Developers, Project Managers |

| Logistics Technology Adoption | 60 | IT Managers, Logistics Coordinators |

| Cold Storage Facilities | 50 | Supply Chain Managers, Food Safety Officers |

| Last-Mile Delivery Solutions | 70 | Logistics Executives, Urban Planners |

The Italy Logistics Real Estate Market is valued at approximately USD 8.5 billion, driven by the increasing demand for efficient supply chain solutions, particularly due to the rise of e-commerce and the need for rapid delivery services.