Region:Europe

Author(s):Shubham

Product Code:KRAA1033

Pages:83

Published On:August 2025

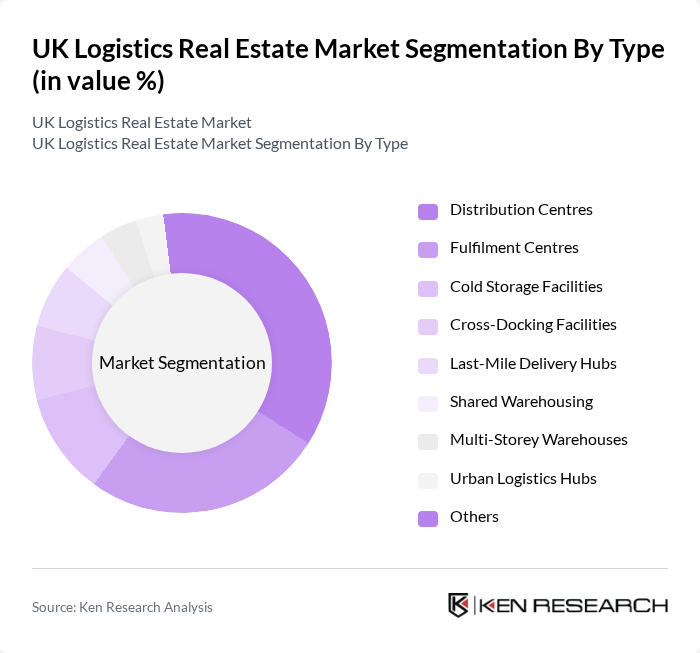

By Type:The logistics real estate market can be segmented into various types, including Distribution Centres, Fulfilment Centres, Cold Storage Facilities, Cross-Docking Facilities, Last-Mile Delivery Hubs, Shared Warehousing, Multi-Storey Warehouses, Urban Logistics Hubs, and Others. Among these, Distribution Centres are currently the dominant sub-segment due to the rising demand for efficient storage and distribution solutions, particularly in the e-commerce sector. Fulfilment Centres are also gaining traction as businesses seek to enhance their order processing capabilities to meet consumer expectations .

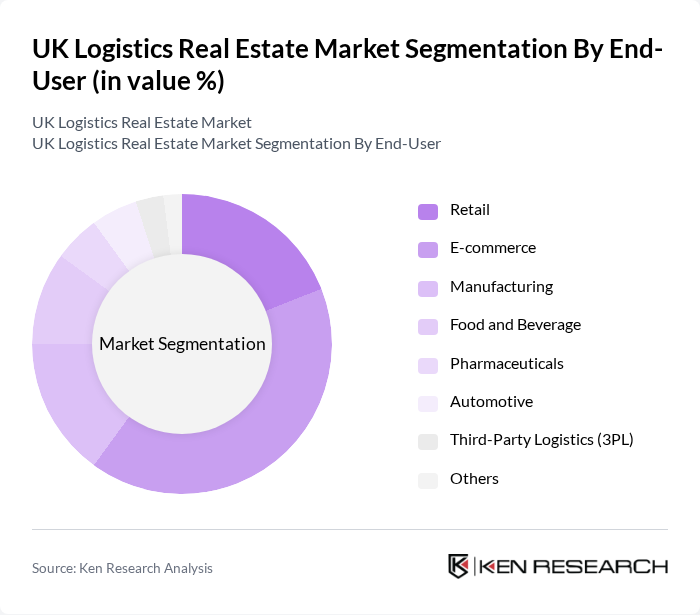

By End-User:The logistics real estate market is also segmented by end-user industries, including Retail, E-commerce, Manufacturing, Food and Beverage, Pharmaceuticals, Automotive, Third-Party Logistics (3PL), and Others. The E-commerce sector is the leading end-user, driven by the rapid growth of online shopping and the need for efficient distribution networks. Retail also plays a significant role, as traditional brick-and-mortar stores adapt to changing consumer behaviors by enhancing their logistics capabilities .

The UK Logistics Real Estate Market is characterized by a dynamic mix of regional and international players. Leading participants such as Prologis, SEGRO, Goodman Group, Panattoni, Tritax Big Box REIT, Blackstone (via Logicor), GLP, Gazeley (GLP Europe), St. Modwen Logistics, DHL Supply Chain, XPO Logistics, Stoford, Savills, JLL, Cushman & Wakefield contribute to innovation, geographic expansion, and service delivery in this space.

The UK logistics real estate market is poised for significant transformation as it adapts to evolving consumer demands and technological advancements. The increasing focus on sustainability and efficiency will drive investments in green logistics and automated warehousing solutions. Additionally, the rise of e-commerce and urbanization will necessitate the development of flexible and strategically located logistics facilities. As the market navigates challenges such as rising construction costs and regulatory compliance, innovative solutions will emerge, shaping the future landscape of logistics real estate in the UK.

| Segment | Sub-Segments |

|---|---|

| By Type | Distribution Centres Fulfilment Centres Cold Storage Facilities Cross-Docking Facilities Last-Mile Delivery Hubs Shared Warehousing Multi-Storey Warehouses Urban Logistics Hubs Others |

| By End-User | Retail E-commerce Manufacturing Food and Beverage Pharmaceuticals Automotive Third-Party Logistics (3PL) Others |

| By Location | Urban Areas Suburban Areas Rural Areas Industrial Zones Logistics Parks Port-Centric Locations Others |

| By Size | Small (<10,000 sq ft) Medium (10,000 - 50,000 sq ft) Large (>50,000 sq ft) Mega (>250,000 sq ft) Others |

| By Ownership Type | Owned Leased Managed Joint Venture Others |

| By Investment Type | Institutional Investment Private Equity Real Estate Investment Trusts (REITs) Public Funding Others |

| By Service Type | Warehousing Services Transportation Services Value-Added Services (e.g., packaging, assembly) Inventory Management Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Warehouse Space Utilization | 120 | Facility Managers, Operations Directors |

| Distribution Center Development | 90 | Real Estate Developers, Project Managers |

| Logistics Technology Adoption | 70 | IT Managers, Logistics Coordinators |

| Urban Logistics Challenges | 60 | City Planners, Policy Makers |

| Cold Storage Facilities | 50 | Supply Chain Managers, Food Safety Officers |

The UK Logistics Real Estate Market is valued at approximately USD 23 billion, driven by the growth of e-commerce, demand for efficient supply chain solutions, and investments in modern logistics infrastructure.