Region:Asia

Author(s):Geetanshi

Product Code:KRAA2083

Pages:87

Published On:August 2025

By Asset Type:The asset type segmentation encompasses Distribution Centers, Fulfillment Centers, Cold Storage Facilities, Cross-Docking Facilities, Last-Mile Delivery Hubs, Urban Logistics Parks, Bonded Logistics Parks, Multi-Story Warehouses, and Others.Distribution Centerscontinue to lead due to the surge in e-commerce and the need for efficient, large-scale storage and distribution.Fulfillment Centersare rapidly expanding, driven by the demand for rapid order processing and last-mile delivery efficiency.Cold Storage Facilitiesare also gaining importance, reflecting growth in pharmaceuticals, fresh food, and cross-border e-commerce .

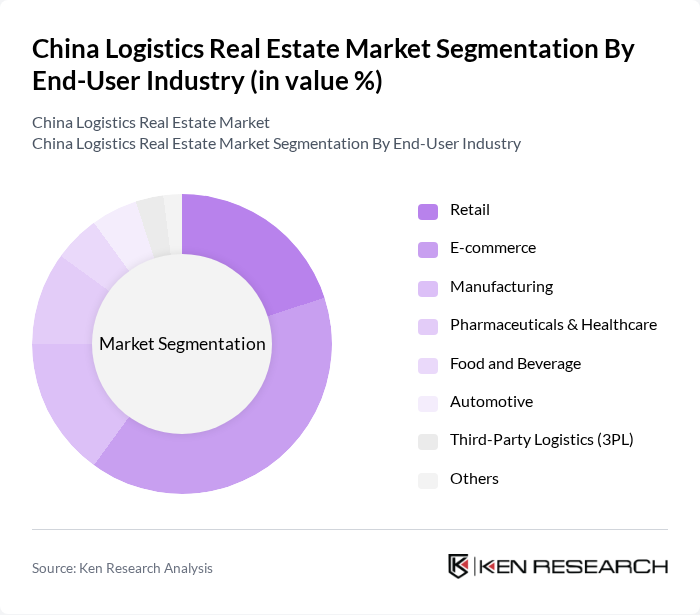

By End-User Industry:The end-user segmentation includes Retail, E-commerce, Manufacturing, Pharmaceuticals & Healthcare, Food and Beverage, Automotive, Third-Party Logistics (3PL), and Others.E-commerceremains the dominant sector, reflecting the rapid growth of online retail and consumer expectations for fast, reliable delivery.RetailandManufacturingalso contribute significantly, as traditional businesses invest in logistics upgrades to remain competitive. ThePharmaceuticals & Healthcaresegment is expanding due to increased demand for specialized storage and distribution, particularly for temperature-sensitive goods .

The China Logistics Real Estate Market is characterized by a dynamic mix of regional and international players. Leading participants such as Prologis China, Goodman Group, GLP (Global Logistic Properties), ESR Group, China Merchants Shekou Industrial Zone Holdings Co., Ltd., Dalian Wanda Group, China Logistics Property Holdings Co., Ltd., Shanghai Yupei Group, Sinotrans Limited, SF REIT (SF Real Estate Investment Trust), JD Property Group (????), Beijing Capital Land Ltd., China Vanke Co., Ltd., Longfor Group Holdings Limited, and China Resources Land Limited contribute to innovation, geographic expansion, and service delivery in this space.

The future of the China logistics real estate market appears promising, driven by continued e-commerce growth and urbanization. As the demand for efficient logistics solutions rises, companies are likely to invest in advanced technologies and sustainable practices. The integration of automation and smart warehousing will enhance operational efficiency. Additionally, the government's commitment to infrastructure development will further support the logistics sector, creating a conducive environment for growth and innovation in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Asset Type | Distribution Centers Fulfillment Centers Cold Storage Facilities Cross-Docking Facilities Last-Mile Delivery Hubs Urban Logistics Parks Bonded Logistics Parks Multi-Story Warehouses Others |

| By End-User Industry | Retail E-commerce Manufacturing Pharmaceuticals & Healthcare Food and Beverage Automotive Third-Party Logistics (3PL) Others |

| By Region | Yangtze River Delta (Shanghai, Jiangsu, Zhejiang) Pearl River Delta (Guangdong, Shenzhen, Guangzhou) Bohai Rim (Beijing, Tianjin, Hebei) Western China (Chengdu, Chongqing, Xi'an) Central China (Wuhan, Zhengzhou, Changsha) Northeastern China (Shenyang, Dalian, Harbin) Others |

| By Application | Retail Logistics Industrial Logistics E-commerce Logistics Cold Chain Logistics Reverse Logistics Cross-Border Logistics Others |

| By Investment Source | Domestic Institutional Investors Foreign Direct Investment (FDI) Public-Private Partnerships (PPP) Real Estate Investment Trusts (REITs) Government Schemes Others |

| By Policy Support | Subsidies Tax Exemptions Regulatory Support Grants Others |

| By Technology Integration | Warehouse Management Systems (WMS) Internet of Things (IoT) Artificial Intelligence (AI) Robotics & Automation Digital Twin & Smart Monitoring Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Warehouse Operations in Tier 1 Cities | 100 | Warehouse Managers, Operations Directors |

| Logistics Real Estate Development Trends | 80 | Real Estate Developers, Investment Analysts |

| Impact of E-commerce on Logistics Facilities | 90 | E-commerce Managers, Supply Chain Executives |

| Cold Chain Logistics Requirements | 60 | Cold Chain Managers, Quality Assurance Officers |

| Last-Mile Delivery Solutions | 50 | Last-Mile Coordinators, Logistics Consultants |

The China Logistics Real Estate Market is valued at approximately USD 180 billion, driven by the rapid growth of e-commerce, increased consumer spending, and significant infrastructure investments. This sector is crucial for modern warehousing and distribution facilities to meet evolving consumer expectations.