Region:Middle East

Author(s):Shubham

Product Code:KRAA1003

Pages:91

Published On:August 2025

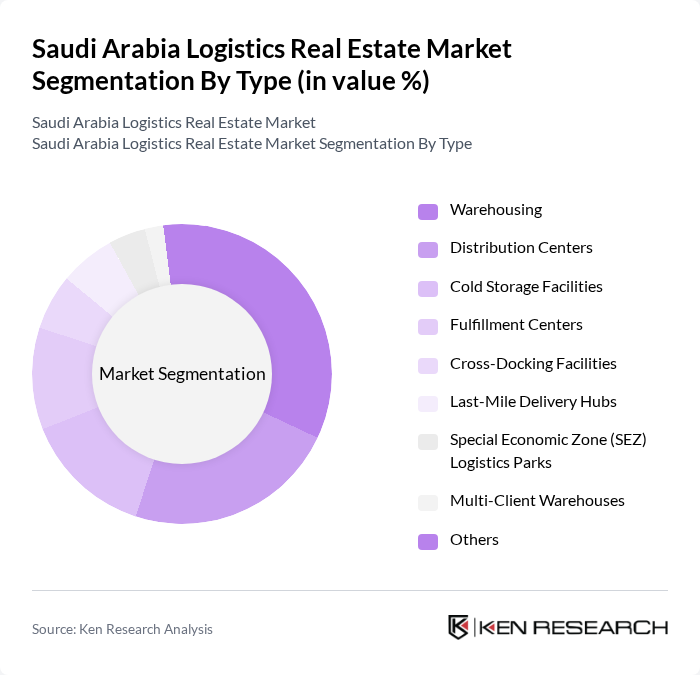

By Type:The logistics real estate market is segmented into Warehousing, Distribution Centers, Cold Storage Facilities, Fulfillment Centers, Cross-Docking Facilities, Last-Mile Delivery Hubs, Special Economic Zone (SEZ) Logistics Parks, Multi-Client Warehouses, and Others. Warehousing and distribution centers represent the largest share, driven by the need for modern, technologically advanced facilities to support e-commerce and retail. Cold storage and temperature-controlled facilities are increasingly in demand due to the growth of the food and pharmaceutical sectors. Fulfillment centers and last-mile delivery hubs are expanding rapidly, reflecting the shift toward online shopping and faster delivery expectations. SEZ logistics parks and multi-client warehouses offer integrated solutions and regulatory incentives, attracting both domestic and international investors .

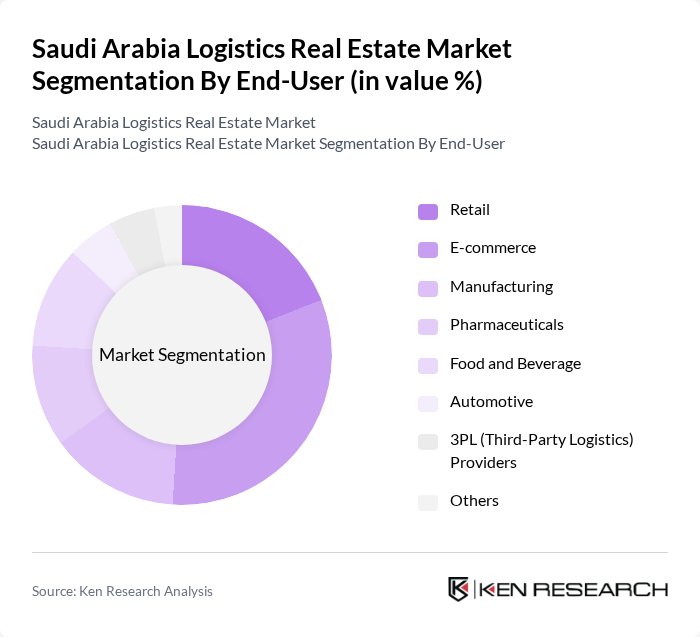

By End-User:The end-user segmentation includes Retail, E-commerce, Manufacturing, Pharmaceuticals, Food and Beverage, Automotive, 3PL (Third-Party Logistics) Providers, and Others. E-commerce and retail are the primary drivers of demand, requiring extensive warehousing and fulfillment infrastructure. The food and pharmaceutical sectors are fueling growth in cold storage and temperature-controlled logistics. Manufacturing and automotive industries require large-scale, specialized logistics facilities, while 3PL providers are expanding their footprint to offer integrated solutions for diverse client needs .

The Saudi Arabia Logistics Real Estate Market is characterized by a dynamic mix of regional and international players. Leading participants such as JLL (Jones Lang LaSalle Saudi Arabia), Saudi Industrial Services Company (SISCO), Arabian Centres Company, Al Rajhi REIT, Agility Logistics Parks (Saudi Arabia), Aramex, DHL Supply Chain Saudi Arabia, LogiPoint (a subsidiary of SISCO), GAC Saudi Arabia, National Shipping Company of Saudi Arabia (Bahri), Saudi Post (SPL - Saudi Post Logistics), Al-Muhaidib Group, Nesma Holding, Al Bawani Company, United Parcel Service (UPS) Saudi Arabia contribute to innovation, geographic expansion, and service delivery in this space.

The logistics real estate market in Saudi Arabia is poised for significant transformation, driven by technological advancements and evolving consumer preferences. The adoption of automation and smart logistics solutions is expected to enhance operational efficiency, while the focus on sustainability will lead to the development of eco-friendly warehouses. Additionally, partnerships with global logistics firms will facilitate knowledge transfer and investment, positioning the Kingdom as a regional logistics hub. These trends will shape the market landscape in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Warehousing Distribution Centers Cold Storage Facilities Fulfillment Centers Cross-Docking Facilities Last-Mile Delivery Hubs Special Economic Zone (SEZ) Logistics Parks Multi-Client Warehouses Others |

| By End-User | Retail E-commerce Manufacturing Pharmaceuticals Food and Beverage Automotive PL (Third-Party Logistics) Providers Others |

| By Location | Urban Areas Suburban Areas Industrial Zones Free Trade Zones Port Proximity Special Economic Zones (SEZs) Others |

| By Facility Size | Small (<10,000 sq ft) Medium (10,000 - 50,000 sq ft) Large (>50,000 sq ft) Mega Distribution Centers (>200,000 sq ft) Custom-Built Facilities Others |

| By Ownership Type | Owned Leased Managed Joint Ventures REIT-Owned Others |

| By Investment Type | Domestic Investment Foreign Direct Investment (FDI) Public-Private Partnerships (PPP) Government Grants Institutional Investment Others |

| By Service Type | Transportation Services Warehousing Services Value-Added Services (e.g., packaging, labeling) Technology Solutions (e.g., WMS, automation) Cold Chain Logistics Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Logistics Facility Developers | 60 | Real Estate Developers, Project Managers |

| Warehouse Operators | 50 | Operations Managers, Facility Managers |

| Supply Chain Executives | 40 | Supply Chain Directors, Logistics Managers |

| Government Policy Makers | 40 | Regulatory Officials, Economic Advisors |

| Industry Analysts | 40 | Market Researchers, Economic Analysts |

The Saudi Arabia Logistics Real Estate Market is valued at approximately USD 13 billion, driven by the growth of e-commerce, demand for advanced warehousing, and significant infrastructure investments.