Region:Africa

Author(s):Geetanshi

Product Code:KRAA1939

Pages:86

Published On:August 2025

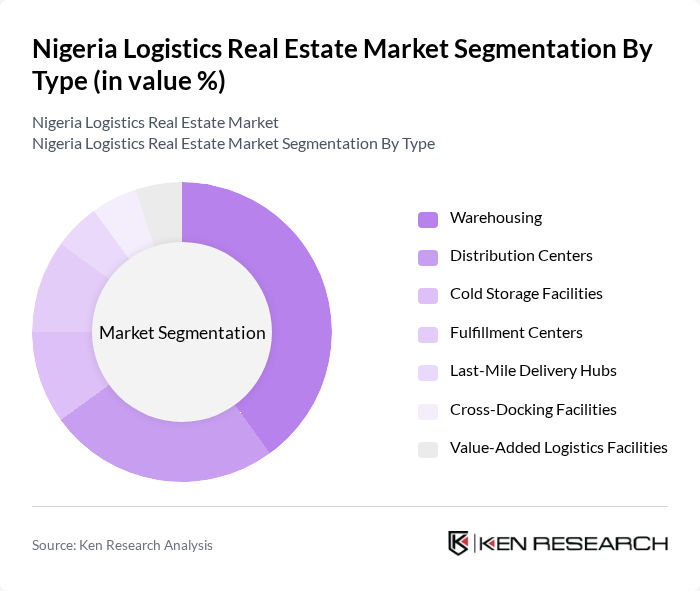

By Type:The logistics real estate market is segmented into warehousing, distribution centers, cold storage facilities, fulfillment centers, last-mile delivery hubs, cross-docking facilities, and value-added logistics facilities. Warehousing remains the most dominant segment, driven by surging demand for storage solutions from e-commerce, retail, and manufacturing sectors. Investments in modern, automated warehousing and multi-temperature storage facilities are accelerating, as companies seek to optimize inventory management and support rapid delivery cycles .

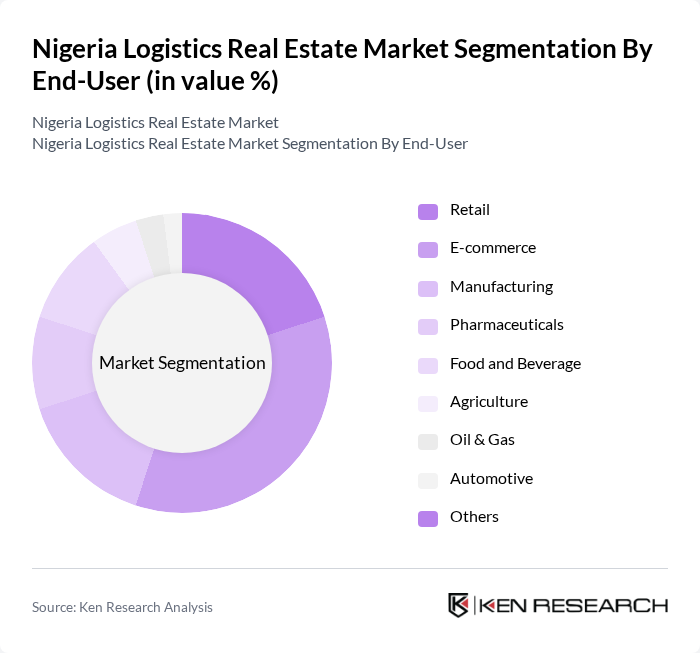

By End-User:The end-user segmentation includes retail, e-commerce, manufacturing, pharmaceuticals, food and beverage, agriculture, oil & gas, automotive, and others. The e-commerce sector leads end-user demand, driven by rapid growth in online shopping and the need for fulfillment centers and last-mile delivery hubs. Manufacturing and food & beverage sectors also contribute significantly, requiring specialized warehousing and distribution solutions to support supply chain efficiency and regulatory compliance .

The Nigeria Logistics Real Estate Market is characterized by a dynamic mix of regional and international players. Leading participants such as Jumia Logistics, DHL Global Forwarding Nigeria, Kuehne + Nagel Nigeria, Maersk Nigeria Limited, GIG Logistics, Red Star Express Plc, FedEx (Red Star Express Partner), Nigerian Ports Authority, TSL Logistics Limited, APM Terminals Apapa Limited, CCECC Nigeria Limited (Warehousing & Logistics Division), Bolloré Transport & Logistics Nigeria, BUA Group (BUA Logistics), Transcorp Group (Transcorp Logistics), Agility Logistics Nigeria contribute to innovation, geographic expansion, and service delivery in this space.

The future of Nigeria's logistics real estate market appears promising, driven by the increasing demand for efficient supply chain solutions. As urbanization accelerates and e-commerce continues to thrive, investments in logistics infrastructure are expected to rise. Additionally, technological advancements, such as automation and data analytics, will enhance operational efficiency. The government's commitment to improving infrastructure through public-private partnerships will further bolster the sector, creating a conducive environment for growth and innovation in logistics real estate.

| Segment | Sub-Segments |

|---|---|

| By Type | Warehousing Distribution Centers Cold Storage Facilities Fulfillment Centers Last-Mile Delivery Hubs Cross-Docking Facilities Value-Added Logistics Facilities |

| By End-User | Retail E-commerce Manufacturing Pharmaceuticals Food and Beverage Agriculture Oil & Gas Automotive Others |

| By Investment Source | Domestic Investment Foreign Direct Investment (FDI) Public-Private Partnerships (PPPs) Government Grants Private Equity & Venture Capital Others |

| By Location | Lagos Metropolitan Area Abuja and Federal Capital Territory Port Harcourt and Niger Delta Industrial Zones (e.g., Ogun, Oyo, Kano) Proximity to Major Highways Port Proximity Others |

| By Facility Size | Small Scale (Less than 10,000 sq ft) Medium Scale (10,000 - 50,000 sq ft) Large Scale (50,000 - 100,000 sq ft) Extra Large Scale (Above 100,000 sq ft) Mega Facilities (Above 500,000 sq ft) Others |

| By Service Type | Third-Party Logistics (3PL) Fourth-Party Logistics (4PL) Freight Forwarding Transportation Services Courier, Express & Parcel (CEP) Others |

| By Lease Type | Short-Term Lease Long-Term Lease Build-to-Suit Sale & Leaseback Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Warehouse Space Utilization | 100 | Warehouse Managers, Facility Operators |

| Distribution Center Operations | 70 | Logistics Managers, Supply Chain Managers |

| Cold Storage Facilities | 50 | Operations Managers, Quality Control Supervisors |

| Last-Mile Delivery Solutions | 60 | Last-Mile Coordinators, Fleet Managers |

| Real Estate Investment Trends | 80 | Real Estate Analysts, Investment Managers |

The Nigeria Logistics Real Estate Market is valued at approximately USD 11 billion, reflecting significant growth driven by e-commerce, urbanization, and foreign direct investment in warehousing and distribution infrastructure.