Region:North America

Author(s):Dev

Product Code:KRAB6124

Pages:81

Published On:October 2025

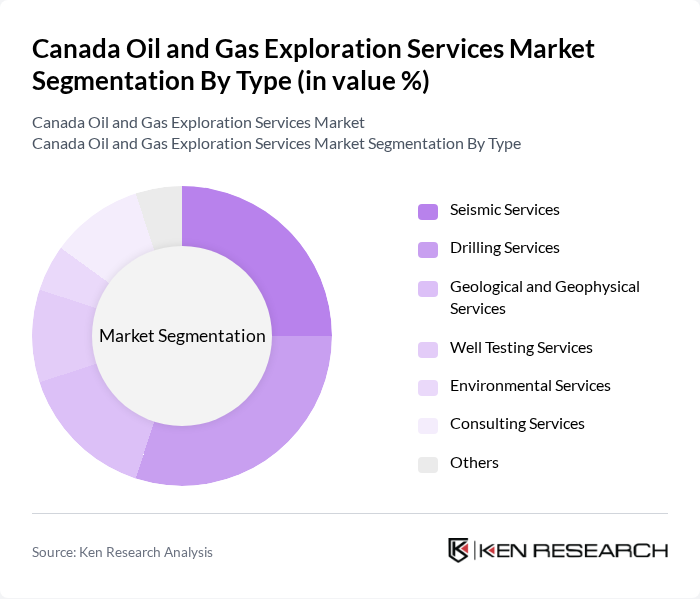

By Type:The market is segmented into various types of services that cater to the needs of oil and gas exploration. The primary segments include Seismic Services, Drilling Services, Geological and Geophysical Services, Well Testing Services, Environmental Services, Consulting Services, and Others. Each of these segments plays a crucial role in the exploration process, contributing to the overall efficiency and effectiveness of resource extraction.

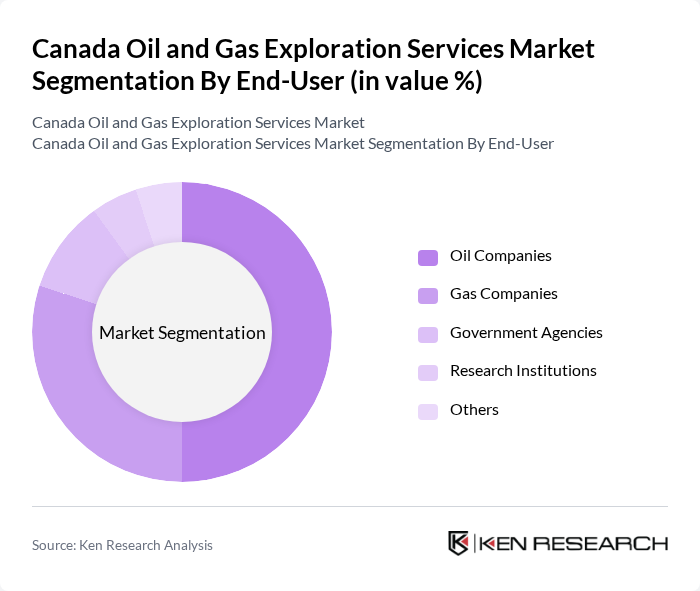

By End-User:The end-user segmentation includes Oil Companies, Gas Companies, Government Agencies, Research Institutions, and Others. Each of these end-users has distinct requirements and plays a vital role in the demand for exploration services. Oil and gas companies are the primary consumers, driving the need for advanced exploration techniques and services.

The Canada Oil and Gas Exploration Services Market is characterized by a dynamic mix of regional and international players. Leading participants such as Canadian Natural Resources Limited, Suncor Energy Inc., Cenovus Energy Inc., Husky Energy Inc., Encana Corporation, Imperial Oil Limited, Talisman Energy Inc., Vermilion Energy Inc., Athabasca Oil Corporation, MEG Energy Corp., Crescent Point Energy Corp., Whitecap Resources Inc., Tourmaline Oil Corp., Paramount Resources Ltd., NuVista Energy Ltd. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Canada oil and gas exploration services market appears promising, driven by technological innovations and a growing emphasis on sustainability. As companies increasingly adopt digital technologies and data analytics, operational efficiencies are expected to improve, leading to cost reductions. Furthermore, the integration of renewable energy sources into traditional exploration practices will likely create new avenues for growth, positioning the sector to adapt to evolving energy demands and regulatory landscapes in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Seismic Services Drilling Services Geological and Geophysical Services Well Testing Services Environmental Services Consulting Services Others |

| By End-User | Oil Companies Gas Companies Government Agencies Research Institutions Others |

| By Region | Western Canada Eastern Canada Northern Canada Central Canada Others |

| By Application | Onshore Exploration Offshore Exploration Enhanced Oil Recovery Environmental Monitoring Others |

| By Investment Source | Private Investments Government Funding Foreign Direct Investment (FDI) Public-Private Partnerships (PPP) Others |

| By Policy Support | Subsidies for Exploration Tax Incentives Regulatory Support Research Grants Others |

| By Technology | Conventional Exploration Unconventional Exploration Digital Exploration Technologies Remote Sensing Technologies Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Oil Sands Exploration Services | 100 | Project Managers, Geophysicists |

| Offshore Drilling Operations | 80 | Operations Directors, Marine Engineers |

| Seismic Survey Technologies | 70 | Technical Specialists, Data Analysts |

| Regulatory Compliance in Exploration | 60 | Compliance Officers, Environmental Managers |

| Emerging Technologies in Exploration | 90 | R&D Managers, Innovation Leads |

The Canada Oil and Gas Exploration Services Market is valued at approximately USD 10 billion, reflecting significant growth driven by increasing energy demand, technological advancements, and investments in both conventional and unconventional exploration methods.