Region:Africa

Author(s):Rebecca

Product Code:KRAB5942

Pages:90

Published On:October 2025

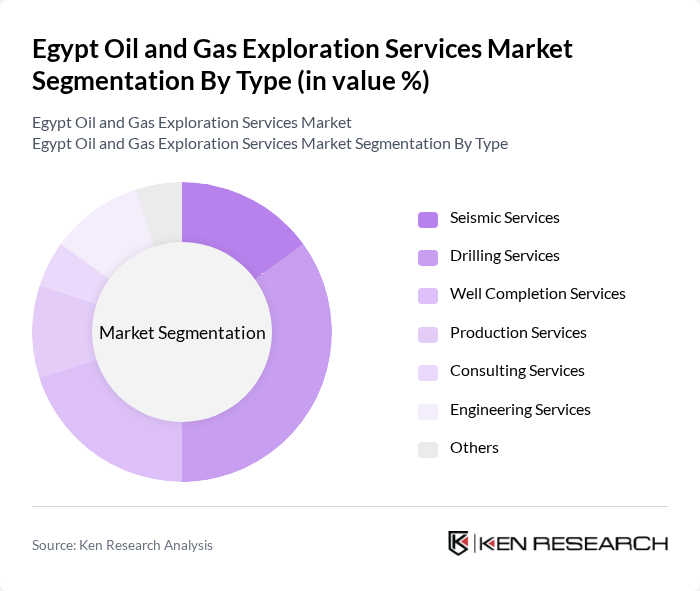

By Type:The segmentation by type includes various services essential for oil and gas exploration. The subsegments are Seismic Services, Drilling Services, Well Completion Services, Production Services, Consulting Services, Engineering Services, and Others. Among these, Drilling Services is the most dominant due to the increasing number of exploration projects and the need for efficient drilling techniques to maximize output.

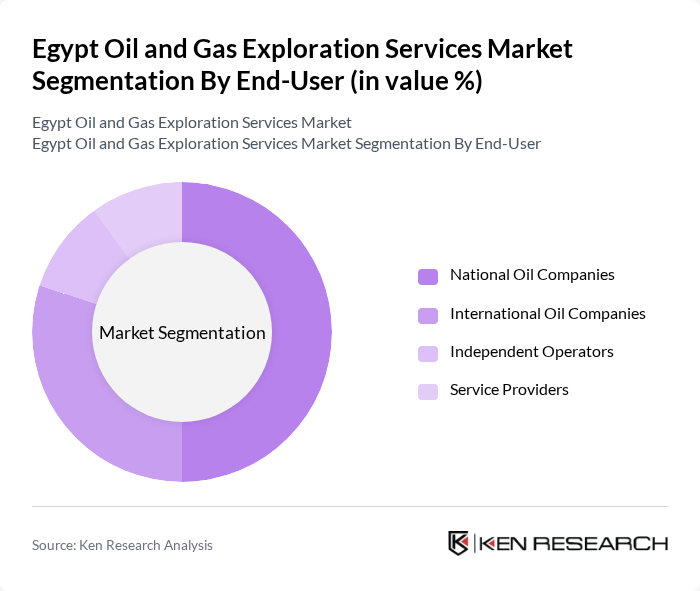

By End-User:The segmentation by end-user includes National Oil Companies, International Oil Companies, Independent Operators, and Service Providers. National Oil Companies dominate the market due to their extensive resources and government backing, which allows them to undertake large-scale exploration projects and maintain a significant presence in the sector.

The Egypt Oil and Gas Exploration Services Market is characterized by a dynamic mix of regional and international players. Leading participants such as Egyptian General Petroleum Corporation (EGPC), Apache Corporation, BP Egypt, Eni S.p.A., TotalEnergies, Shell Egypt, Halliburton, Schlumberger, Weatherford International, Petrobel, GUPCO, Cheiron Holdings, TransGlobe Energy, Dana Gas, Mediterra Energy contribute to innovation, geographic expansion, and service delivery in this space.

The future of Egypt's oil and gas exploration services market appears promising, driven by technological innovations and a growing emphasis on sustainability. As the government continues to support foreign investments and streamline regulatory processes, the sector is likely to attract more players. Additionally, the integration of renewable energy sources into traditional exploration practices will create new avenues for growth, ensuring that Egypt remains competitive in the global energy landscape while addressing environmental concerns.

| Segment | Sub-Segments |

|---|---|

| By Type | Seismic Services Drilling Services Well Completion Services Production Services Consulting Services Engineering Services Others |

| By End-User | National Oil Companies International Oil Companies Independent Operators Service Providers |

| By Application | Onshore Exploration Offshore Exploration Enhanced Oil Recovery Reservoir Management |

| By Investment Source | Domestic Investment Foreign Direct Investment (FDI) Public-Private Partnerships (PPP) Government Funding |

| By Service Model | Contractual Services Turnkey Projects Joint Ventures |

| By Technology | Conventional Techniques Advanced Technologies Digital Solutions |

| By Policy Support | Subsidies Tax Exemptions Regulatory Support Incentives for Local Content |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Oil Exploration Services | 100 | Exploration Managers, Geophysicists |

| Gas Exploration Services | 80 | Project Engineers, Reservoir Engineers |

| Seismic Survey Services | 60 | Field Technicians, Survey Managers |

| Drilling Services | 90 | Drilling Supervisors, Operations Managers |

| Regulatory Compliance in Exploration | 70 | Compliance Officers, Legal Advisors |

The Egypt Oil and Gas Exploration Services Market is valued at approximately USD 5 billion, reflecting a robust growth trajectory driven by the country's rich hydrocarbon resources and increasing foreign investments.