Region:Europe

Author(s):Rebecca

Product Code:KRAB1858

Pages:87

Published On:October 2025

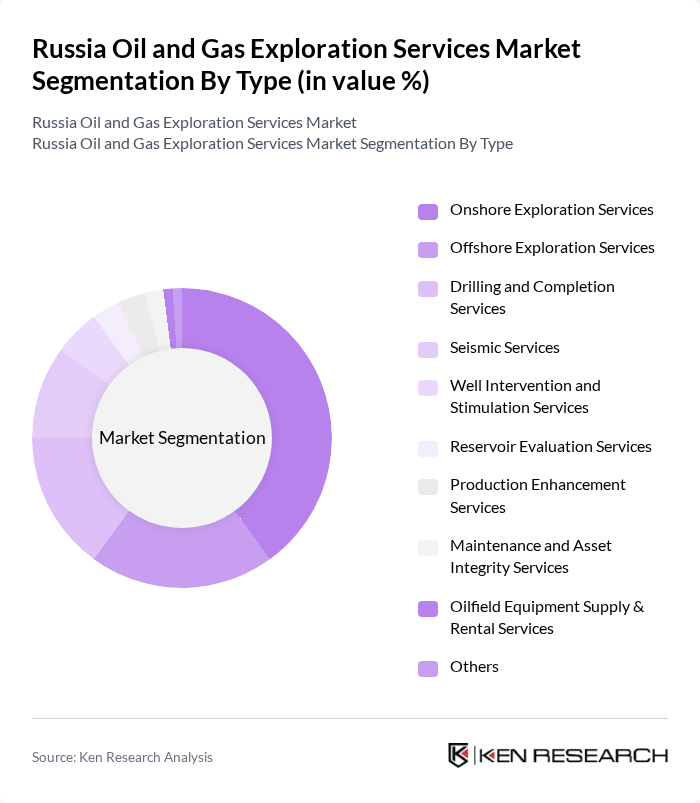

By Type:The market is segmented into various types of exploration services, each addressing specific operational requirements. Subsegments include Onshore Exploration Services, Offshore Exploration Services, Drilling and Completion Services, Seismic Services, Well Intervention and Stimulation Services, Reservoir Evaluation Services, Production Enhancement Services, Maintenance and Asset Integrity Services, Oilfield Equipment Supply & Rental Services, and Others. Onshore Exploration Services dominate the market, primarily due to the extensive oil fields and established infrastructure in Western Siberia and the Volga Region, as well as the cost-effectiveness and technological advancements in digital oilfield solutions and automation .

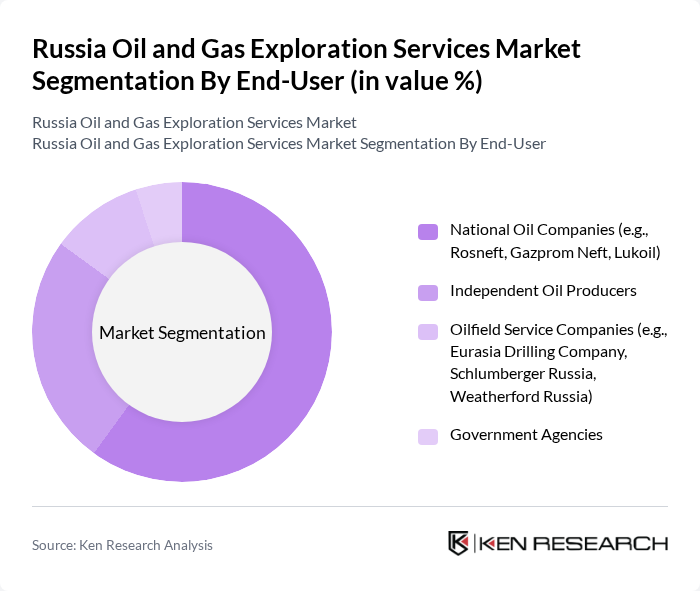

By End-User:The end-user segmentation includes National Oil Companies, Independent Oil Producers, Oilfield Service Companies, and Government Agencies. National Oil Companies, such as Rosneft and Gazprom Neft, are the primary consumers of exploration services due to their dominant control over reserves, government support, and capacity for large-scale investments. Independent Oil Producers contribute notably, especially in regions with flexible operational environments .

The Russia Oil and Gas Exploration Services Market is characterized by a dynamic mix of regional and international players. Leading participants such as Gazprom Neft, Lukoil, Rosneft, Surgutneftegas, Novatek, Tatneft, Zarubezhneft, Bashneft, Russneft, Slavneft, Eurasia Drilling Company (EDC), Vostok Oil, RN-Exploration, Gazprom, SIBUR, Weatherford Russia, Schlumberger Russia, and PetroAlliance contribute to innovation, geographic expansion, and service delivery in this space .

The future of the Russia oil and gas exploration services market appears promising, driven by increasing energy demands and technological innovations. As the country seeks to enhance its production capabilities, investments in advanced exploration technologies and infrastructure upgrades will be critical. Additionally, the market is likely to see a shift towards sustainable practices, aligning with global energy trends. However, geopolitical risks and regulatory challenges will require strategic navigation to ensure continued growth and investment in the sector.

| Segment | Sub-Segments |

|---|---|

| By Type | Onshore Exploration Services Offshore Exploration Services Drilling and Completion Services Seismic Services Well Intervention and Stimulation Services Reservoir Evaluation Services Production Enhancement Services Maintenance and Asset Integrity Services Oilfield Equipment Supply & Rental Services Others |

| By End-User | National Oil Companies (e.g., Rosneft, Gazprom Neft, Lukoil) Independent Oil Producers Oilfield Service Companies (e.g., Eurasia Drilling Company, Schlumberger Russia, Weatherford Russia) Government Agencies |

| By Region | Western Siberia Volga Region Arctic Region Far East Region |

| By Application | Exploration Production Transportation Refining |

| By Investment Source | Domestic Investment Foreign Direct Investment (FDI) Public-Private Partnerships (PPP) Government Grants |

| By Policy Support | Subsidies Tax Exemptions Regulatory Support |

| By Technology | Advanced Drilling Technologies Enhanced Oil Recovery Technologies Digital Oilfield Technologies Remote Monitoring & Automation Solutions Others |

| By Service Duration | Short-term Contracts Long-term Contracts Project-based Contracts |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Onshore Oil Exploration | 100 | Exploration Managers, Geologists |

| Offshore Gas Exploration | 60 | Project Engineers, Environmental Specialists |

| Seismic Survey Services | 50 | Survey Technicians, Data Analysts |

| Regulatory Compliance in Exploration | 40 | Compliance Officers, Legal Advisors |

| Investment in Exploration Technologies | 50 | R&D Managers, Technology Officers |

The Russia Oil and Gas Exploration Services Market is valued at approximately USD 24 billion, driven by the country's vast natural resources and increasing energy demand, alongside advancements in exploration and extraction technologies.