Region:Asia

Author(s):Dev

Product Code:KRAB6070

Pages:90

Published On:October 2025

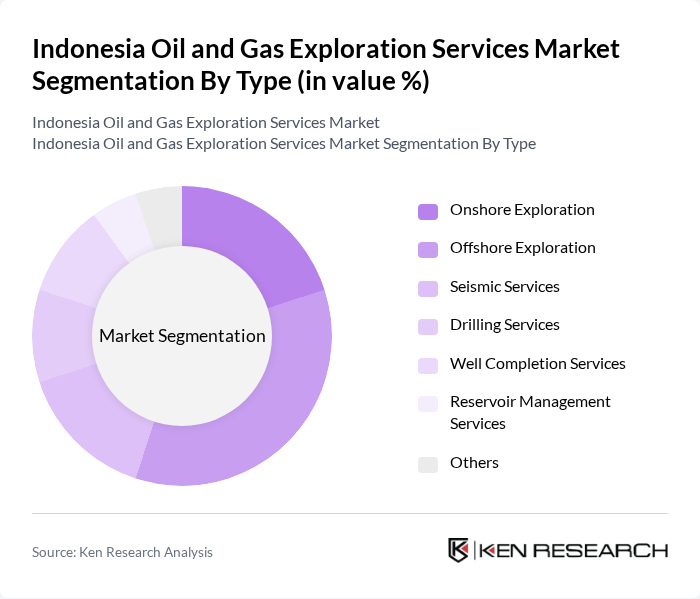

By Type:The market is segmented into various types, including Onshore Exploration, Offshore Exploration, Seismic Services, Drilling Services, Well Completion Services, Reservoir Management Services, and Others. Among these, Offshore Exploration is currently the leading sub-segment due to Indonesia's extensive maritime territory, which holds significant untapped oil and gas reserves. The increasing technological advancements in offshore drilling and exploration techniques further bolster this segment's growth.

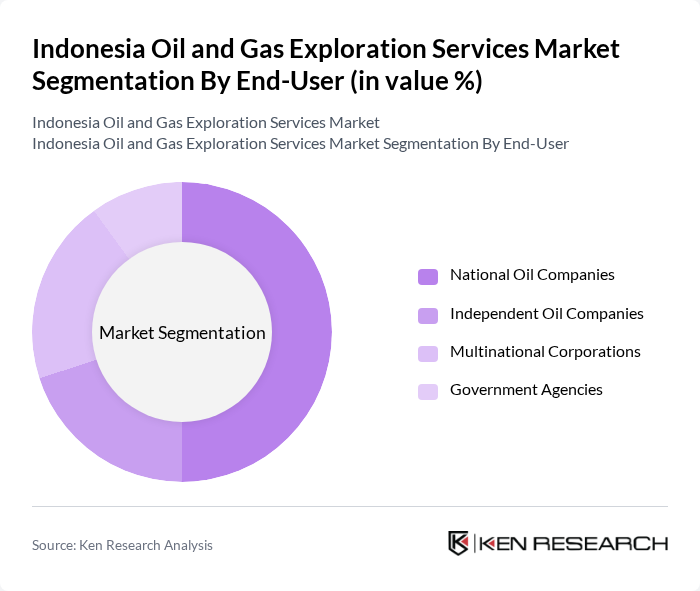

By End-User:The end-user segmentation includes National Oil Companies, Independent Oil Companies, Multinational Corporations, and Government Agencies. National Oil Companies dominate this segment due to their extensive resources and government backing, allowing them to undertake large-scale exploration projects. Their established infrastructure and experience in the local market further enhance their competitive edge.

The Indonesia Oil and Gas Exploration Services Market is characterized by a dynamic mix of regional and international players. Leading participants such as Pertamina, Medco Energi Internasional Tbk, TotalEnergies EP Indonesia, Chevron Pacific Indonesia, ConocoPhillips Indonesia, Eni Indonesia, Repsol S.A., Hess Corporation, Inpex Corporation, Schlumberger Limited, Halliburton Company, Baker Hughes Company, Weatherford International, Petrofac Limited, Wood Group PLC contribute to innovation, geographic expansion, and service delivery in this space.

The future of Indonesia's oil and gas exploration services market appears promising, driven by a combination of government support and technological innovation. As the country seeks to balance energy demands with environmental sustainability, investments in cleaner technologies and practices are likely to increase. Furthermore, the ongoing push for energy independence will encourage exploration in untapped regions, fostering partnerships between local and foreign firms to enhance operational efficiency and resource management.

| Segment | Sub-Segments |

|---|---|

| By Type | Onshore Exploration Offshore Exploration Seismic Services Drilling Services Well Completion Services Reservoir Management Services Others |

| By End-User | National Oil Companies Independent Oil Companies Multinational Corporations Government Agencies |

| By Service Type | Geological Services Geophysical Services Drilling Services Production Services |

| By Project Stage | Exploration Stage Development Stage Production Stage |

| By Contract Type | Service Contracts Joint Ventures Production Sharing Contracts |

| By Investment Type | Domestic Investment Foreign Direct Investment Public-Private Partnerships |

| By Policy Support | Subsidies Tax Incentives Regulatory Support Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Seismic Survey Services | 100 | Geophysicists, Exploration Managers |

| Drilling Services | 80 | Drilling Engineers, Operations Supervisors |

| Environmental Consulting | 60 | Environmental Managers, Compliance Officers |

| Geological Services | 70 | Geologists, Project Managers |

| Regulatory Affairs | 50 | Regulatory Affairs Specialists, Policy Analysts |

The Indonesia Oil and Gas Exploration Services Market is valued at approximately USD 8 billion, reflecting significant growth driven by rising energy demand and government initiatives to enhance exploration activities in untapped regions.