Region:Europe

Author(s):Shubham

Product Code:KRAB1087

Pages:88

Published On:October 2025

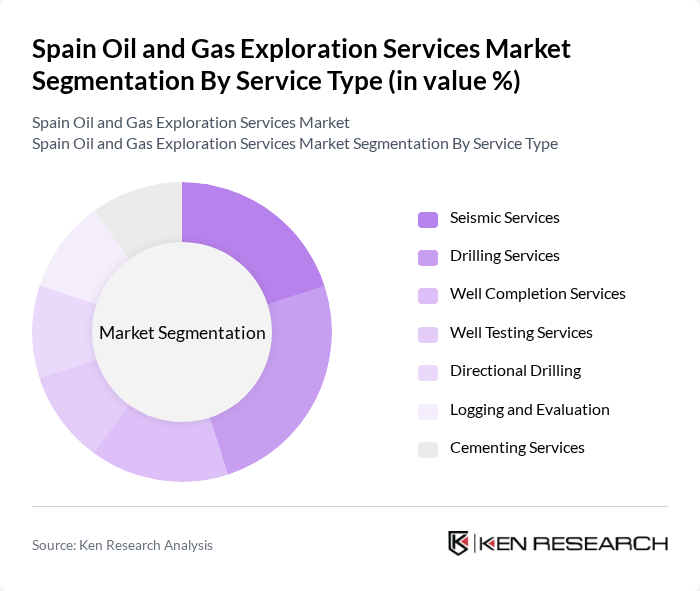

By Service Type:The service type segmentation comprises specialized offerings essential for exploration and production. These include Seismic Services (geophysical surveys for subsurface mapping), Drilling Services (well construction and borehole development), Well Completion Services (preparing wells for production), Well Testing Services (evaluating reservoir performance), Directional Drilling (precision well placement), Logging and Evaluation (downhole data acquisition), and Cementing Services (well integrity and zonal isolation). Each service is tailored to optimize resource identification, extraction, and operational safety.

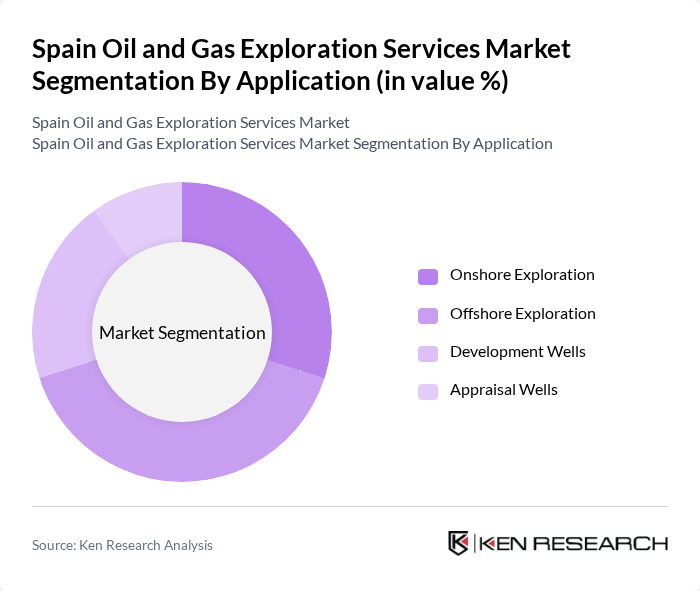

By Application:The application segmentation reflects core exploration activities: Onshore Exploration (resource identification in inland basins), Offshore Exploration (deepwater and coastal resource mapping), Development Wells (production optimization in proven fields), and Appraisal Wells (resource viability assessment). Onshore and offshore projects are pivotal for reserve expansion, while development and appraisal wells ensure sustainable production and resource validation.

The Spain Oil and Gas Exploration Services Market is characterized by a dynamic mix of regional and international players. Leading participants such as Repsol S.A., Halliburton Company, Saipem S.p.A., Schlumberger Limited, Baker Hughes Company, TechnipFMC plc, Aker Solutions ASA, Petrofac Limited, Wood Group PLC, National Oilwell Varco Inc., Weatherford International plc, CGG S.A., Fugro N.V., TGS ASA, Shearwater GeoServices contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Spain oil and gas exploration services market appears promising, driven by a combination of technological advancements and government support. As companies increasingly adopt digital transformation strategies, operational efficiencies are expected to improve significantly. Furthermore, the integration of renewable energy sources into traditional oil and gas operations will likely create new avenues for growth. The market is anticipated to adapt to evolving energy demands while addressing environmental concerns, positioning itself for sustainable development.

| Segment | Sub-Segments |

|---|---|

| By Service Type | Seismic Services Drilling Services Well Completion Services Well Testing Services Directional Drilling Logging and Evaluation Cementing Services |

| By Application | Onshore Exploration Offshore Exploration Development Wells Appraisal Wells |

| By End-User | National Oil Companies International Oil Companies Independent Oil Companies Government Agencies |

| By Technology | Conventional Exploration Unconventional Exploration Digital Technologies Automation Solutions |

| By Contract Type | Turnkey Contracts Day Rate Contracts Footage Contracts Integrated Service Contracts |

| By Geographic Region | Northern Spain Mediterranean Coast Cantabrian Sea Balearic Islands |

| By Investment Source | Domestic Investment Foreign Direct Investment Public-Private Partnerships Government Funding |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Oil Exploration Services | 60 | Exploration Managers, Project Directors |

| Gas Exploration Services | 50 | Geologists, Reservoir Engineers |

| Regulatory Compliance in Exploration | 40 | Regulatory Affairs Specialists, Compliance Officers |

| Technological Innovations in Exploration | 45 | R&D Managers, Technology Officers |

| Market Trends and Forecasting | 55 | Market Analysts, Business Development Managers |

The Spain Oil and Gas Exploration Services Market is valued at approximately USD 1.3 billion, reflecting growth driven by rising energy demand, technological advancements, and increased offshore exploration activities.