Region:Europe

Author(s):Rebecca

Product Code:KRAB1968

Pages:81

Published On:October 2025

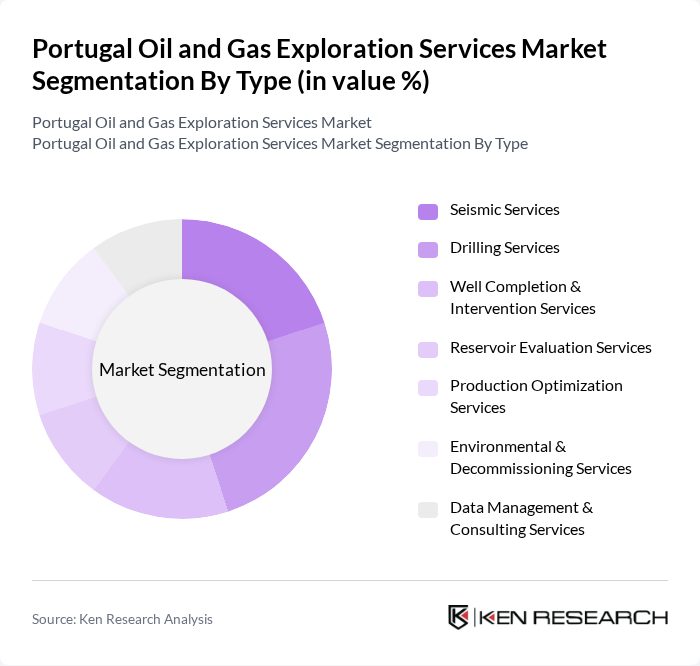

By Type:The market is segmented into various types of services that cater to the diverse needs of oil and gas exploration. The subsegments include Seismic Services, Drilling Services, Well Completion & Intervention Services, Reservoir Evaluation Services, Production Optimization Services, Environmental & Decommissioning Services, and Data Management & Consulting Services. Each of these services plays a crucial role in the exploration and production phases, with specific applications tailored to meet industry demands.

The Drilling Services subsegment is currently dominating the market due to the increasing number of exploration projects and the need for efficient extraction methods. Companies are investing heavily in advanced drilling technologies to enhance productivity and reduce operational costs, driven by technological advancements in oil and gas drilling techniques. The demand for drilling services is further fueled by the rising global energy needs and the push for energy independence, making it a critical component of the exploration services landscape.

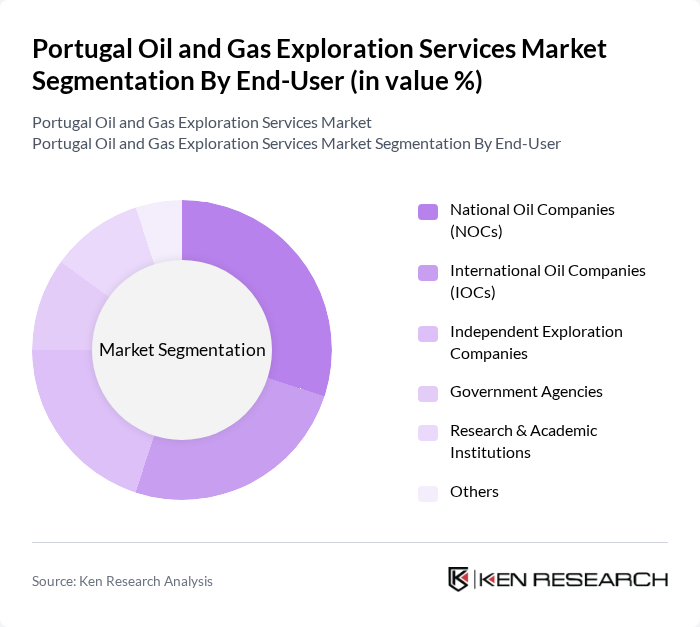

By End-User:The market is segmented based on the end-users of exploration services, which include National Oil Companies (NOCs), International Oil Companies (IOCs), Independent Exploration Companies, Government Agencies, Research & Academic Institutions, and Others. Each end-user category has distinct requirements and influences the demand for various exploration services, particularly in response to increasing demand for energy resources in Portugal.

National Oil Companies (NOCs) are the leading end-users in the market, primarily due to their significant investments in exploration and production activities. These companies often have the backing of government resources, allowing them to undertake large-scale projects. Their focus on enhancing domestic production capabilities and reducing reliance on imports further solidifies their position as key players in the exploration services market.

The Portugal Oil and Gas Exploration Services Market is characterized by a dynamic mix of regional and international players. Leading participants such as Galp Energia, S.A., Petrogal, S.A., Repsol, S.A., Eni S.p.A., Partex Oil and Gas (Holdings) Corporation, Schlumberger Limited, Halliburton Company, TechnipFMC plc, Baker Hughes Company, Saipem S.p.A., CGG S.A., Fugro N.V., DNV AS, Wood Group PLC, KCA Deutag contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Portugal oil and gas exploration services market appears promising, driven by a combination of technological advancements and government initiatives. As the country seeks to balance energy demands with environmental responsibilities, investments in cleaner technologies will likely increase. Furthermore, the integration of renewable energy sources into traditional oil and gas operations is expected to create a more resilient energy landscape, fostering innovation and attracting foreign investments to the sector.

| Segment | Sub-Segments |

|---|---|

| By Type | Seismic Services Drilling Services Well Completion & Intervention Services Reservoir Evaluation Services Production Optimization Services Environmental & Decommissioning Services Data Management & Consulting Services |

| By End-User | National Oil Companies (NOCs) International Oil Companies (IOCs) Independent Exploration Companies Government Agencies Research & Academic Institutions Others |

| By Application | Offshore Exploration Onshore Exploration Unconventional Resources Reservoir Management Environmental Impact Assessments Others |

| By Service Model | Integrated Service Contracts Turnkey Projects Project-Based Services Consultancy & Advisory Services Others |

| By Investment Source | Domestic Investment Foreign Direct Investment (FDI) Public-Private Partnerships (PPP) Government Grants Multilateral Funding Others |

| By Regulatory Compliance | Environmental Compliance Safety Compliance Quality Assurance Local Content Requirements Others |

| By Market Maturity | Emerging Market Established Market Declining Market Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Offshore Exploration Projects | 50 | Project Managers, Exploration Directors |

| Onshore Drilling Operations | 60 | Field Engineers, Operations Supervisors |

| Environmental Impact Assessments | 40 | Environmental Consultants, Compliance Officers |

| Regulatory Framework Insights | 45 | Government Officials, Policy Advisors |

| Technological Innovations in Exploration | 55 | R&D Managers, Technology Officers |

The Portugal Oil and Gas Exploration Services Market is valued at approximately USD 1.3 billion, reflecting a five-year historical analysis. This growth is driven by rising energy demands, technological advancements, and government initiatives supporting exploration and production activities.