Region:North America

Author(s):Rebecca

Product Code:KRAA2123

Pages:88

Published On:August 2025

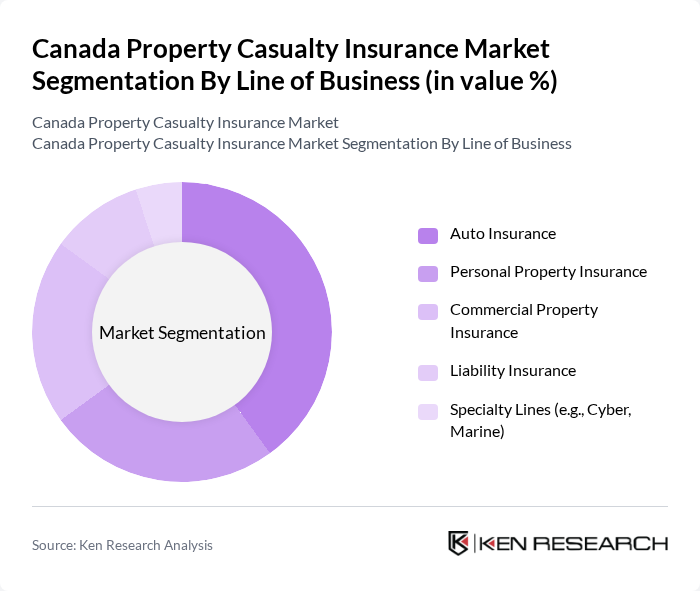

By Line of Business:

The line of business segmentation includes various subsegments such as Auto Insurance, Personal Property Insurance, Commercial Property Insurance, Liability Insurance, and Specialty Lines (e.g., Cyber, Marine). Among these,Auto Insuranceis the leading subsegment, driven by the high number of vehicles on the road and the mandatory nature of auto coverage in Canada. The increasing frequency of accidents, rising costs of vehicle repairs, and a surge in auto thefts further bolster the demand for comprehensive auto insurance policies. Personal and commercial property lines are also experiencing growth due to increased claims from climate-related catastrophes and higher property values .

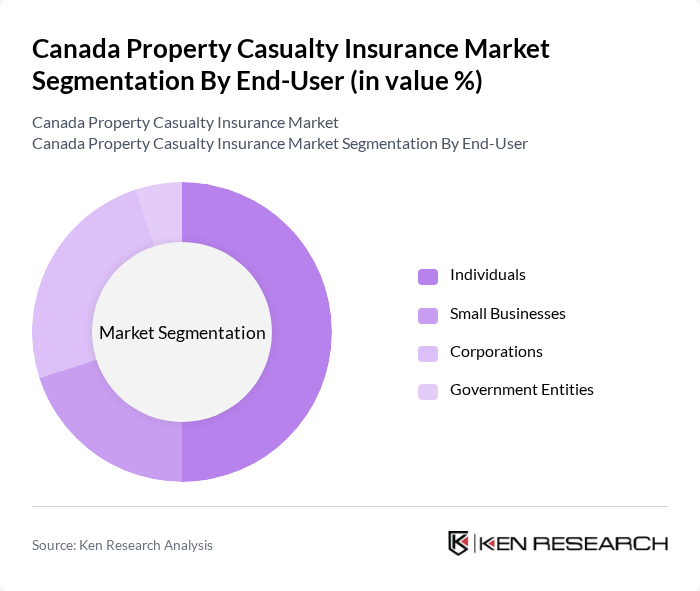

By End-User:

This segmentation includes Individuals, Small Businesses, Corporations, and Government Entities. TheIndividualssubsegment is the most significant, as it encompasses a large portion of the population seeking personal insurance coverage for homes, vehicles, and personal liability. Growing awareness of personal risk management, increased exposure to climate events, and the necessity for insurance in daily life contribute to the expansion of this segment. Businesses and corporations are also increasing their uptake of commercial and specialty lines to address evolving operational and cyber risks .

The Canada Property Casualty Insurance Market is characterized by a dynamic mix of regional and international players. Leading participants such as Intact Financial Corporation, Aviva Canada, The Co-operators Group Limited, Economical Insurance, RSA Canada, Wawanesa Mutual Insurance Company, Desjardins General Insurance Group, Allstate Insurance Company of Canada, Travelers Canada, SGI CANADA, Zurich Insurance Company Ltd., Chubb Insurance Company of Canada, AIG Insurance Company of Canada, Liberty Mutual Canada, Northbridge Financial Corporation contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Canadian property casualty insurance market appears promising, driven by technological advancements and a growing emphasis on sustainability. Insurers are increasingly adopting big data analytics to enhance risk assessment and customer engagement. Additionally, the shift towards sustainable insurance practices is expected to gain momentum, aligning with consumer preferences for environmentally responsible solutions. As the market evolves, insurers will need to adapt to these trends to remain competitive and meet changing consumer demands effectively.

| Segment | Sub-Segments |

|---|---|

| By Line of Business | Auto Insurance Personal Property Insurance Commercial Property Insurance Liability Insurance Specialty Lines (e.g., Cyber, Marine) |

| By End-User | Individuals Small Businesses Corporations Government Entities |

| By Distribution Channel | Brokers and Independent Agents Direct-to-Consumer Platforms Bancassurance Embedded Partnerships |

| By Coverage Type | Comprehensive Coverage Third-Party Liability Collision Coverage Personal Injury Protection |

| By Policy Duration | Short-Term Policies Long-Term Policies |

| By Customer Segment | High Net-Worth Individuals Middle-Class Families Startups Established Enterprises |

| By Risk Type | Natural Disaster Risk Theft and Vandalism Risk Liability Risk Business Interruption Risk |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Homeowners Insurance Insights | 60 | Underwriters, Product Managers |

| Commercial Property Insurance Trends | 50 | Risk Managers, Claims Adjusters |

| Auto Insurance Market Dynamics | 55 | Actuaries, Sales Directors |

| Regulatory Impact on Insurance Practices | 40 | Compliance Officers, Legal Advisors |

| Customer Experience in Insurance | 45 | Customer Service Managers, Marketing Executives |

The Canada Property Casualty Insurance Market is valued at approximately USD 96 billion, reflecting growth driven by increasing consumer demand for comprehensive coverage, rising auto repair costs, and the impact of climate-related catastrophes.