Region:Asia

Author(s):Rebecca

Product Code:KRAA2173

Pages:93

Published On:August 2025

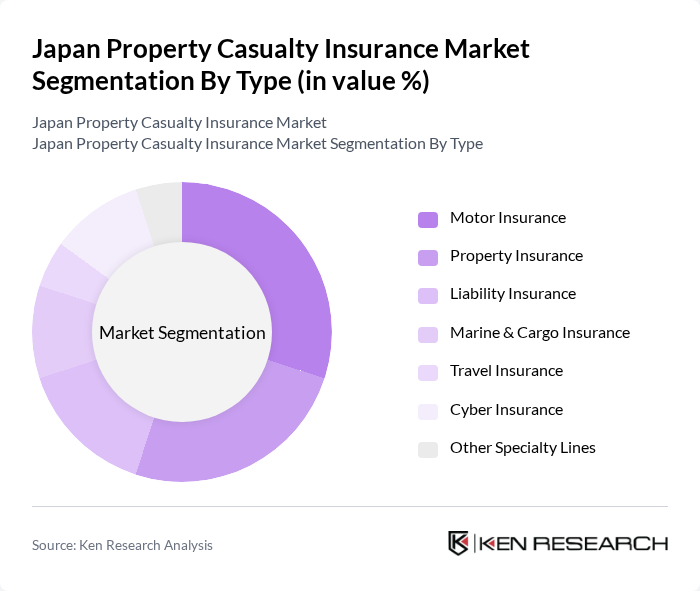

By Type:The market is segmented into various types of insurance products, including Motor Insurance, Property Insurance, Liability Insurance, Marine & Cargo Insurance, Travel Insurance, Cyber Insurance, and Other Specialty Lines. Each of these segments addresses distinct consumer needs and risk exposures. Motor Insurance remains the largest segment, driven by evolving risk profiles due to electrification and telematics, while Cyber Insurance is experiencing rapid growth amid rising digital risk awareness and increased ransomware incidents among businesses .

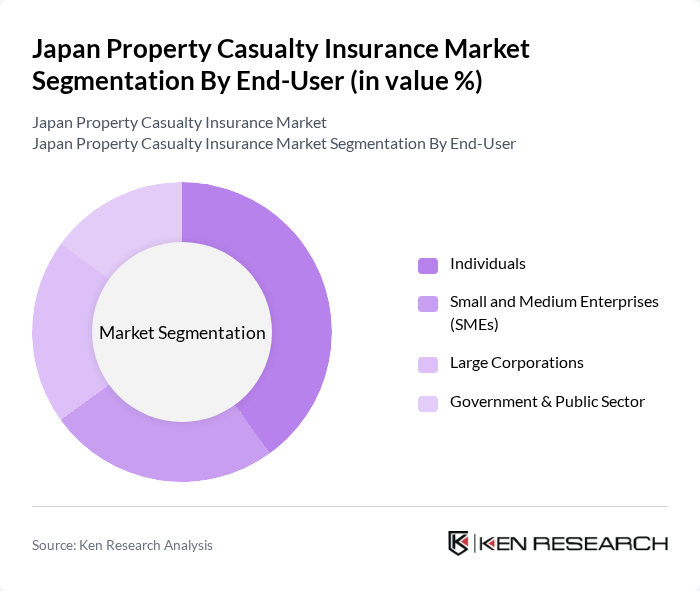

By End-User:The end-user segmentation includes Individuals, Small and Medium Enterprises (SMEs), Large Corporations, and Government & Public Sector. Each segment has unique insurance needs: Individuals typically seek personal and property coverage; SMEs and large corporations focus on comprehensive risk management, especially for cyber and liability exposures; while the Government & Public Sector segment emphasizes disaster recovery and infrastructure protection .

The Japan Property Casualty Insurance Market is characterized by a dynamic mix of regional and international players. Leading participants such as Tokio Marine & Nichido Fire Insurance Co., Ltd., Sompo Holdings, Inc., MS&AD Insurance Group Holdings, Inc., Mitsui Sumitomo Insurance Co., Ltd., Aioi Nissay Dowa Insurance Co., Ltd., Rakuten General Insurance Co., Ltd., Saison Automobile & Fire Insurance Co., Ltd., SECOM General Insurance Co., Ltd., Hitachi Capital Insurance Corporation, Nisshin Fire & Marine Insurance Co., Ltd., Kyoei Fire & Marine Insurance Co., Ltd., Mitsui Direct General Insurance Co., Ltd., Chubb Limited (Japan), Zurich Insurance Company Ltd. (Japan), and AIG General Insurance Company, Ltd. (Japan) contribute to innovation, geographic expansion, and service delivery in this space .

The future of the Japan property casualty insurance market is poised for transformation, driven by technological advancements and evolving consumer expectations. Insurers are increasingly adopting digital solutions to enhance customer engagement and streamline operations. Additionally, the focus on sustainable practices is expected to shape product offerings, aligning with global trends. As the market adapts to these changes, opportunities for growth will emerge, particularly in areas such as customized insurance products and digital platforms that cater to the tech-savvy consumer base.

| Segment | Sub-Segments |

|---|---|

| By Type | Motor Insurance Property Insurance Liability Insurance Marine & Cargo Insurance Travel Insurance Cyber Insurance Other Specialty Lines |

| By End-User | Individuals Small and Medium Enterprises (SMEs) Large Corporations Government & Public Sector |

| By Distribution Channel | Direct (Including Online) Agents Brokers Bancassurance Other Channels |

| By Coverage Type | Standard Coverage Comprehensive Coverage Parametric/Index-Based Coverage |

| By Policy Duration | Short-Term Policies Long-Term Policies |

| By Customer Segment | High Net-Worth Individuals Middle-Income Households Corporate Clients |

| By Risk Type | Natural Catastrophe Risks Man-Made Risks Cyber Risks Supply Chain/Business Interruption Risks |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Residential Property Insurance | 120 | Homeowners, Insurance Agents |

| Commercial Property Insurance | 90 | Business Owners, Risk Managers |

| Liability Insurance Products | 60 | Corporate Executives, Compliance Officers |

| Specialty Insurance Lines | 50 | Underwriters, Product Development Managers |

| Claims Management Processes | 70 | Claims Adjusters, Customer Service Representatives |

The Japan Property Casualty Insurance Market is valued at approximately USD 70 billion, reflecting a steady growth driven by increasing natural disasters, regulatory reforms, and advancements in risk modeling and digitalization.