Region:Middle East

Author(s):Geetanshi

Product Code:KRAD4029

Pages:89

Published On:December 2025

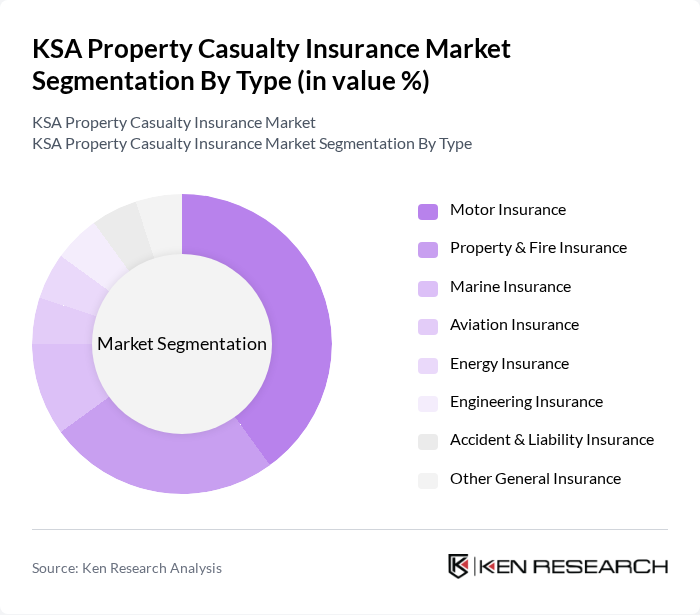

By Type:The KSA Property Casualty Insurance Market can be segmented into Motor Insurance, Property & Fire Insurance, Marine Insurance, Aviation Insurance, Energy Insurance, Engineering Insurance, Accident & Liability Insurance, and Other General Insurance. Each of these segments targets specific risk profiles and industry needs, with Motor Insurance typically representing the largest single line in many non-life portfolios due to high vehicle ownership and compulsory third-party coverage requirements. To ensure accuracy, the dominance of motor insurance and the relative sizes of other segments should be confirmed against the most recent non-life line-of-business breakdown published by regulators or leading industry analysts before final publication.

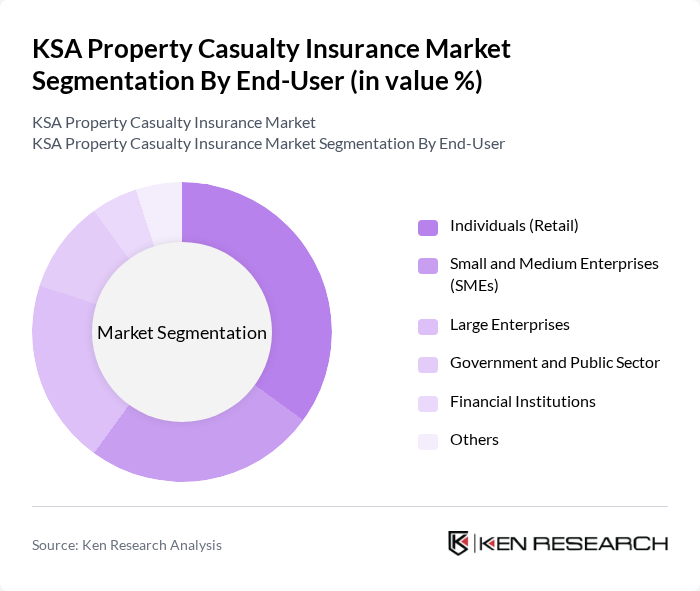

By End-User:The market can also be segmented by end-user categories, including Individuals (Retail), Small and Medium Enterprises (SMEs), Large Enterprises, Government and Public Sector, Financial Institutions, and Others. The retail segment is particularly important, influenced by greater risk awareness among individuals, rising car ownership, and broader uptake of property and liability products, while SMEs and large enterprises drive demand for specialized covers such as property damage, business interruption, engineering, energy, and professional liability. Before relying on the numerical distribution across end-user categories, the listed market shares should be reconciled with the latest available breakdowns of non-life premiums by customer type from regulatory or independent industry reports.

The KSA Property Casualty Insurance Market is characterized by a mix of regional and international insurers operating under a cooperative and takaful framework, with a number of publicly listed entities on the local stock exchange. Leading participants such as The Company for Cooperative Insurance (Tawuniya), Bupa Arabia for Cooperative Insurance, Al Rajhi Company for Cooperative Insurance (Al Rajhi Takaful), Gulf Insurance Group – Saudi Arabia (GIG Saudi), Allianz Saudi Fransi Cooperative Insurance Company, Saudi Arabian Cooperative Insurance Company (SAICO), Mediterranean and Gulf Cooperative Insurance and Reinsurance Company (Medgulf), Alinma Tokio Marine Company, United Cooperative Assurance Company (UCA), Al Ahlia for Cooperative Insurance Company, Al Etihad Cooperative Insurance Co., AlJazira Takaful Taawuni Company, Walaa Cooperative Insurance Co., Arabian Shield Cooperative Insurance Co., and Malath Cooperative Insurance Co. contribute to product innovation, digital distribution, and customer service enhancement across motor, property, and specialty lines. The relative positions of these companies in the property and casualty segment can shift over time due to mergers, portfolio restructuring, and regulatory-driven consolidation, so any ranking or market share statement should be checked against the latest publicly available financial statements and supervisory statistics.

The KSA property casualty insurance market is poised for significant transformation driven by technological advancements and evolving consumer preferences. InsurTech innovations are expected to streamline operations and enhance customer experiences, while a shift towards personalized insurance products will cater to diverse consumer needs. Additionally, sustainability trends will likely influence product offerings, with insurers increasingly focusing on green insurance solutions. These developments will create a more dynamic and responsive market, fostering growth and improving overall insurance penetration in the Kingdom.

| Segment | Sub-Segments |

|---|---|

| By Type | Motor Insurance Property & Fire Insurance Marine Insurance Aviation Insurance Energy Insurance Engineering Insurance Accident & Liability Insurance Other General Insurance |

| By End-User | Individuals (Retail) Small and Medium Enterprises (SMEs) Large Enterprises Government and Public Sector Financial Institutions Others |

| By Region | Central Region Western Region Eastern Region Northern Region Southern Region |

| By Distribution Channel | Insurance Agencies Brokers Bancassurance Direct Sales (Including Online) Other Distribution Channels |

| By Coverage Type | Comprehensive Coverage Third-Party Liability Coverage Named Perils / Limited Coverage Others |

| By Policy Duration | Short-Term Policies (? 1 Year) Long-Term Policies (> 1 Year) Others |

| By Customer Segment | Retail Customers Corporate Clients Institutional and Government Clients High-Net-Worth Individuals (HNWIs) |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Residential Property Insurance | 120 | Insurance Agents, Homeowners, Risk Managers |

| Commercial Property Insurance | 110 | Business Owners, CFOs, Insurance Brokers |

| Liability Insurance Products | 70 | Legal Advisors, Claims Adjusters, Underwriters |

| Motor Insurance Sector | 130 | Fleet Managers, Insurance Sales Representatives, Policyholders |

| Insurance Technology Adoption | 60 | IT Managers, Digital Transformation Officers, InsurTech Startups |

The KSA Property Casualty Insurance Market is valued at approximately USD 10.5 billion, based on a five-year historical analysis. This figure should be verified with the latest data on gross written premiums for non-life insurance in Saudi Arabia.