Region:Africa

Author(s):Shubham

Product Code:KRAA1740

Pages:87

Published On:August 2025

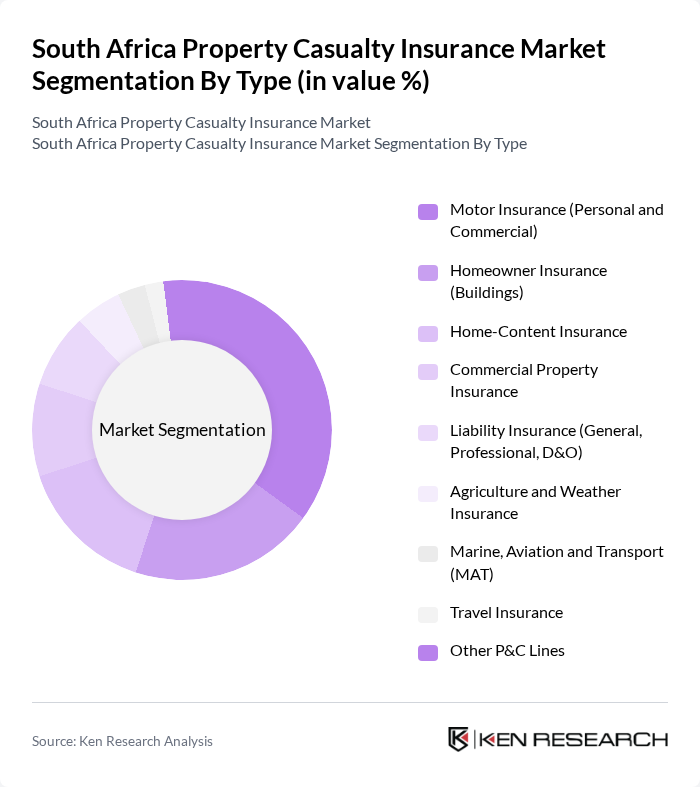

By Type:

The segmentation by type includes various subsegments such as Motor Insurance (Personal and Commercial), Homeowner Insurance (Buildings), Home-Content Insurance, Commercial Property Insurance, Liability Insurance (General, Professional, D&O), Agriculture and Weather Insurance, Marine, Aviation and Transport (MAT), Travel Insurance, and Other P&C Lines. Among these, Motor Insurance is the leading subsegment, driven by high vehicle parc and the necessity for coverage against accidents, theft, and third-party liability. Motor-claims inflation and technology-enabled pricing (e.g., telematics) are active dynamics reinforcing motor’s share within South Africa’s non-life portfolio .

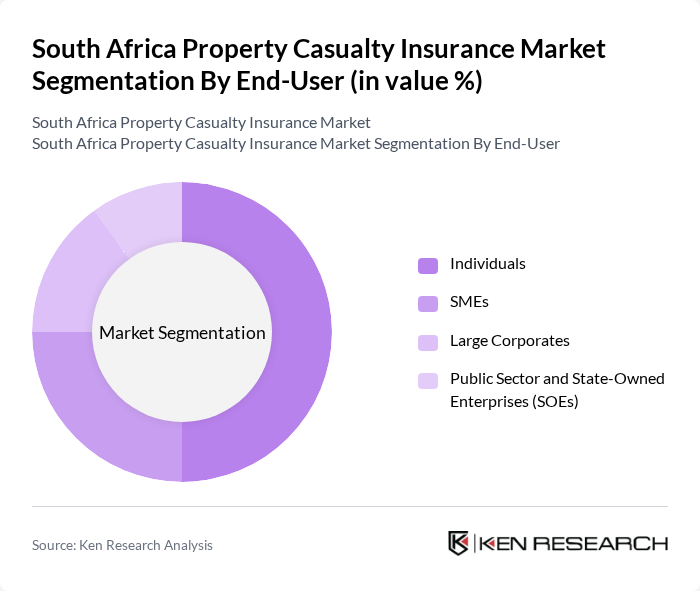

By End-User:

This segmentation includes Individuals, SMEs, Large Corporates, and Public Sector and State-Owned Enterprises (SOEs). The Individuals segment is the most significant, supported by widespread motor and household insurance uptake, while SMEs and corporates drive commercial property and liability demand, including supply-chain and business interruption covers. Increased use of embedded and digital distribution has broadened access for retail customers .

The South Africa Property Casualty Insurance Market is characterized by a dynamic mix of regional and international players. Leading participants such as Santam Ltd., Old Mutual Insure Ltd., Discovery Insure Ltd., Hollard Insurance Company Ltd., Bryte Insurance Company Ltd. (A Fairfax Company), OUTsurance Insurance Company Ltd., Momentum Insure (Momentum Metropolitan Holdings), Absa Insurance Company Ltd. (Absa Group), First for Women Insurance (Telesure Investment Holdings), Auto & General Insurance Co. Ltd. (Telesure Investment Holdings), MiWay Insurance Ltd. (Sanlam Group), King Price Insurance Ltd., Renasa Insurance Company Ltd., Constantia Insurance Company Ltd., Sasria SOC Ltd., Hollard Partner Solutions (Cell Captive, incl. Guardrisk peers), Guardrisk Insurance Company Ltd. (MMI Holdings), AIG South Africa Ltd., Chubb Insurance South Africa Ltd., iTOO Special Risks (Hollard Group) contribute to innovation, geographic expansion, and service delivery in this space .

The South African property casualty insurance market is poised for transformation, driven by technological advancements and changing consumer preferences. The shift towards digital platforms is expected to enhance customer engagement and streamline operations, while the adoption of AI and big data analytics will enable insurers to offer personalized products. Additionally, the focus on sustainable practices will likely shape future offerings, aligning with global trends and consumer expectations for responsible insurance solutions.

| Segment | Sub-Segments |

|---|---|

| By Type | Motor Insurance (Personal and Commercial) Homeowner Insurance (Buildings) Home-Content Insurance Commercial Property Insurance Liability Insurance (General, Professional, D&O) Agriculture and Weather Insurance Marine, Aviation and Transport (MAT) Travel Insurance Other P&C Lines |

| By End-User | Individuals SMEs Large Corporates Public Sector and State-Owned Enterprises (SOEs) |

| By Distribution Channel | Brokers Agents Banks (Bancassurance) Direct-to-Consumer (Insurer Direct) Digital Aggregators and InsurTech Platforms |

| By Coverage Type | Comprehensive (All-Risk) Coverage Third-Party/Specified Perils Coverage |

| By Policy Duration | Short-Term Policies (Monthly/Annual) Multi-Year/Long-Term Policies |

| By Premium Range | Low Premium Medium Premium High Premium |

| By Claims Process | Standard Claims Fast-Track/Digital Claims Complex/Large Loss Claims |

| By Region | Gauteng Western Cape KwaZulu-Natal Eastern Cape Rest of South Africa |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Residential Property Insurance | 140 | Homeowners, Insurance Agents |

| Commercial Property Insurance | 100 | Business Owners, Risk Managers |

| Motor Vehicle Insurance | 120 | Car Owners, Insurance Brokers |

| Liability Insurance | 80 | Corporate Executives, Compliance Officers |

| Claims Processing Insights | 90 | Claims Adjusters, Underwriters |

The South Africa Property Casualty Insurance Market is valued at approximately USD 5.3 billion, reflecting the scale of short-term insurance activity in the country. This valuation is based on a five-year historical analysis of non-life insurance premiums.