Region:Middle East

Author(s):Geetanshi

Product Code:KRAD4758

Pages:80

Published On:December 2025

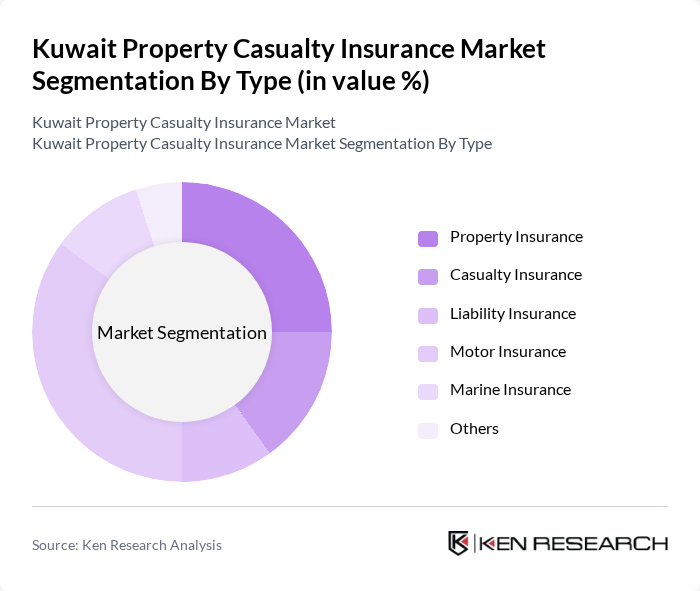

By Type:

The market is segmented into various types, including Property Insurance, Casualty Insurance, Liability Insurance, Motor Insurance, Marine Insurance, and Others. This structure is consistent with the broader Kuwait general insurance segmentation, where property, motor, liability and marine are key non-life classes. Among these, Motor Insurance is the leading sub-segment, driven by the high number of vehicles on the road and mandatory third-party liability insurance requirements set by the government for vehicle registration and renewal. The increasing number of expatriates and the growing urban population further contribute to the demand for comprehensive motor insurance policies, while rising vehicle values encourage uptake of own-damage and comprehensive covers. Property Insurance also holds a significant share, as individuals and businesses seek to protect buildings, contents, and industrial facilities against fire, natural events, and other operational risks, supported by ongoing infrastructure and real estate development in Kuwait.

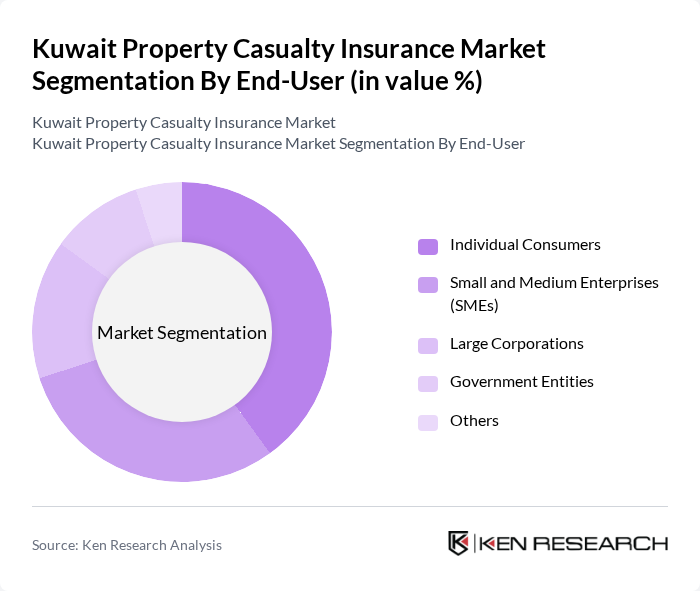

By End-User:

The end-user segmentation includes Individual Consumers, Small and Medium Enterprises (SMEs), Large Corporations, Government Entities, and Others. Individual Consumers dominate the market, primarily due to the increasing awareness of personal insurance products such as motor, home, and travel cover, and the growing need for financial security among the population. SMEs are also significant contributors, as they seek to protect their businesses from property damage, business interruption, liability, and workers’ compensation risks, supported by bank lending and contractual insurance requirements in commercial dealings. Large corporations and government-related entities tend to focus on comprehensive risk-transfer programmes, including industrial all-risk, energy, marine, and specialized liability covers to mitigate potential operational and third-party liabilities, often placed through brokers and international reinsurance markets.

The Kuwait Property Casualty Insurance Market is characterized by a dynamic mix of regional and international players. Leading participants such as Kuwait Insurance Company, Gulf Insurance Group, Al Ahli United Insurance Company, National Insurance Company, Warba Insurance Company, Kuwait Reinsurance Company, Takaful International Company, Al Sagr Cooperative Insurance Company, Al-Masraf Insurance Company, Al-Ahlia Insurance Company, United Insurance Company, Al-Bilad Insurance Company, Al-Jazeera Insurance Company, Al-Mawashi Insurance Company, Al-Madina Insurance Company contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Kuwait property casualty insurance market appears promising, driven by technological advancements and evolving consumer preferences. Insurers are increasingly adopting digital platforms to enhance customer engagement and streamline operations. Additionally, the growing emphasis on sustainability is likely to shape product offerings, as consumers demand more environmentally responsible insurance solutions. As the market matures, a focus on innovation and customer-centric approaches will be crucial for insurers to thrive in this dynamic landscape.

| Segment | Sub-Segments |

|---|---|

| By Type | Property Insurance Casualty Insurance Liability Insurance Motor Insurance Marine Insurance Others |

| By End-User | Individual Consumers Small and Medium Enterprises (SMEs) Large Corporations Government Entities Others |

| By Coverage Type | Comprehensive Coverage Third-Party Coverage Others |

| By Distribution Channel | Direct Sales Brokers Online Platforms Agents Others |

| By Policy Duration | Short-Term Policies Long-Term Policies Others |

| By Customer Segment | Individual Customers Corporate Customers Others |

| By Risk Type | Natural Disaster Risks Man-Made Risks Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Residential Property Insurance | 120 | Homeowners, Property Managers |

| Commercial Property Insurance | 100 | Business Owners, Risk Managers |

| Automobile Insurance | 110 | Car Owners, Fleet Managers |

| Liability Insurance | 80 | Corporate Executives, Legal Advisors |

| Insurance Brokers and Agents | 90 | Insurance Brokers, Sales Agents |

The Kuwait Property Casualty Insurance Market is valued at approximately USD 1.9 billion, reflecting its growth in line with the broader general insurance market in Kuwait, which is around USD 2.5 billion when including health and other non-life lines.