Region:Middle East

Author(s):Rebecca

Product Code:KRAC0206

Pages:84

Published On:August 2025

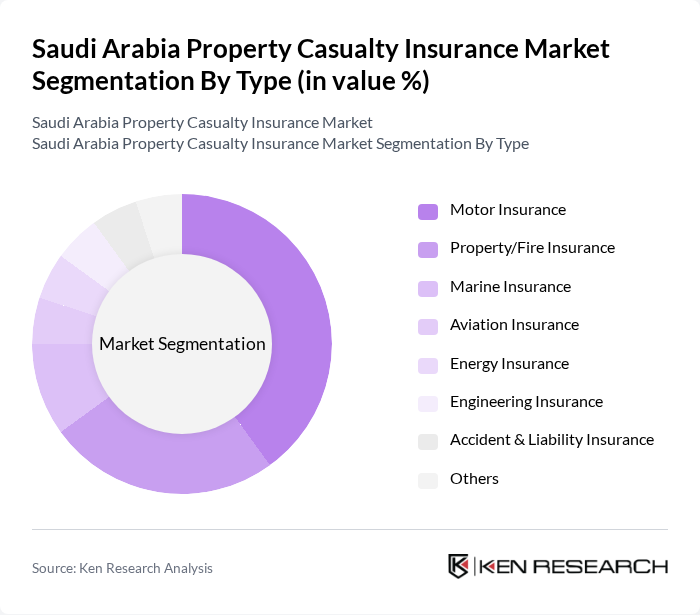

By Type:

The market is segmented into various types of insurance products, including Motor Insurance, Property/Fire Insurance, Marine Insurance, Aviation Insurance, Energy Insurance, Engineering Insurance, Accident & Liability Insurance, and Others. Among these, Motor Insurance is the leading segment, driven by the increasing number of vehicles on the road and the mandatory nature of vehicle insurance in the country. The growing urban population, rising disposable incomes, and digitalization of insurance services have further fueled the demand for comprehensive motor insurance policies .

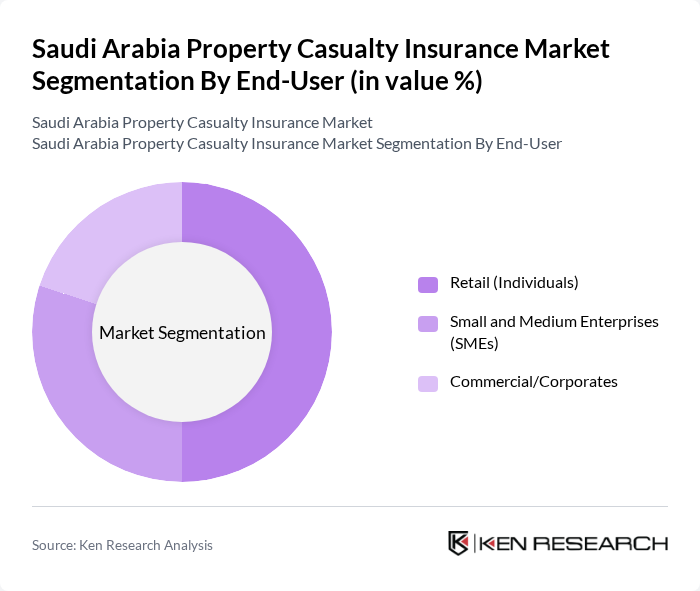

By End-User:

The end-user segmentation includes Retail (Individuals), Small and Medium Enterprises (SMEs), and Commercial/Corporates. The Retail segment is the most significant contributor, as individual consumers increasingly recognize the need for personal insurance products. The rise in home ownership and vehicle purchases among the growing middle class, coupled with enhanced digital access to insurance services, has led to a surge in demand for personal insurance solutions, making it a dominant force in the market .

The Saudi Arabia Property Casualty Insurance Market is characterized by a dynamic mix of regional and international players. Leading participants such as Tawuniya (The Company for Cooperative Insurance), Bupa Arabia for Cooperative Insurance, Al Rajhi Company for Cooperative Insurance (Al Rajhi Takaful), Gulf Insurance Group (GIG Saudi), Saudi Arabian Cooperative Insurance Company (SAICO), Allianz Saudi Fransi Cooperative Insurance Company, Mediterranean and Gulf Cooperative Insurance and Reinsurance Company (Medgulf), Alinma Tokio Marine Company, United Cooperative Assurance Company (UCA), Al-Ahlia Insurance Company for Cooperative Insurance, Al-Etihad Cooperative Insurance Co., Aljazira Takaful Taawuni Company, Malath Cooperative Insurance Co., Al Sagr Cooperative Insurance Co., Walaa Cooperative Insurance Co. contribute to innovation, geographic expansion, and service delivery in this space.

The Saudi Arabia property casualty insurance market is poised for significant transformation driven by technological advancements and evolving consumer preferences. As digital solutions become more prevalent, insurers are expected to enhance their service delivery through online platforms and mobile applications. Additionally, the integration of artificial intelligence and big data analytics will streamline underwriting processes, improving risk assessment and pricing strategies. These trends will likely foster a more competitive landscape, encouraging innovation and customer-centric offerings in the future.

| Segment | Sub-Segments |

|---|---|

| By Type | Motor Insurance Property/Fire Insurance Marine Insurance Aviation Insurance Energy Insurance Engineering Insurance Accident & Liability Insurance Others |

| By End-User | Retail (Individuals) Small and Medium Enterprises (SMEs) Commercial/Corporates |

| By Distribution Channel | Insurance Agency Bancassurance Brokers Direct Sales Other Distribution Channels |

| By Region | Central Western Eastern Northern Southern |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Residential Property Insurance | 100 | Homeowners, Property Managers |

| Commercial Property Insurance | 80 | Business Owners, Risk Managers |

| Casualty Insurance for SMEs | 60 | Small Business Owners, Insurance Brokers |

| Motor Insurance Policies | 90 | Vehicle Owners, Fleet Managers |

| Insurance Claims Processing | 50 | Claims Adjusters, Customer Service Representatives |

The Saudi Arabia Property Casualty Insurance Market is valued at approximately USD 12 billion, reflecting significant growth driven by economic diversification, infrastructure development, and increasing urbanization under the Vision 2030 initiative.