Region:North America

Author(s):Shubham

Product Code:KRAB1051

Pages:98

Published On:October 2025

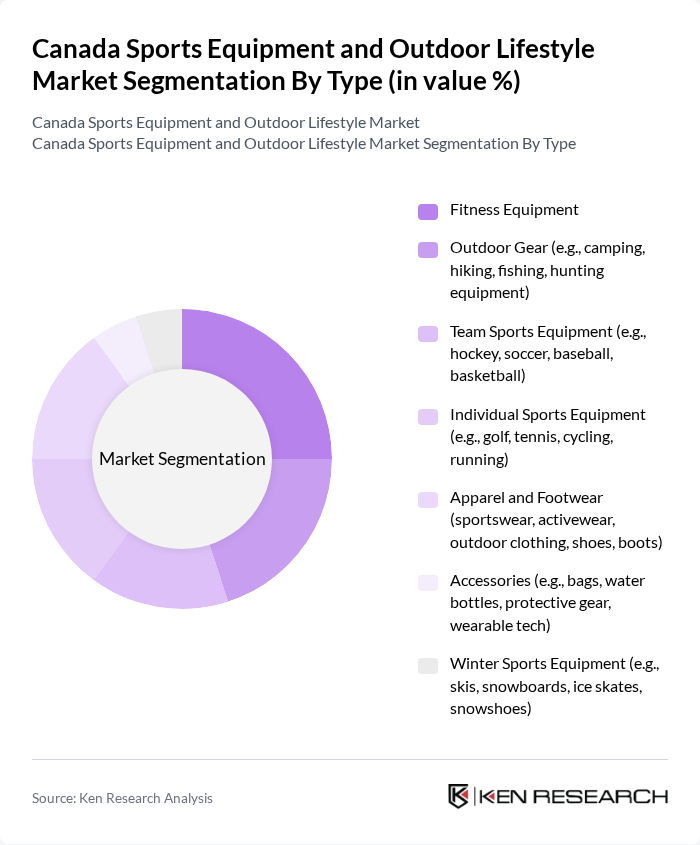

By Type:The market is segmented into fitness equipment, outdoor gear, sports apparel and footwear, accessories, team sports equipment, individual sports equipment, water sports equipment, winter sports equipment, and others. Fitness equipment and outdoor gear remain prominent, driven by the continued popularity of home workouts, outdoor pursuits, and the integration of smart technology in fitness products.

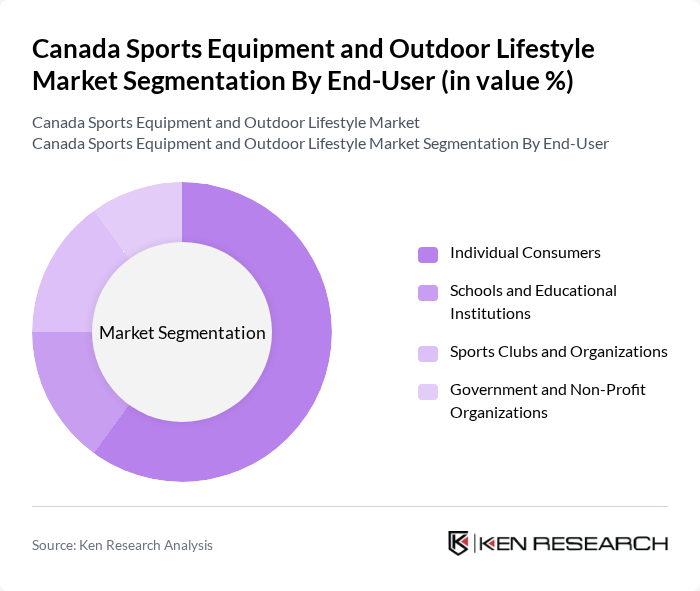

By End-User:The end-user segmentation includes individual consumers, schools and educational institutions, sports clubs and organizations, government and municipalities, and gyms and fitness centers. Individual consumers represent the largest segment, reflecting the ongoing trend towards personal fitness, home-based exercise, and outdoor activity participation.

The Canada Sports Equipment and Outdoor Lifestyle Market is characterized by a dynamic mix of regional and international players. Leading participants such as Canadian Tire Corporation, Sport Chek (FGL Sports Ltd.), MEC (Mountain Equipment Company), Under Armour Canada, Adidas Canada Ltd., Nike Canada Corp., Wilson Sporting Goods Canada, Bauer Hockey Ltd., The North Face Canada, Columbia Sportswear Canada, Salomon Canada, Burton Snowboards Canada, Patagonia Canada, New Balance Canada, Inc., ASICS Canada Corporation contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Canada sports equipment and outdoor lifestyle market appears promising, driven by ongoing trends in health consciousness and outdoor participation. As consumers increasingly seek innovative and sustainable products, companies are likely to invest in eco-friendly materials and smart technology integration. Additionally, the rise of digital platforms will facilitate greater consumer engagement, allowing brands to tailor their offerings to meet evolving preferences, ultimately enhancing market resilience and growth potential in the future.

| Segment | Sub-Segments |

|---|---|

| By Type | Fitness Equipment Outdoor Gear (Camping, Hiking, Fishing, Hunting Equipment) Sports Apparel & Footwear Accessories (Wearables, Smart Devices, Water Bottles, Bags) Team Sports Equipment (Hockey, Soccer, Baseball, Basketball) Individual Sports Equipment (Golf, Tennis, Cycling, Running) Water Sports Equipment (Kayaks, Canoes, Paddleboards, Swimming Gear) Winter Sports Equipment (Skiing, Snowboarding, Ice Skating) Others (Playground Equipment, Martial Arts, etc.) |

| By End-User | Individual Consumers Schools and Educational Institutions Sports Clubs and Organizations Government and Municipalities Gyms and Fitness Centers |

| By Sales Channel | Online Retail Brick-and-Mortar Stores Wholesale Distributors Direct Sales |

| By Price Range | Budget Mid-range Premium |

| By Brand Loyalty | Brand Loyal Customers Price-sensitive Customers First-time Buyers |

| By Product Lifecycle Stage | Introduction Stage Growth Stage Maturity Stage |

| By Distribution Mode | Direct Distribution Indirect Distribution E-commerce Platforms |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Sports Equipment Retailers | 150 | Store Managers, Sales Representatives |

| Outdoor Lifestyle Brands | 100 | Brand Managers, Marketing Directors |

| Consumer Insights on Sports Participation | 150 | Active Sports Participants, Casual Outdoor Users |

| Market Trends in E-commerce for Sports Gear | 120 | E-commerce Managers, Digital Marketing Specialists |

| Product Development in Outdoor Equipment | 80 | Product Designers, R&D Managers |

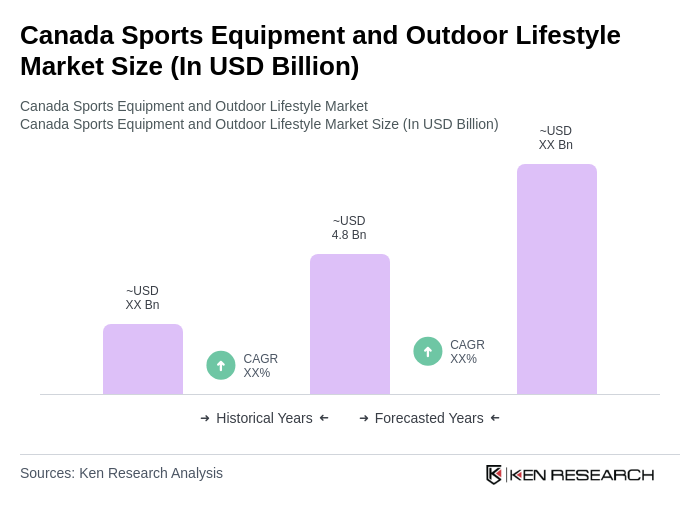

The Canada Sports Equipment and Outdoor Lifestyle Market is valued at approximately USD 3.3 billion, reflecting a robust demand for sports equipment, accessories, and outdoor lifestyle products, driven by health consciousness and increased participation in fitness activities.