Region:Europe

Author(s):Dev

Product Code:KRAA5139

Pages:85

Published On:September 2025

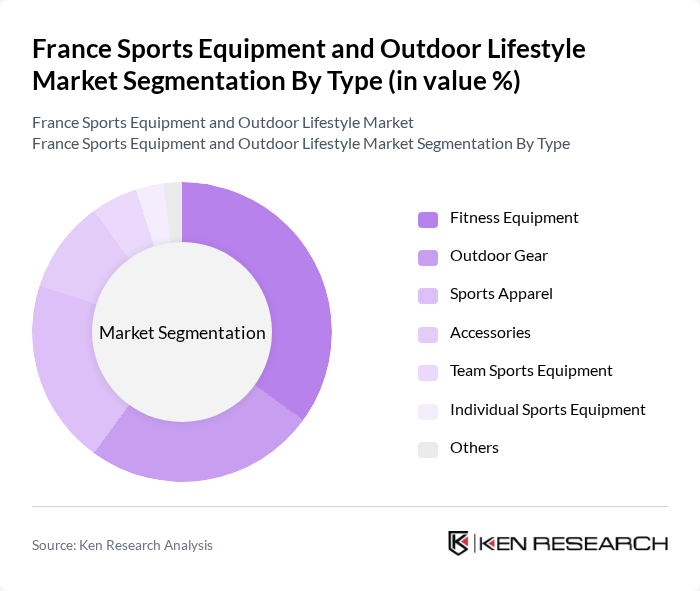

By Type:The market is segmented into various types, including Fitness Equipment, Outdoor Gear, Sports Apparel, Accessories, Team Sports Equipment, Individual Sports Equipment, and Others. Among these, Fitness Equipment has emerged as a dominant segment, driven by the increasing trend of home workouts and gym memberships. Consumers are investing in high-quality fitness gear, which has led to a surge in demand for innovative and technologically advanced products. Outdoor Gear also holds a significant share, as more individuals engage in outdoor activities such as hiking, cycling, and camping, particularly in scenic regions of France.

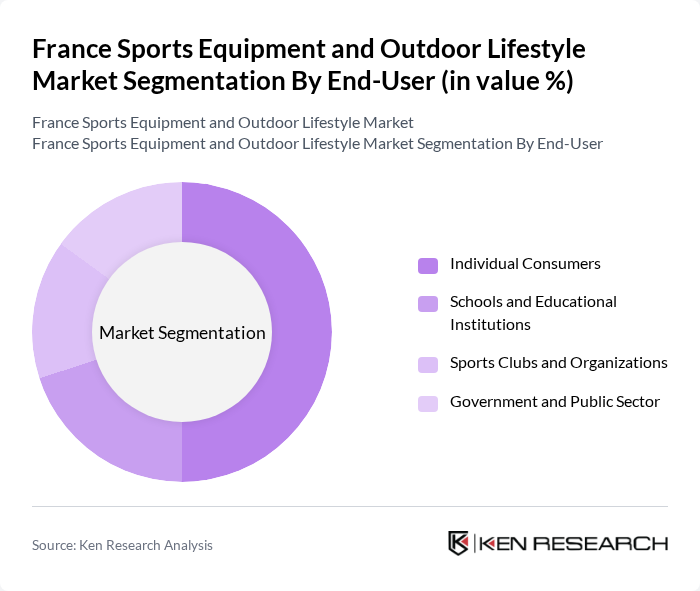

By End-User:The end-user segmentation includes Individual Consumers, Schools and Educational Institutions, Sports Clubs and Organizations, and Government and Public Sector. Individual Consumers represent the largest segment, as the growing trend of personal fitness and outdoor activities drives demand for sports equipment. Schools and Educational Institutions also contribute significantly, as they invest in sports facilities and equipment to promote physical education. Sports Clubs and Organizations are increasingly focusing on enhancing their offerings, while the Government and Public Sector plays a role in promoting sports initiatives.

The France Sports Equipment and Outdoor Lifestyle Market is characterized by a dynamic mix of regional and international players. Leading participants such as Decathlon, Go Sport, Intersport, Salomon, Quechua, The North Face, Adidas, Nike, Puma, Under Armour, Asics, Columbia Sportswear, New Balance, Oakley, Mizuno contribute to innovation, geographic expansion, and service delivery in this space.

The future of the France sports equipment and outdoor lifestyle market appears promising, driven by a growing emphasis on health and wellness. As consumers increasingly seek personalized and technologically advanced products, companies are likely to invest in innovative solutions. Additionally, the rise of eco-consciousness among consumers will push brands to adopt sustainable practices, aligning with market demands. This evolving landscape presents opportunities for growth and adaptation, ensuring the market remains dynamic and responsive to consumer needs.

| Segment | Sub-Segments |

|---|---|

| By Type | Fitness Equipment Outdoor Gear Sports Apparel Accessories Team Sports Equipment Individual Sports Equipment Others |

| By End-User | Individual Consumers Schools and Educational Institutions Sports Clubs and Organizations Government and Public Sector |

| By Sales Channel | Online Retail Brick-and-Mortar Stores Wholesale Distributors Direct Sales |

| By Price Range | Budget Mid-Range Premium |

| By Brand Loyalty | Brand Loyal Customers Price-Sensitive Customers Quality-Conscious Customers |

| By Product Lifecycle Stage | Introduction Stage Growth Stage Maturity Stage |

| By Distribution Mode | Direct Distribution Indirect Distribution Hybrid Distribution |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Sports Equipment Retailers | 150 | Store Managers, Sales Executives |

| Outdoor Lifestyle Enthusiasts | 100 | Active Consumers, Adventure Seekers |

| Fitness and Sports Clubs | 80 | Club Managers, Fitness Instructors |

| Manufacturers of Sports Gear | 70 | Product Managers, Marketing Directors |

| Outdoor Event Organizers | 60 | Event Coordinators, Sponsorship Managers |

The France Sports Equipment and Outdoor Lifestyle Market is valued at approximately USD 12 billion, reflecting a robust growth driven by increasing health consciousness and a rise in outdoor recreational activities among consumers.