Region:North America

Author(s):Dev

Product Code:KRAB0936

Pages:85

Published On:October 2025

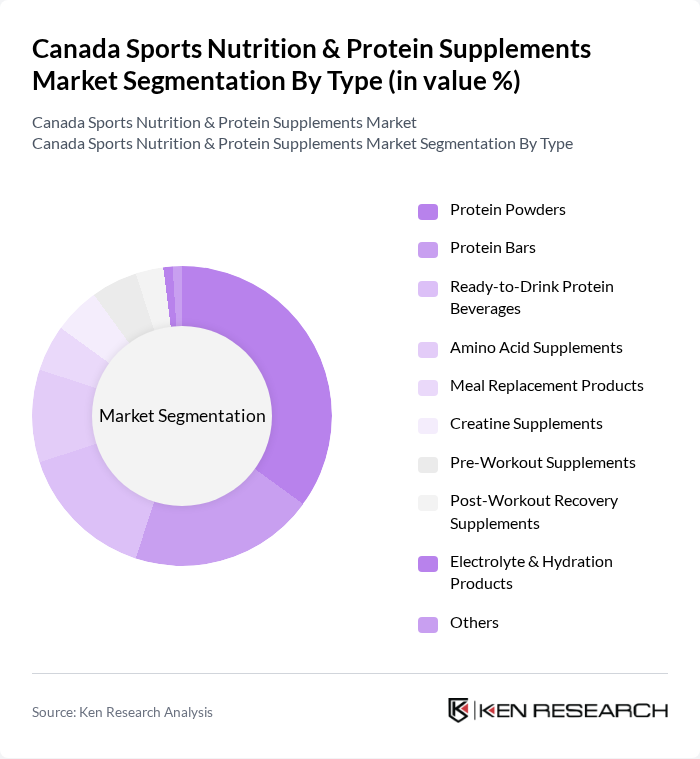

By Type:The market is segmented into various types of products, including protein powders, protein bars, ready-to-drink protein beverages, amino acid supplements, meal replacement products, creatine supplements, pre-workout supplements, post-workout recovery supplements, electrolyte & hydration products, and others. Among these,protein powdersremain the most dominant segment due to their versatility and widespread use among athletes, fitness enthusiasts, and general consumers. The increasing trend of home workouts, the convenience of protein powders, and the demand for plant-based and clean-label formulations have significantly contributed to their popularity .

By End-User:The end-user segmentation includes athletes, fitness enthusiasts, bodybuilders, general consumers, and seniors/active aging population.Athletesrepresent the largest segment, driven by their need for enhanced performance, endurance, and recovery. The growing awareness of the benefits of protein supplementation among fitness enthusiasts and the aging population seeking to maintain muscle mass and overall wellness also contributes to the market's expansion. The market is further supported by the increasing participation of women and youth in fitness activities, as well as the adoption of sports nutrition products by general consumers for preventive health .

The Canada Sports Nutrition & Protein Supplements Market is characterized by a dynamic mix of regional and international players. Leading participants such as Glanbia PLC (Optimum Nutrition, BSN), Iovate Health Sciences International Inc. (MuscleTech, Six Star Pro Nutrition), Abbott Laboratories (Ensure, ZonePerfect), NOW Foods, Dymatize Enterprises, LLC, Quest Nutrition LLC, GNC Holdings, LLC, Isagenix International LLC, Vega (Danone S.A.), Bodybuilding.com, Myprotein (The Hut Group), Garden of Life (Nestlé Health Science), ProMix Nutrition, Klean Athlete (Douglas Laboratories), Orgain Inc., Amazing Grass (Glanbia PLC), MusclePharm Corporation, Muscle Milk (CytoSport, Inc.) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Canada sports nutrition and protein supplements market appears promising, driven by evolving consumer preferences and technological advancements. As health consciousness continues to rise, brands are likely to innovate with cleaner, more transparent product offerings. Additionally, the integration of technology in fitness and nutrition, such as personalized supplement recommendations, will enhance consumer engagement. This dynamic environment presents opportunities for growth, particularly in niche segments like plant-based proteins and functional foods, which are gaining traction among health-focused consumers.

| Segment | Sub-Segments |

|---|---|

| By Type | Protein Powders Protein Bars Ready-to-Drink Protein Beverages Amino Acid Supplements Meal Replacement Products Creatine Supplements Pre-Workout Supplements Post-Workout Recovery Supplements Electrolyte & Hydration Products Others |

| By End-User | Athletes Fitness Enthusiasts Bodybuilders General Consumers Seniors/Active Aging Population |

| By Distribution Channel | Online Retail Supermarkets/Hypermarkets Specialty Nutrition Stores Health and Wellness Stores Pharmacies/Drugstores |

| By Ingredient Source | Animal-Based Plant-Based Blended/Mixed Source Synthetic |

| By Price Range | Premium Mid-Range Budget |

| By Packaging Type | Bottles Pouches Tubs Sachets/Single-Serve Packs |

| By Formulation | Ready-to-Drink Powdered Solid (Bars, Tablets) Gummies/Chews Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| General Consumer Insights | 120 | Active individuals aged 18-45 |

| Fitness Professionals | 60 | Personal trainers, gym owners |

| Nutrition Experts | 40 | Registered dietitians, sports nutritionists |

| Retailers of Protein Supplements | 50 | Store managers, product buyers |

| Competitive Athletes | 45 | Amateur and professional athletes |

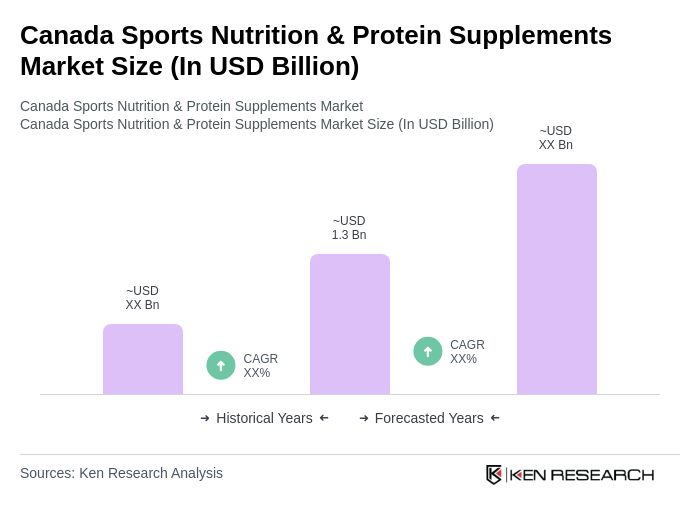

The Canada Sports Nutrition & Protein Supplements Market is valued at approximately USD 1.3 billion, reflecting a significant growth trend driven by increasing health consciousness and the rise in fitness activities among various demographics.