Region:North America

Author(s):Dev

Product Code:KRAB0443

Pages:96

Published On:August 2025

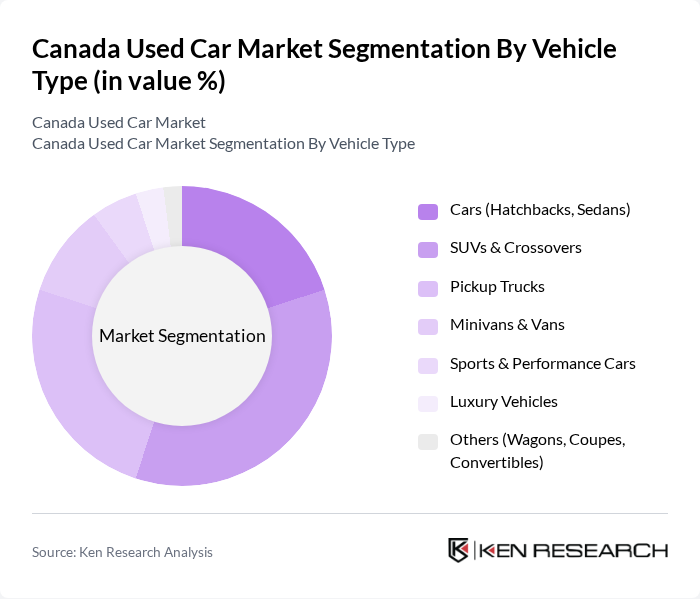

By Vehicle Type:The vehicle type segmentation includes various categories such as Cars (Hatchbacks, Sedans), SUVs & Crossovers, Pickup Trucks, Minivans & Vans, Sports & Performance Cars, Luxury Vehicles, and Others (Wagons, Coupes, Convertibles). Among these, SUVs & Crossovers have gained significant popularity due to their versatility and spaciousness, appealing to families and adventure seekers alike. Industry data indicates SUVs lead used transactions, reflecting consumer preference for utility and safety features, while Pickup Trucks remain resilient given work and lifestyle needs. Certified pre-owned offerings are supporting demand in higher-trim SUVs and luxury segments ; .

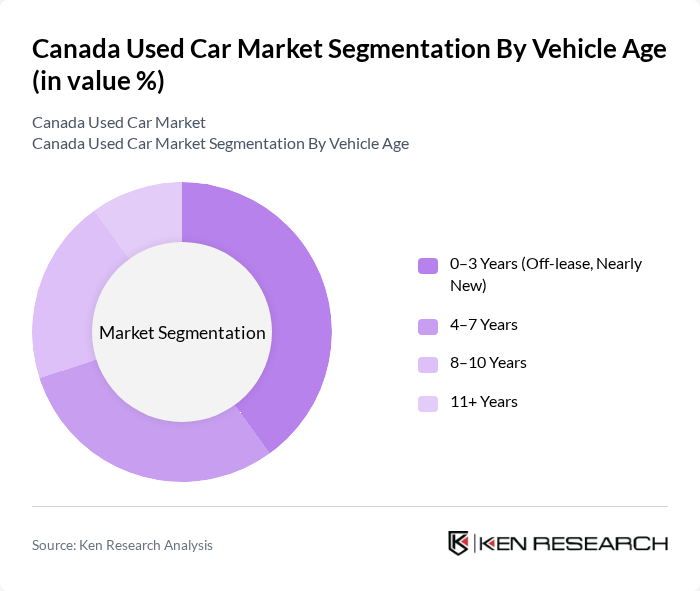

By Vehicle Age:The vehicle age segmentation includes categories such as 0–3 Years (Off-lease, Nearly New), 4–7 Years, 8–10 Years, and 11+ Years. The 0–3 Years segment remains highly sought after for modern features and remaining warranty coverage, but market supply of late-model vehicles has been tighter due to pandemic-era production shortages and longer ownership cycles. The 4–7 Years segment also performs well with value-focused buyers balancing price and reliability .

The Canada Used Car Market is characterized by a dynamic mix of regional and international players. Leading participants such as AutoTrader.ca, CarGurus Canada, Kijiji Autos, Canadian Black Book, Carfax Canada, AutoCanada Inc., Dilawri Group of Companies, Pfaff Automotive Partners, Groupe Park Avenue, OpenRoad Auto Group, Drive Savvy by Canada Drives, HGrégoire (HGreg.com), Clutch Technologies Inc. (Canada), Car-On Auto Group, DesRosiers Automotive Consultants (market data provider) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Canada used car market appears promising, driven by technological advancements and changing consumer preferences. The integration of enhanced vehicle inspection technologies is expected to improve buyer confidence, while the growing importance of sustainability will influence purchasing decisions. Additionally, the rise of electric and hybrid used vehicles is anticipated to reshape the market landscape, catering to environmentally conscious consumers seeking affordable options. Overall, these trends indicate a dynamic and evolving market environment.

| Segment | Sub-Segments |

|---|---|

| By Vehicle Type | Cars (Hatchbacks, Sedans) SUVs & Crossovers Pickup Trucks Minivans & Vans Sports & Performance Cars Luxury Vehicles Others (Wagons, Coupes, Convertibles) |

| By Vehicle Age | –3 Years (Off-lease, Nearly New) –7 Years –10 Years + Years |

| By Condition | Certified Pre-Owned (CPO) Non-Certified |

| By Sales Channel | Franchised Dealerships Independent Dealers Online-Direct Platforms/Marketplaces Private Party Sales |

| By Fuel/Powertrain | Gasoline Diesel Hybrid (HEV) Plug-in Hybrid (PHEV) Battery Electric (BEV) |

| By Buyer Type | Retail (Individual Consumers) Fleet/Commercial (SMEs, Rentals, Government) |

| By Geography (Province) | Ontario Quebec British Columbia Alberta Prairies (SK, MB) Atlantic Canada (NS, NB, NL, PE) Northern Territories (YT, NT, NU) |

| By Price Band (CAD) | Under $10,000 $10,000–$20,000 $20,000–$30,000 $30,000–$50,000 Over $50,000 |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Used Car Dealerships | 120 | Dealership Owners, Sales Managers |

| Recent Used Car Buyers | 140 | Consumers aged 25-55, First-time Buyers |

| Automotive Industry Experts | 40 | Market Analysts, Automotive Consultants |

| Online Car Marketplace Users | 100 | Frequent Online Shoppers, Tech-savvy Consumers |

| Financial Institutions Offering Auto Loans | 75 | Loan Officers, Financial Advisors |

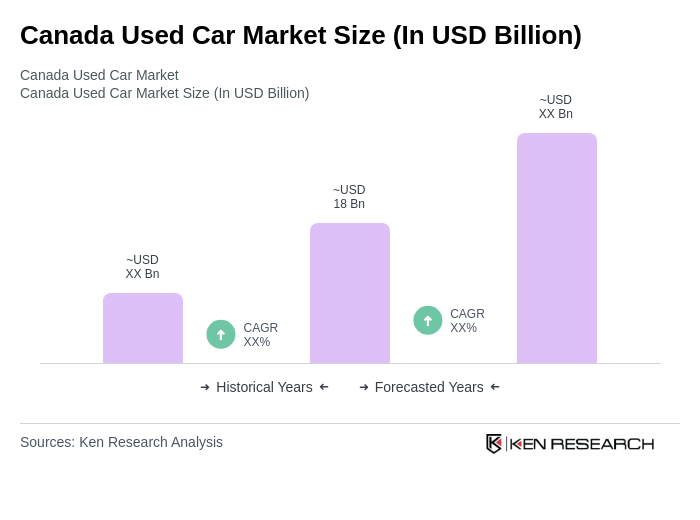

The Canada Used Car Market is valued at approximately USD 18 billion, reflecting a significant demand for used vehicles amid rising new vehicle prices and supply constraints. This market has seen a notable increase in transactions, particularly through online channels.