Region:Central and South America

Author(s):Shubham

Product Code:KRAA0726

Pages:85

Published On:August 2025

By Service Type:The service type segmentation includes various consulting services tailored to meet the diverse needs of fleet operators. The subsegments are Strategy & Operations Consulting, Digital Transformation & Telematics Consulting, Regulatory Compliance & Risk Advisory, Fleet Electrification & Sustainability Consulting, Training & Change Management, Maintenance Optimization Consulting, and Others. Among these, Digital Transformation & Telematics Consulting is currently the leading subsegment, driven by the increasing adoption of technology in fleet operations. Companies are focusing on integrating telematics, AI analytics, and real-time data solutions to enhance operational efficiency, reduce costs, and support sustainability initiatives .

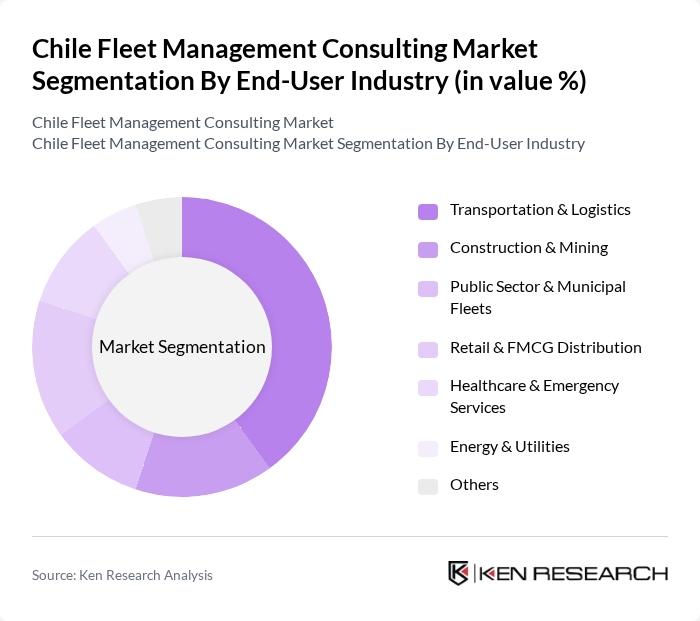

By End-User Industry:The end-user industry segmentation encompasses various sectors that utilize fleet management consulting services. The subsegments include Transportation & Logistics, Construction & Mining, Public Sector & Municipal Fleets, Retail & FMCG Distribution, Healthcare & Emergency Services, Energy & Utilities, and Others. The Transportation & Logistics sector is the dominant segment, as it requires efficient fleet management to ensure timely deliveries and cost-effective operations. The increasing demand for e-commerce, last-mile delivery, and digital supply chain solutions further fuels this growth .

The Chile Fleet Management Consulting Market is characterized by a dynamic mix of regional and international players. Leading participants such as Deloitte Chile, PwC Chile, Accenture Chile, KPMG Chile, EY Chile, Geotab, Verizon Connect, Trimble, FleetUp Latin America, MiX Telematics, Omnitracs, TomTom Telematics, Fleet Complete, Teletrac Navman, Element Fleet Management contribute to innovation, geographic expansion, and service delivery in this space.

The Chile fleet management consulting market is poised for significant transformation as businesses increasingly prioritize efficiency and compliance. With the anticipated growth in e-commerce logistics, the demand for optimized fleet operations will rise. Additionally, the integration of AI and machine learning technologies is expected to enhance decision-making processes, driving further adoption of consulting services. As sustainability becomes a core focus, fleet management consulting will play a crucial role in helping companies navigate regulatory landscapes and implement eco-friendly practices.

| Segment | Sub-Segments |

|---|---|

| By Service Type | Strategy & Operations Consulting Digital Transformation & Telematics Consulting Regulatory Compliance & Risk Advisory Fleet Electrification & Sustainability Consulting Training & Change Management Maintenance Optimization Consulting Others |

| By End-User Industry | Transportation & Logistics Construction & Mining Public Sector & Municipal Fleets Retail & FMCG Distribution Healthcare & Emergency Services Energy & Utilities Others |

| By Fleet Size | Small Fleets (1-20 Vehicles) Medium Fleets (21-100 Vehicles) Large Fleets (101+ Vehicles) |

| By Service Model | Project-Based Consulting Retainer/Managed Services Hybrid Engagements Others |

| By Geographic Coverage | Metropolitan Regions (e.g., Santiago, Valparaíso) Regional/Provincial Coverage National Coverage Others |

| By Technology Focus | Telematics & IoT Integration Data Analytics & Reporting Electrification & Alternative Fuels Automation & AI Solutions Others |

| By Pricing Model | Fixed Fee Performance-Based Subscription/Retainer Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Mining Fleet Management | 60 | Fleet Managers, Operations Directors |

| Logistics and Transportation | 70 | Logistics Coordinators, Supply Chain Managers |

| Public Transport Systems | 50 | Transport Planners, Fleet Supervisors |

| Construction Equipment Fleet | 40 | Project Managers, Equipment Managers |

| Technology Adoption in Fleet Management | 45 | IT Managers, Innovation Officers |

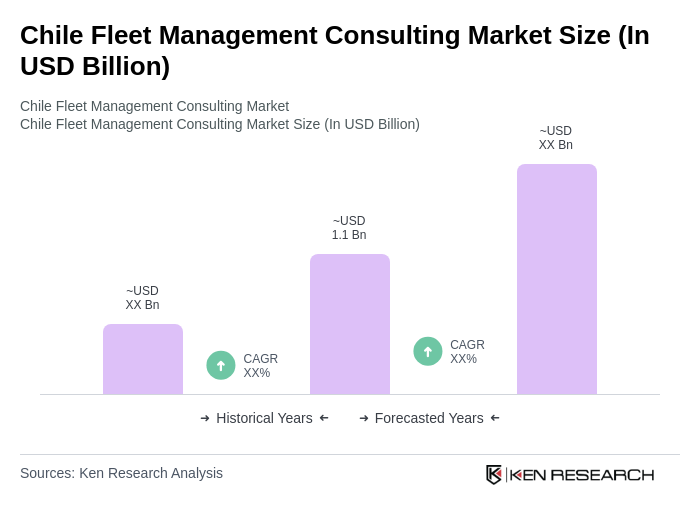

The Chile Fleet Management Consulting Market is valued at approximately USD 1.1 billion, reflecting a significant growth driven by the demand for efficient fleet operations, cost reduction strategies, and advanced technologies like telematics and AI-driven analytics.