Region:Europe

Author(s):Dev

Product Code:KRAA0415

Pages:82

Published On:August 2025

By Type:The market is segmented into various consulting types, including Strategic Consulting, Operational Consulting, Technology Consulting, Compliance Consulting, Sustainability Consulting, Risk Management Consulting, Vehicle Leasing Consulting, Maintenance & Accident Management Consulting, and Others. Each of these segments plays a crucial role in addressing specific needs within fleet management. Strategic Consulting focuses on long-term planning and cost reduction, Operational Consulting addresses day-to-day fleet efficiency, Technology Consulting supports digital transformation and telematics adoption, Compliance Consulting ensures regulatory adherence, Sustainability Consulting guides environmental initiatives, Risk Management Consulting mitigates operational risks, Vehicle Leasing Consulting optimizes leasing strategies, and Maintenance & Accident Management Consulting enhances vehicle uptime and safety .

The Technology Consulting segment is currently dominating the market due to the rapid adoption of telematics, IoT, and digital solutions in fleet management. Companies are increasingly investing in technology to enhance operational efficiency, reduce costs, and improve safety. The demand for data analytics and AI tools is also on the rise, as businesses seek to leverage insights for better decision-making. This trend is further fueled by the growing emphasis on sustainability, prompting fleets to adopt innovative technologies that align with environmental goals .

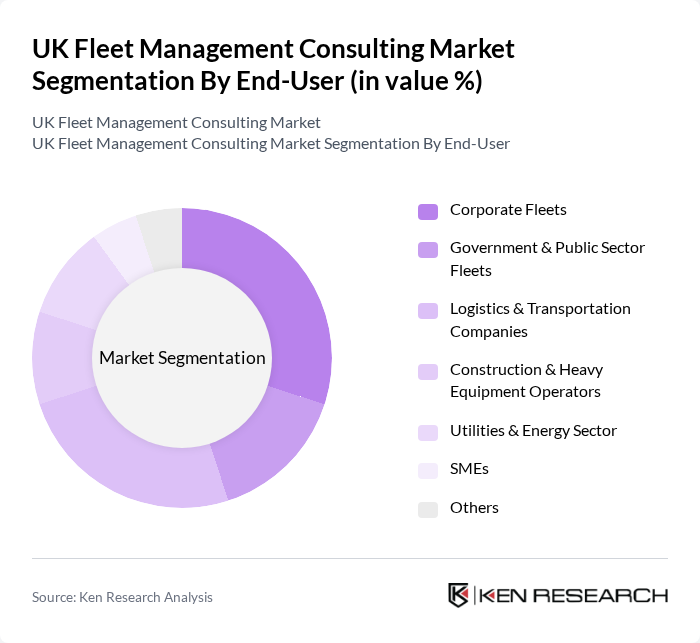

By End-User:The market is segmented by end-users, including Corporate Fleets, Government & Public Sector Fleets, Logistics & Transportation Companies, Construction & Heavy Equipment Operators, Utilities & Energy Sector, SMEs, and Others. Each end-user category has distinct requirements and challenges that consulting services aim to address. Corporate Fleets require scalable solutions for diverse vehicle types, Government & Public Sector Fleets focus on regulatory compliance and public accountability, Logistics & Transportation Companies prioritize route optimization and real-time tracking, Construction & Heavy Equipment Operators need asset utilization and safety management, Utilities & Energy Sector seeks sustainability and uptime, SMEs demand cost-effective and flexible services, while Others include niche and specialized fleet operators .

Corporate Fleets represent the largest end-user segment, driven by the need for efficient fleet management solutions to optimize costs and improve service delivery. These organizations often have diverse vehicle types and require tailored consulting services to manage their fleets effectively. The logistics and transportation companies also play a significant role, as they are increasingly focused on enhancing operational efficiency and compliance with regulations, further driving demand for consulting services .

The UK Fleet Management Consulting Market is characterized by a dynamic mix of regional and international players. Leading participants such as ARI Fleet UK, LeasePlan UK, Alphabet (GB) Limited, Fleet Operations Ltd, Holman UK, CLM Fleet Management, Ogilvie Fleet, Zenith, ALD Automotive UK, Marshall Leasing, Rivus Fleet Solutions, Fleet Alliance, Inchcape Fleet Solutions, JCT600 Vehicle Leasing Solutions, Lex Autolease contribute to innovation, geographic expansion, and service delivery in this space.

The future of the UK fleet management consulting market appears promising, driven by technological advancements and regulatory changes. As businesses increasingly prioritize sustainability, the demand for consulting services that facilitate the transition to electric vehicles and eco-friendly practices is expected to rise. Additionally, the integration of AI and data analytics will enhance operational efficiencies, allowing firms to offer more tailored solutions. Overall, the market is poised for growth as companies adapt to evolving consumer preferences and regulatory landscapes.

| Segment | Sub-Segments |

|---|---|

| By Type | Strategic Consulting Operational Consulting Technology Consulting Compliance Consulting Sustainability Consulting Risk Management Consulting Vehicle Leasing Consulting Maintenance & Accident Management Consulting Others |

| By End-User | Corporate Fleets Government & Public Sector Fleets Logistics & Transportation Companies Construction & Heavy Equipment Operators Utilities & Energy Sector SMEs Others |

| By Fleet Size | Small Fleets (1-10 Vehicles) Medium Fleets (11-50 Vehicles) Large Fleets (51+ Vehicles) Others |

| By Service Type | Fleet Optimization & Efficiency Services Maintenance and Repair Consulting Fuel Management Consulting Driver Management & Training Services Telematics & Digital Integration Services Accident & Risk Management Services Others |

| By Geographic Coverage | National Coverage Regional Coverage Local Coverage Others |

| By Technology Integration | Telematics Integration Fleet Management Software Consulting GPS Tracking Solutions Data Analytics & AI Tools IoT & Connectivity Solutions Others |

| By Consulting Model | Project-Based Consulting Retainer-Based Consulting On-Demand Consulting Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Logistics Fleet Management | 100 | Fleet Managers, Operations Directors |

| Public Transport Fleet Operations | 60 | Transport Planners, Fleet Supervisors |

| Construction Vehicle Management | 50 | Site Managers, Equipment Coordinators |

| Technology Adoption in Fleet Management | 40 | IT Managers, Innovation Officers |

| Environmental Impact of Fleet Operations | 40 | Sustainability Managers, Compliance Officers |

The UK Fleet Management Consulting Market is valued at approximately GBP 510 million, reflecting a significant growth driven by the increasing complexity of fleet operations, cost optimization needs, and the demand for sustainable transportation solutions.