Region:Middle East

Author(s):Geetanshi

Product Code:KRAA2006

Pages:99

Published On:August 2025

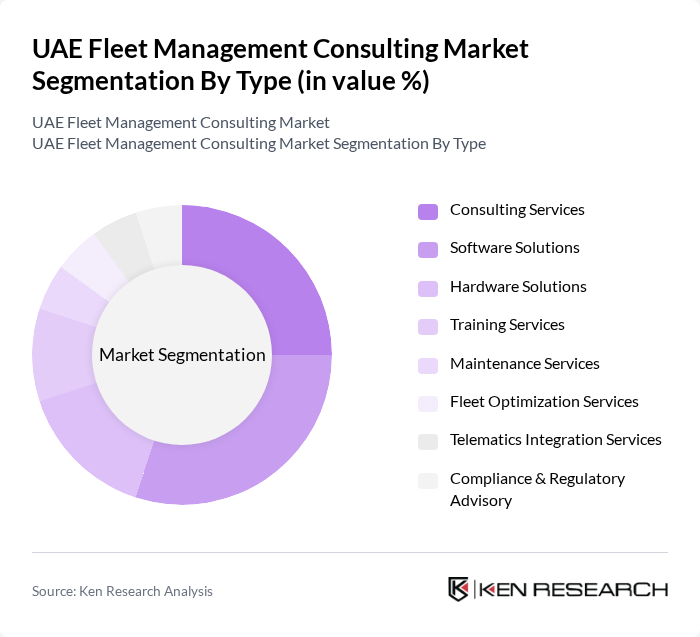

By Type:The market is segmented into Consulting Services, Software Solutions, Hardware Solutions, Training Services, Maintenance Services, Fleet Optimization Services, Telematics Integration Services, and Compliance & Regulatory Advisory. Each segment is vital for improving fleet efficiency, withSoftware SolutionsandConsulting Servicesleading due to strong demand for digital transformation, regulatory compliance, and operational analytics. Hardware Solutions and Telematics Integration Services are increasingly adopted for real-time monitoring and predictive maintenance. Training and Compliance Advisory remain essential for workforce upskilling and regulatory alignment.

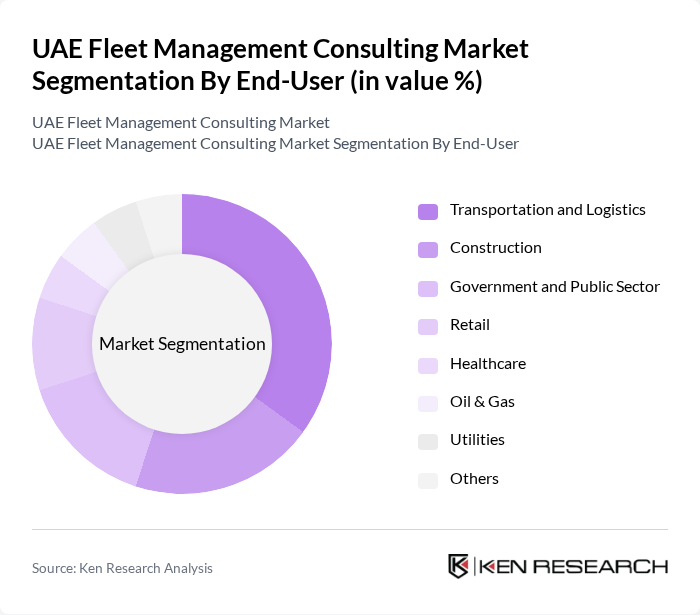

By End-User:The end-user segmentation includes Transportation and Logistics, Construction, Government and Public Sector, Retail, Healthcare, Oil & Gas, Utilities, and Others.Transportation and Logisticsis the largest segment, driven by the UAE’s role as a regional logistics hub and the expansion of e-commerce. Construction and Government sectors are significant due to ongoing infrastructure projects and public fleet modernization. Retail, Healthcare, Oil & Gas, and Utilities segments are adopting fleet management consulting for cost control, compliance, and service reliability.

The UAE Fleet Management Consulting Market is characterized by a dynamic mix of regional and international players. Leading participants such as MiX Telematics, Geotab, Astrata Middle East, Trakker Middle East, Fleet Complete, Gurtam, TomTom Telematics, Omnix International, Location Solutions, Verizon Connect, Inseego, Samsara, Ctrack, Fleet Management Systems International (FMSi), Al Masaood Group contribute to innovation, geographic expansion, and service delivery in this space.

The future of the UAE fleet management consulting market appears promising, driven by technological advancements and a growing emphasis on sustainability. As businesses increasingly recognize the importance of efficient fleet operations, the integration of AI and IoT technologies will likely enhance service offerings. Additionally, the government's commitment to green initiatives will further propel the adoption of electric and hybrid vehicles, creating a more sustainable transportation ecosystem in the UAE.

| Segment | Sub-Segments |

|---|---|

| By Type | Consulting Services Software Solutions Hardware Solutions Training Services Maintenance Services Fleet Optimization Services Telematics Integration Services Compliance & Regulatory Advisory |

| By End-User | Transportation and Logistics Construction Government and Public Sector Retail Healthcare Oil & Gas Utilities Others |

| By Fleet Size | Small Fleets (1-10 Vehicles) Medium Fleets (11-50 Vehicles) Large Fleets (51+ Vehicles) |

| By Service Type | Fleet Maintenance Fleet Tracking Fleet Optimization Fleet Compliance Route Planning & Optimization Driver Behavior Analysis Fuel Management Advisory |

| By Geographic Coverage | Dubai Abu Dhabi Sharjah Northern Emirates Cross-Border Operations |

| By Technology Adoption | Traditional Fleet Management Advanced Fleet Management Solutions (IoT, AI, Telematics) |

| By Policy Support | Government Subsidies Tax Incentives Regulatory Support |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Light Vehicle Fleet Management | 100 | Fleet Managers, Operations Supervisors |

| Heavy-Duty Vehicle Operations | 70 | Logistics Directors, Fleet Maintenance Heads |

| Telematics and Fleet Tracking Solutions | 60 | IT Managers, Technology Officers |

| Fuel Management Systems | 50 | Procurement Managers, Sustainability Coordinators |

| Fleet Safety and Compliance | 80 | Safety Managers, Compliance Officers |

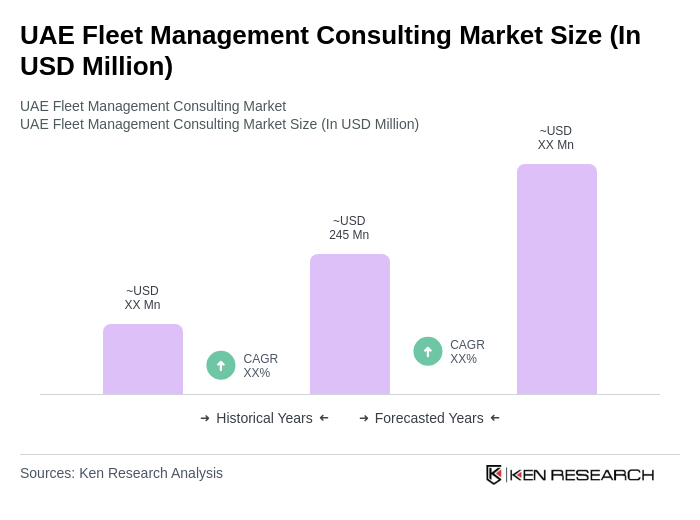

The UAE Fleet Management Consulting Market is valued at approximately USD 245 million, reflecting a significant growth trend driven by the demand for efficient fleet operations and the adoption of advanced technologies like telematics and IoT.