Region:Europe

Author(s):Dev

Product Code:KRAA0478

Pages:96

Published On:August 2025

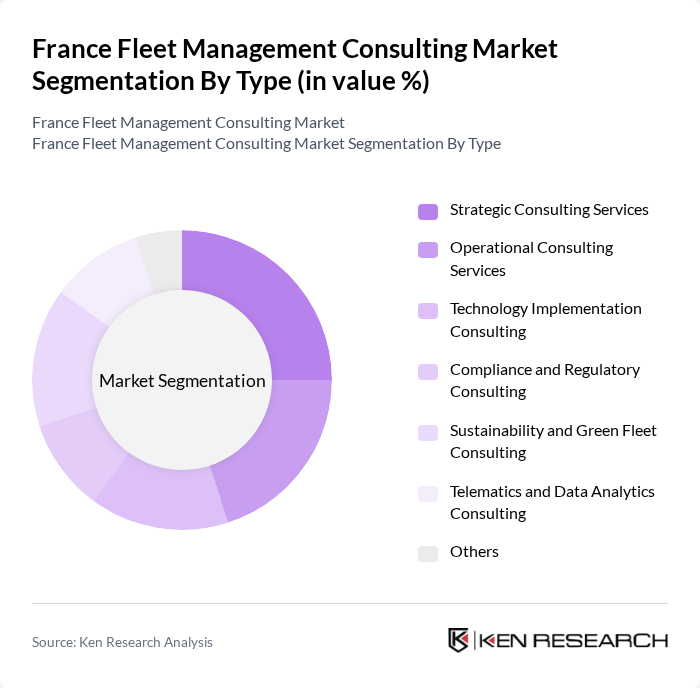

By Type:The market is segmented into various types of consulting services that cater to the diverse needs of fleet operators. The subsegments include Strategic Consulting Services, Operational Consulting Services, Technology Implementation Consulting, Compliance and Regulatory Consulting, Sustainability and Green Fleet Consulting, Telematics and Data Analytics Consulting, and Others. Each of these subsegments plays a crucial role in enhancing fleet efficiency and effectiveness, with a growing emphasis on digital transformation, predictive analytics, and sustainability consulting .

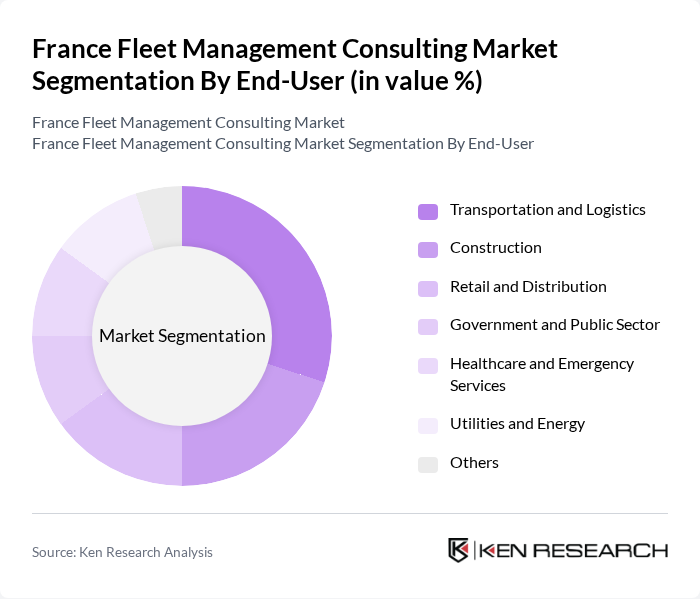

By End-User:The end-user segmentation includes various industries that utilize fleet management consulting services. Key segments are Transportation and Logistics, Construction, Retail and Distribution, Government and Public Sector, Healthcare and Emergency Services, Utilities and Energy, and Others. Each sector has unique requirements and challenges that consulting services address to optimize fleet operations, with transportation and logistics remaining the largest segment due to the scale and complexity of their fleets .

The France Fleet Management Consulting Market is characterized by a dynamic mix of regional and international players. Leading participants such as Accenture, Capgemini Invent, BearingPoint, Sopra Steria, CGI, ARI Fleet (Holman), ALD Automotive (Société Générale), Targa Telematics, Teletrac Navman, Omnitracs, Fleet Logistics Group, LeasePlan France, PwC France, KPMG France, Deloitte France contribute to innovation, geographic expansion, and service delivery in this space.

The future of the fleet management consulting market in France appears promising, driven by technological advancements and regulatory support. As companies increasingly prioritize sustainability, the shift towards electric and hybrid vehicles will reshape fleet strategies. Furthermore, the integration of AI and machine learning will enhance operational efficiencies, enabling predictive maintenance and optimized routing. These trends indicate a dynamic market landscape, where innovation and compliance will play pivotal roles in shaping future growth trajectories.

| Segment | Sub-Segments |

|---|---|

| By Type | Strategic Consulting Services Operational Consulting Services Technology Implementation Consulting Compliance and Regulatory Consulting Sustainability and Green Fleet Consulting Telematics and Data Analytics Consulting Others |

| By End-User | Transportation and Logistics Construction Retail and Distribution Government and Public Sector Healthcare and Emergency Services Utilities and Energy Others |

| By Fleet Size | Small Fleets (1-10 Vehicles) Medium Fleets (11-50 Vehicles) Large Fleets (51+ Vehicles) Mega Fleets (500+ Vehicles) |

| By Geographic Coverage | National Coverage Regional Coverage Local Coverage Cross-Border/International Coverage |

| By Service Model | On-Premise Solutions Cloud-Based Solutions Hybrid Solutions Managed Services |

| By Industry Vertical | Automotive Manufacturing Telecommunications Food & Beverage Others |

| By Technology Integration | GPS Tracking IoT Integration Telematics AI and Predictive Analytics Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Logistics Fleet Management | 100 | Fleet Managers, Operations Directors |

| Public Transport Fleet Optimization | 80 | Transport Planners, Fleet Supervisors |

| Construction Vehicle Management | 60 | Project Managers, Equipment Managers |

| Corporate Fleet Solutions | 50 | Procurement Managers, Sustainability Officers |

| Electric Vehicle Fleet Integration | 40 | Innovation Managers, Environmental Compliance Officers |

The France Fleet Management Consulting Market is valued at approximately EUR 1.1 billion, reflecting a significant growth driven by the demand for efficient fleet operations, cost reduction strategies, and the integration of advanced technologies like telematics and IoT.