Region:Asia

Author(s):Geetanshi

Product Code:KRAA0215

Pages:87

Published On:August 2025

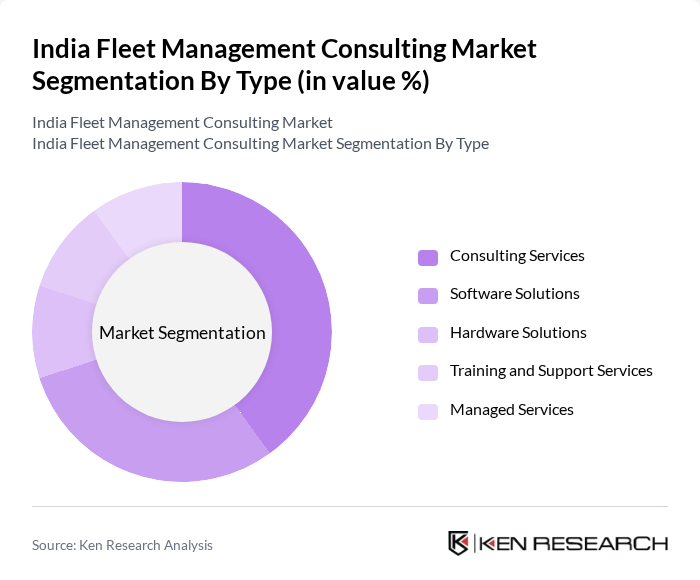

By Type:The market is segmented into various types, including Consulting Services, Software Solutions, Hardware Solutions, Training and Support Services, and Managed Services. Each of these segments plays a crucial role in enhancing fleet efficiency and operational effectiveness. Consulting Services remain dominant, as businesses seek expert guidance to optimize their fleet operations, ensure regulatory compliance, and reduce costs. Software Solutions are also gaining traction due to the increasing reliance on telematics, real-time analytics, and cloud-based platforms for fleet management .

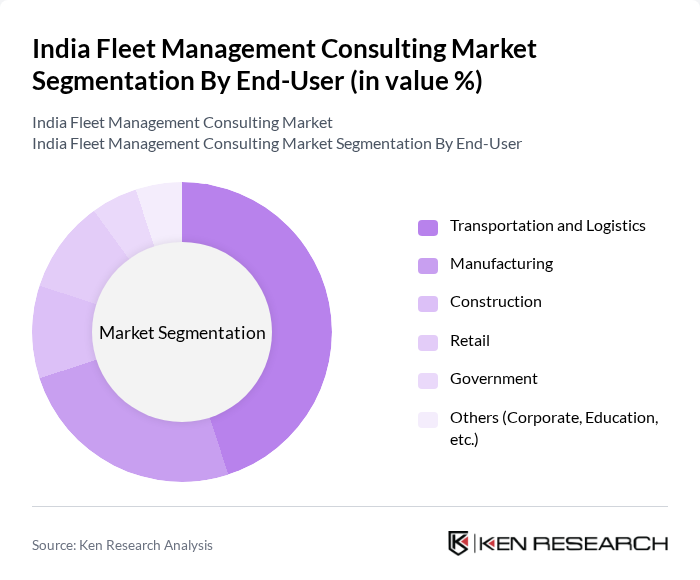

By End-User:The end-user segmentation includes Transportation and Logistics, Manufacturing, Construction, Retail, Government, and Others (Corporate, Education, etc.). The Transportation and Logistics sector is the largest consumer of fleet management consulting services, driven by the need for efficient supply chain management, regulatory compliance, and cost-effective transportation solutions. The Manufacturing sector is also significant, as companies seek to optimize logistics, distribution, and asset utilization through advanced fleet management strategies .

The India Fleet Management Consulting Market is characterized by a dynamic mix of regional and international players. Leading participants such as Tata Consultancy Services (TCS), Trimble Inc., Mahindra Logistics, WheelsEye, LocoNav, Fleetx, Bosch Limited (Mobility Solutions), MapmyIndia, Verizon Connect, Intangles Lab Pvt. Ltd., AVL India, Letstrack, Trak N Tell, Arya Omnitalk, and BlackBuck contribute to innovation, geographic expansion, and service delivery in this space.

The future of the India fleet management consulting market appears promising, driven by technological innovations and increasing regulatory pressures. As companies prioritize sustainability, the shift towards electric vehicles and eco-friendly practices is expected to gain momentum. Additionally, the integration of AI and IoT technologies will enhance operational efficiencies, enabling businesses to leverage data analytics for better decision-making. These trends will likely shape the market landscape, fostering growth and innovation in fleet management consulting services.

| Segment | Sub-Segments |

|---|---|

| By Type | Consulting Services Software Solutions Hardware Solutions Training and Support Services Managed Services |

| By End-User | Transportation and Logistics Manufacturing Construction Retail Government Others (Corporate, Education, etc.) |

| By Region | North India South India East India West India |

| By Fleet Size | Small Fleets (1-10 Vehicles) Medium Fleets (11-50 Vehicles) Large Fleets (51+ Vehicles) |

| By Service Type | Fleet Optimization Compliance Management Risk Management Telematics Consulting Digital Transformation Advisory |

| By Technology Used | GPS Tracking Telematics Fleet Management Software GNSS (Global Navigation Satellite System) IoT Integration |

| By Deployment Model | On-Premise Cloud |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Commercial Fleet Management | 60 | Fleet Managers, Operations Directors |

| Public Transportation Fleet | 50 | Transport Planners, Fleet Supervisors |

| Construction Equipment Fleet | 40 | Project Managers, Equipment Managers |

| Logistics and Supply Chain Fleet | 55 | Logistics Coordinators, Supply Chain Analysts |

| Technology Adoption in Fleet Management | 45 | IT Managers, Fleet Technology Specialists |

The India Fleet Management Consulting Market is valued at approximately USD 1.5 billion, driven by the demand for efficient fleet operations, cost reduction strategies, and the adoption of advanced technologies like telematics and AI.