Region:Middle East

Author(s):Geetanshi

Product Code:KRAA0303

Pages:86

Published On:August 2025

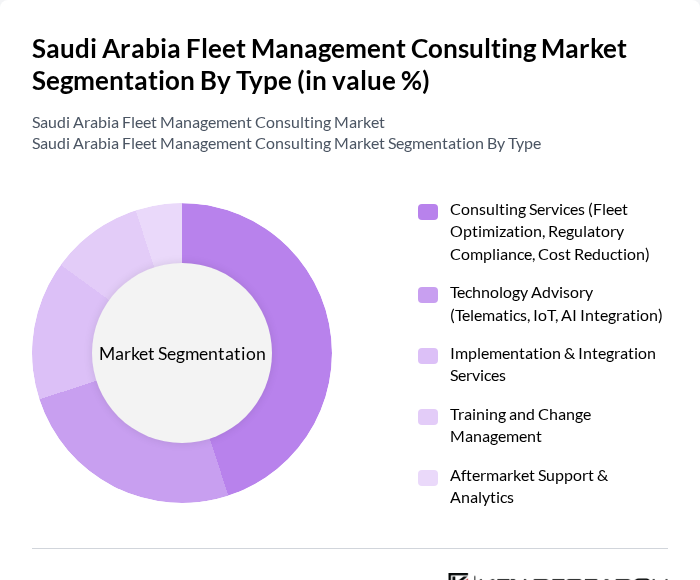

By Type:The market is segmented into Consulting Services, Technology Advisory, Implementation & Integration Services, Training and Change Management, and Aftermarket Support & Analytics. Consulting Services, which include fleet optimization, regulatory compliance, and cost reduction strategies, dominate the market due to the increasing need for operational efficiency and compliance with evolving regulations .

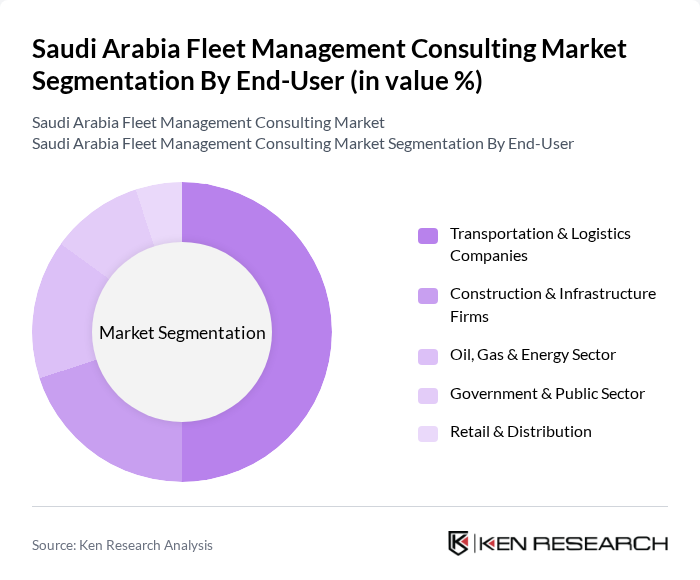

By End-User:The end-user segmentation includes Transportation & Logistics Companies, Construction & Infrastructure Firms, Oil, Gas & Energy Sector, Government & Public Sector, and Retail & Distribution. Transportation & Logistics Companies lead this segment, driven by the need for efficient fleet management solutions to handle increasing demand and operational complexities .

The Saudi Arabia Fleet Management Consulting Market is characterized by a dynamic mix of regional and international players. Leading participants such as Aljomaih Automotive Company, Abdul Latif Jameel Logistics, Al Mulla Group (Fleet Management Division), Arabian Hala Company (HALA Auto), Al Tayyar Group (Seera Group), Budget Saudi Arabia (United International Transportation Co.), Hanco Rent a Car, Key Car Rental, GlobeMed Saudi (Fleet Health Management), Trukkin Middle East, Almarai (Fleet Operations), Sixt Saudi Arabia, Al Faris Group, Almarshad Group, Al Jabr Group (Al Jabr Leasing & Fleet Management) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the fleet management consulting market in Saudi Arabia appears promising, driven by technological advancements and government support. As companies increasingly adopt data-driven decision-making, the demand for sophisticated fleet management solutions will rise. Additionally, the focus on sustainability and efficiency will likely lead to greater investments in electric and hybrid vehicles, further transforming the landscape. The integration of AI and IoT technologies will enhance operational capabilities, making fleet management more efficient and responsive to market needs.

| Segment | Sub-Segments |

|---|---|

| By Type | Consulting Services (Fleet Optimization, Regulatory Compliance, Cost Reduction) Technology Advisory (Telematics, IoT, AI Integration) Implementation & Integration Services Training and Change Management Aftermarket Support & Analytics |

| By End-User | Transportation & Logistics Companies Construction & Infrastructure Firms Oil, Gas & Energy Sector Government & Public Sector Retail & Distribution |

| By Fleet Size | Small Fleets (1-20 vehicles) Medium Fleets (21-100 vehicles) Large Fleets (101+ vehicles) |

| By Geographic Coverage | Riyadh Region Jeddah/Makkah Region Eastern Province Other Regions |

| By Service Model | On-Premise Consulting Remote/Virtual Consulting Hybrid Consulting Models |

| By Industry Vertical | Logistics & Supply Chain Oil & Gas Construction Government/Public Sector Retail & FMCG |

| By Policy Support | Government Subsidies Tax Incentives Grants for Technology Adoption Regulatory Mandates |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Oil & Gas Fleet Management | 60 | Fleet Managers, Operations Directors |

| Construction Vehicle Fleet | 50 | Fleet Managers, Equipment Supervisors |

| Retail Delivery Fleet | 40 | Logistics Coordinators, Supply Chain Managers |

| Public Transportation Fleet | 40 | Transport Authorities, Fleet Operations Managers |

| Technology Adoption in Fleet Management | 50 | IT Managers, Fleet Technology Specialists |

The Saudi Arabia Fleet Management Consulting Market is valued at approximately USD 730 million, reflecting a significant growth driven by the demand for efficient fleet operations and the adoption of telematics and IoT solutions.