Region:Central and South America

Author(s):Geetanshi

Product Code:KRAA1976

Pages:87

Published On:August 2025

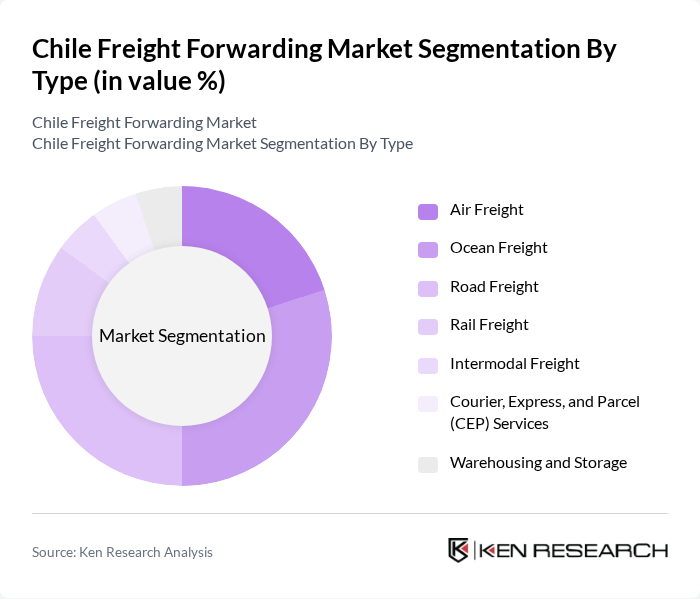

By Type:The freight forwarding market in Chile is segmented into various types, including air freight, ocean freight, road freight, rail freight, intermodal freight, courier, express, and parcel (CEP) services, and warehousing and storage. Each of these segments plays a crucial role in the logistics ecosystem, catering to different transportation needs and customer preferences. Air freight is experiencing growth due to increased adoption of sustainable aviation fuels and expansion of freighter fleets, while ocean freight remains dominant for bulk exports. Road and rail freight benefit from ongoing infrastructure upgrades and digitalization, and CEP services are expanding rapidly with rising e-commerce demand. Warehousing and storage, particularly temperature-controlled facilities, are increasingly important for food and pharmaceutical logistics .

By End-User:The end-user segmentation of the freight forwarding market in Chile includes agriculture, fishing, and forestry; mining and quarrying; manufacturing; oil and gas; wholesale and retail trade; food and beverage; pharmaceuticals; electronics; automotive; and others. Each sector has unique logistics requirements, influencing the demand for freight forwarding services. Mining and quarrying remain the largest contributors, driven by copper exports, while agriculture, manufacturing, and retail trade also generate significant logistics demand. The food and pharmaceutical sectors increasingly require temperature-controlled logistics and specialized warehousing solutions .

The Chile Freight Forwarding Market is characterized by a dynamic mix of regional and international players. Leading participants such as DHL Supply Chain Chile, Kuehne + Nagel Chile, DB Schenker Chile, DSV Chile, Agunsa S.A., Andes Logistics de Chile S.A., Maersk Chile, UPS Supply Chain Solutions Chile, Expeditors International Chile, CEVA Logistics Chile, Rhenus Logistics Chile, Toll Group Chile, LATAM Cargo Chile, Panalpina Chile (now part of DSV), Geodis Chile contribute to innovation, geographic expansion, and service delivery in this space. Competition is driven by operational efficiency, technological adoption, sustainability initiatives, and strategic partnerships .

The Chile freight forwarding market is poised for significant transformation, driven by technological advancements and evolving consumer preferences. As companies increasingly adopt automation and digital solutions, operational efficiencies will improve, reducing costs and enhancing service delivery. Additionally, the focus on sustainability will shape logistics strategies, compelling freight forwarders to adopt greener practices. These trends will create a dynamic environment, fostering innovation and collaboration among industry players, ultimately leading to a more resilient and competitive market landscape.

| Segment | Sub-Segments |

|---|---|

| By Type | Air Freight Ocean Freight Road Freight Rail Freight Intermodal Freight Courier, Express, and Parcel (CEP) Services Warehousing and Storage |

| By End-User | Agriculture, Fishing, and Forestry Mining and Quarrying Manufacturing Oil and Gas Wholesale and Retail Trade Food and Beverage Pharmaceuticals Electronics Automotive Others |

| By Service Type | Freight Forwarding Customs Brokerage Freight Insurance Warehousing Distribution Consulting Services Others |

| By Shipment Size | Full Container Load (FCL) Less than Container Load (LCL) Bulk Shipments Breakbulk Shipments Others |

| By Geographic Coverage | Domestic International Regional Others |

| By Delivery Speed | Standard Delivery Expedited Delivery Same-Day Delivery Others |

| By Pricing Model | Fixed Pricing Variable Pricing Subscription-Based Pricing Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| General Freight Forwarding Services | 120 | Logistics Managers, Operations Directors |

| Specialized Cargo Handling | 60 | Project Managers, Cargo Specialists |

| Customs Brokerage Services | 50 | Customs Compliance Officers, Trade Analysts |

| Cold Chain Logistics | 40 | Supply Chain Managers, Quality Assurance Heads |

| Last-Mile Delivery Solutions | 55 | Delivery Managers, E-commerce Logistics Coordinators |

The Chile Freight Forwarding Market is valued at approximately USD 12 billion, reflecting significant growth driven by increased trade activities, particularly in mining and agriculture, as well as advancements in logistics technology and infrastructure investments.