Region:Middle East

Author(s):Dev

Product Code:KRAA0476

Pages:95

Published On:August 2025

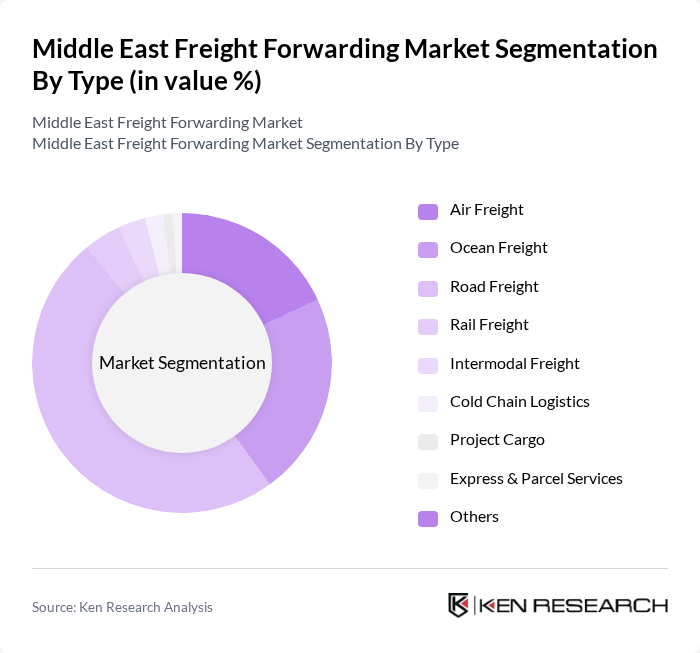

By Type:The freight forwarding market is segmented by mode, including air freight, ocean freight, road freight, rail freight, intermodal freight, cold chain logistics, project cargo, express & parcel services, and others. Each segment addresses specific logistics needs: road freight dominates for regional distribution, ocean freight is essential for bulk international shipments, air freight is used for high-value or time-sensitive goods, and cold chain logistics ensures temperature control for pharmaceuticals and perishables .

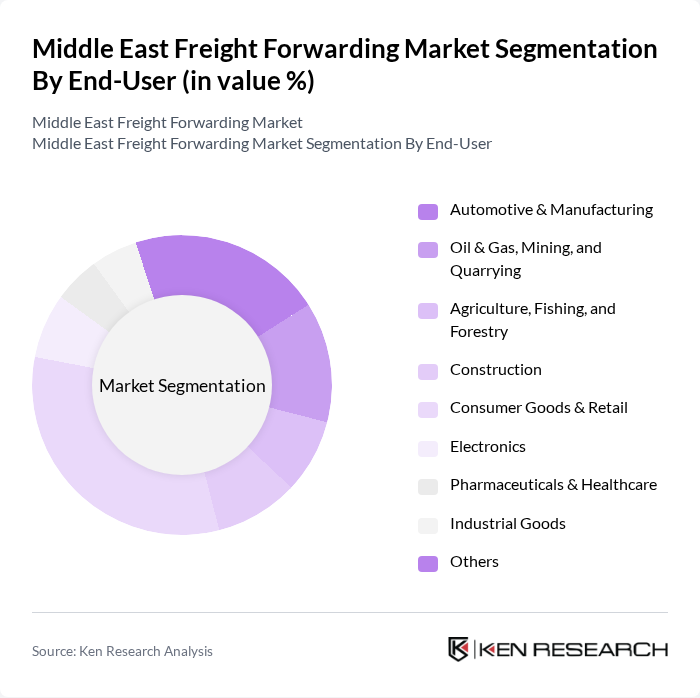

By End-User:The end-user segmentation includes automotive & manufacturing, oil & gas, mining and quarrying, agriculture, fishing and forestry, construction, consumer goods & retail, electronics, pharmaceuticals & healthcare, industrial goods, and others. Each sector has unique logistics requirements: automotive and manufacturing rely on just-in-time delivery, oil & gas require specialized handling, consumer goods & retail drive demand for last-mile and e-commerce logistics, and healthcare depends on cold chain and regulatory compliance .

The Middle East Freight Forwarding Market is characterized by a dynamic mix of regional and international players. Leading participants such as DHL Global Forwarding, Kuehne + Nagel, DB Schenker, Agility Logistics, CEVA Logistics, Expeditors International, DSV, Emirates SkyCargo, Aramex, Hellmann Worldwide Logistics, Yusen Logistics, ZIM Integrated Shipping Services, Bahri (The National Shipping Company of Saudi Arabia), Gulf Agency Company (GAC), FedEx Express Middle East contribute to innovation, geographic expansion, and service delivery in this space.

The Middle East freight forwarding market is poised for significant evolution, driven by ongoing technological advancements and increasing demand for efficient logistics solutions. As e-commerce continues to expand, particularly in the Gulf states, freight forwarders will need to adapt to changing consumer expectations. Furthermore, sustainability initiatives are likely to gain traction, prompting companies to invest in green logistics practices. Overall, the market is expected to embrace innovation while addressing challenges related to compliance and geopolitical risks.

| Segment | Sub-Segments |

|---|---|

| By Type | Air Freight Ocean Freight Road Freight Rail Freight Intermodal Freight Cold Chain Logistics Project Cargo Express & Parcel Services Others |

| By End-User | Automotive & Manufacturing Oil & Gas, Mining, and Quarrying Agriculture, Fishing, and Forestry Construction Consumer Goods & Retail Electronics Pharmaceuticals & Healthcare Industrial Goods Others |

| By Service Type | Freight Forwarding Customs Brokerage Warehousing & Storage Distribution Supply Chain Management Value-Added Services Others |

| By Region | Saudi Arabia United Arab Emirates Qatar Kuwait Oman Bahrain Jordan Lebanon Israel North Africa Others |

| By Mode of Transport | Air Transport Sea Transport Land Transport (Road & Rail) Multimodal Transport Others |

| By Customer Type | B2B B2C Government Others |

| By Technology Adoption | Traditional Methods Digital Platforms Automated & Smart Systems Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Oil & Gas Freight Forwarding | 60 | Logistics Coordinators, Supply Chain Managers |

| Retail Logistics Operations | 50 | Operations Directors, Inventory Managers |

| Manufacturing Supply Chain | 45 | Procurement Managers, Production Planners |

| Pharmaceutical Logistics | 40 | Quality Assurance Managers, Regulatory Affairs Specialists |

| E-commerce Freight Solutions | 55 | eCommerce Operations Managers, Logistics Analysts |

The Middle East Freight Forwarding Market is valued at approximately USD 22 billion, driven by the region's strategic location, e-commerce growth, and increasing logistics demands. This valuation is based on a comprehensive five-year historical analysis.