Region:Middle East

Author(s):Shubham

Product Code:KRAA0736

Pages:80

Published On:August 2025

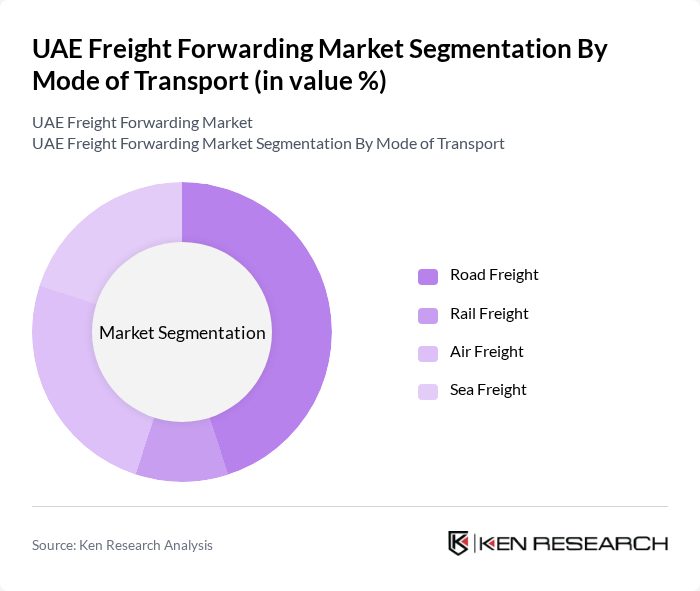

By Mode of Transport:The freight forwarding market is segmented into four primary modes of transport: Road Freight, Rail Freight, Air Freight, and Sea Freight. Each mode serves distinct logistical needs. Road Freight is the most utilized due to its flexibility and accessibility, especially for domestic and regional distribution. Air Freight is preferred for high-value and time-sensitive shipments, leveraging the UAE's major airports. Sea Freight is essential for bulk goods and international trade, supported by the country's extensive port infrastructure. Rail Freight, while less common, is gaining traction with the development of the Etihad Rail network, offering cost-effective solutions for transporting large volumes over land .

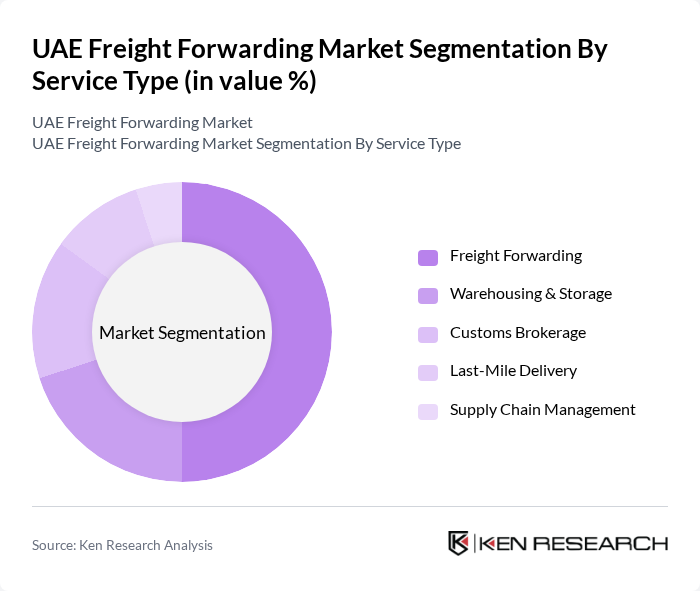

By Service Type:This market is also categorized by service types, including Freight Forwarding, Warehousing & Storage, Customs Brokerage, Last-Mile Delivery, and Supply Chain Management. Freight Forwarding remains the dominant service type, driven by the increasing complexity of global supply chains and the demand for integrated logistics solutions. Warehousing & Storage services are increasingly critical, especially with the rise of e-commerce, which requires robust inventory management and distribution capabilities. Customs Brokerage, Last-Mile Delivery, and Supply Chain Management are also essential components, supporting efficient cross-border trade and end-to-end logistics .

The UAE Freight Forwarding Market is characterized by a dynamic mix of regional and international players. Leading participants such as DHL Global Forwarding, DB Schenker, CEVA Logistics, Agility Logistics, Emirates Logistics LLC, DP World, Aramex, GAC Group, Kuehne + Nagel, Hellmann Worldwide Logistics, DSV, Expeditors International, Yusen Logistics, Al-Futtaim Logistics, and Freightworks contribute to innovation, geographic expansion, and service delivery in this space .

The UAE freight forwarding market is poised for significant transformation driven by technological advancements and evolving consumer demands. As e-commerce continues to expand, logistics providers will increasingly adopt automation and AI-driven solutions to enhance operational efficiency. Additionally, the focus on sustainability will prompt companies to invest in eco-friendly logistics practices. These trends will not only improve service delivery but also position the UAE as a leader in innovative freight solutions in the region.

| Segment | Sub-Segments |

|---|---|

| By Mode of Transport | Road Freight Rail Freight Air Freight Sea Freight |

| By Service Type | Freight Forwarding Warehousing & Storage Customs Brokerage Last-Mile Delivery Supply Chain Management |

| By End-User Industry | Construction Oil & Gas Retail & E-Commerce Automotive Pharmaceuticals Electronics Others |

| By Region | Dubai Abu Dhabi Sharjah Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Oil & Gas Freight Forwarding | 50 | Logistics Coordinators, Supply Chain Managers |

| Retail Supply Chain Logistics | 40 | Operations Directors, Procurement Managers |

| Manufacturing Sector Logistics | 40 | Warehouse Managers, Production Supervisors |

| Pharmaceuticals Distribution | 40 | Quality Assurance Managers, Regulatory Affairs Specialists |

| E-commerce Freight Solutions | 50 | eCommerce Operations Managers, Logistics Analysts |

The UAE Freight Forwarding Market is valued at approximately USD 21.6 billion, driven by the growth of e-commerce, infrastructure investments, and the UAE's strategic position as a global trade hub.