Region:Central and South America

Author(s):Dev

Product Code:KRAA1595

Pages:80

Published On:August 2025

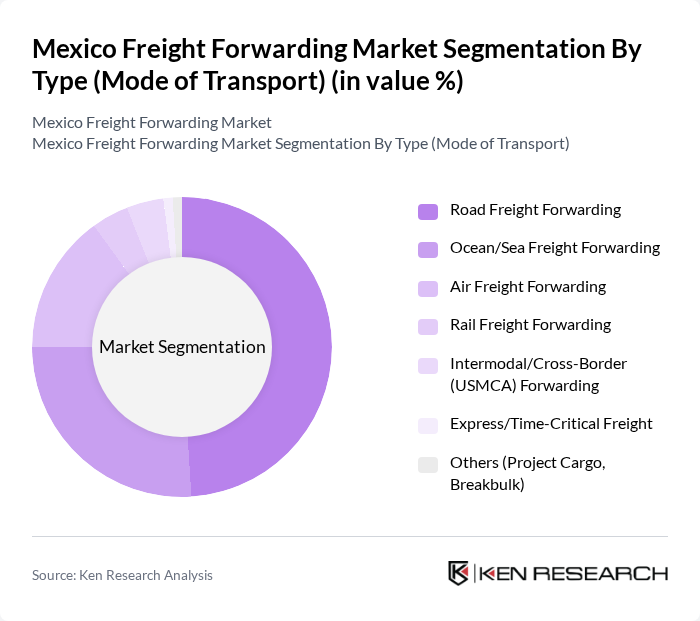

By Type (Mode of Transport):

Road Freight Forwarding is the dominant segment in the market, accounting for a significant share due to its flexibility and cost-effectiveness. The extensive road network in Mexico facilitates the movement of goods across various regions, making it the preferred mode for many businesses. Additionally, the rise of e-commerce has led to increased demand for last-mile delivery services, further boosting the road freight segment. The convenience and speed of road transport make it a vital component of the logistics landscape.

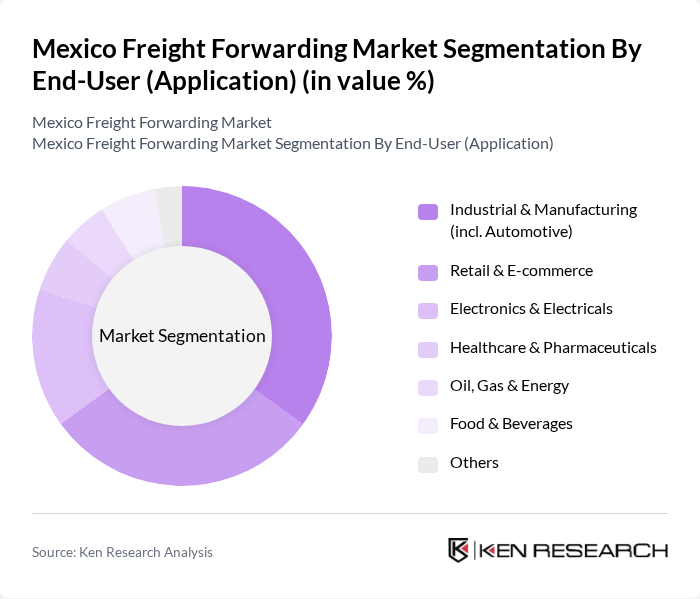

By End-User (Application):

The Industrial & Manufacturing sector, particularly the automotive industry, is the leading end-user in the freight forwarding market. This segment benefits from the high volume of goods transported, including parts and finished products. The growth of manufacturing in Mexico, driven by foreign investments and trade agreements, has significantly increased the demand for freight forwarding services. Additionally, the rise of e-commerce has led to a surge in retail logistics, further diversifying the market.

The Mexico Freight Forwarding Market is characterized by a dynamic mix of regional and international players. Leading participants such as DHL Global Forwarding Mexico, Kuehne+Nagel Mexico, DB Schenker Mexico, DSV Mexico, CEVA Logistics Mexico, UPS Supply Chain Solutions Mexico, Expeditors Mexico, GEODIS Mexico, C.H. Robinson Mexico, Maersk Logistics & Services Mexico (incl. Damco legacy), CMA CGM Logistics (CEVA) Mexico, Grupo TMM Logistics, Traxión (Grupo Traxión) – Red de Autotransporte/Forwarding, Mexpress Logistics, Yusen Logistics Mexico contribute to innovation, geographic expansion, and service delivery in this space.

The Mexico freight forwarding market is poised for significant transformation, driven by technological advancements and evolving consumer preferences. The integration of automation and artificial intelligence in logistics operations is expected to enhance efficiency and reduce costs. Additionally, the increasing focus on sustainability will likely lead to the adoption of green logistics practices, positioning companies to meet regulatory demands and consumer expectations. As the market adapts to these trends, opportunities for growth and innovation will emerge, shaping the future landscape of freight forwarding in Mexico.

| Segment | Sub-Segments |

|---|---|

| By Type (Mode of Transport) | Road Freight Forwarding Ocean/Sea Freight Forwarding Air Freight Forwarding Rail Freight Forwarding Intermodal/Cross-Border (USMCA) Forwarding Express/Time-Critical Freight Others (Project Cargo, Breakbulk) |

| By End-User (Application) | Industrial & Manufacturing (incl. Automotive) Retail & E-commerce Electronics & Electricals Healthcare & Pharmaceuticals Oil, Gas & Energy Food & Beverages Others |

| By Service Type | Transportation & Warehousing Customs Brokerage & Documentation Packaging & Labeling Freight Insurance Value-Added Services (VAS) & Distribution Others |

| By Region | Northern Mexico (Baja California, Sonora, Chihuahua, Coahuila, Nuevo León, Tamaulipas) Central Mexico (CDMX, Estado de México, Querétaro, Guanajuato, Puebla, Hidalgo) Western Mexico (Jalisco, Michoacán, Colima) Gulf & Southeast (Veracruz, Tabasco, Yucatán Peninsula) Pacific Corridor (Sinaloa, Nayarit; incl. Lázaro Cárdenas/Manzanillo port hinterlands) Others |

| By Delivery Speed | Same-Day (Domestic Express) Next-Day Standard (2–5 Days Domestic, Economy International) Time-Definite/Guaranteed Others |

| By Customer Type | B2B B2C C2C Others |

| By Pricing Model | Contract/Freight All Kinds (FAK) & Fixed Rates Spot/Variable Rates (Fuel & Surcharges Linked) Subscription/Platform Fees (Digital Forwarders) Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Automotive Freight Forwarding | 120 | Logistics Coordinators, Supply Chain Managers |

| Retail Supply Chain Logistics | 90 | Operations Directors, Inventory Managers |

| Pharmaceuticals Distribution | 70 | Compliance Officers, Distribution Managers |

| Food and Beverage Logistics | 60 | Quality Assurance Managers, Supply Chain Analysts |

| E-commerce Logistics Solutions | 80 | eCommerce Operations Managers, Fulfillment Specialists |

The Mexico Freight Forwarding Market is valued at approximately USD 6 billion, driven by increased demand for logistics services due to e-commerce growth, manufacturing expansion, and trade activities, alongside improvements in infrastructure such as highways and ports.