Region:Asia

Author(s):Shubham

Product Code:KRAA0894

Pages:90

Published On:August 2025

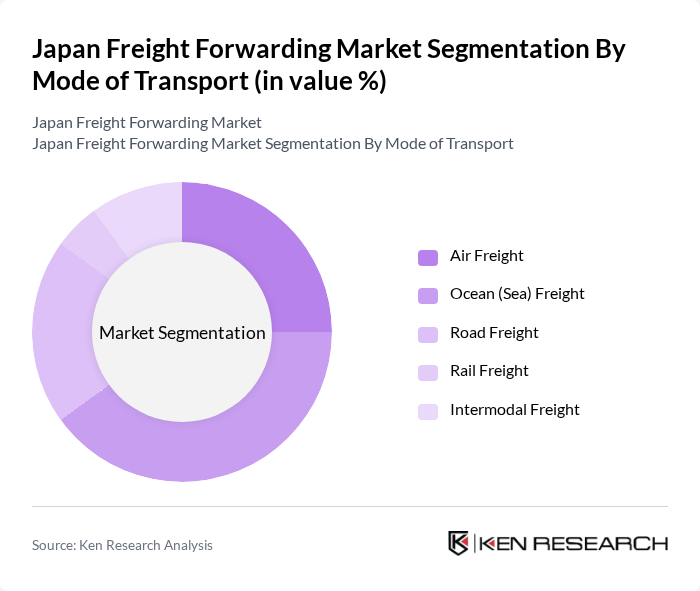

By Mode of Transport:The freight forwarding market is segmented by mode of transport, including air freight, ocean freight, road freight, rail freight, and intermodal freight. Air freight is preferred for time-sensitive and high-value shipments, while ocean freight is favored for bulk goods due to cost efficiency. Road and rail freight provide essential connections for domestic distribution, and intermodal freight leverages multiple transport modes for optimized logistics solutions .

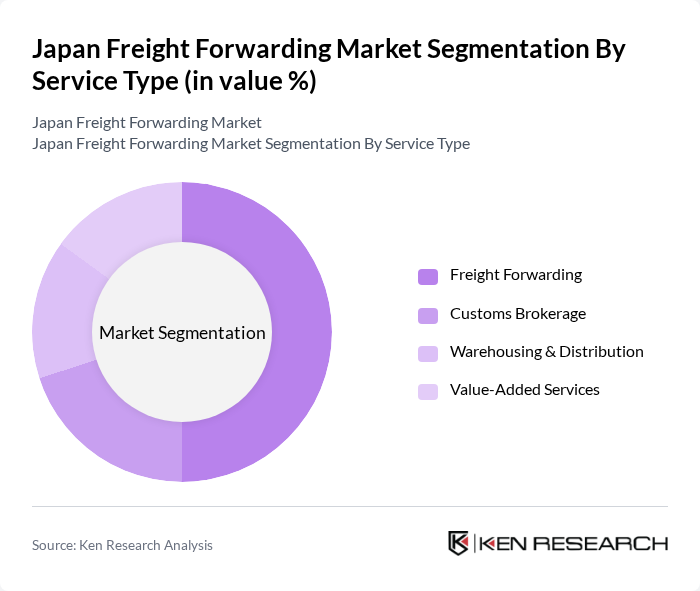

By Service Type:The market is also segmented by service type, including freight forwarding, customs brokerage, warehousing & distribution, and value-added services. Freight forwarding remains the core service, facilitating the movement of goods across borders. Customs brokerage ensures regulatory compliance, warehousing and distribution support inventory management, and value-added services enhance logistics offerings to meet specific customer requirements .

The Japan Freight Forwarding Market is characterized by a dynamic mix of regional and international players. Leading participants such as Nippon Express Holdings, Yamato Holdings, Kintetsu World Express, SG Holdings (Sagawa Express), Hitachi Transport System, Seino Holdings, Mitsui-Soko Holdings, Yusen Logistics, Marubeni Logistics, Sankyu Inc., Kuehne + Nagel, DB Schenker, DSV, CEVA Logistics, Geodis, DHL Global Forwarding, and UPS Supply Chain Solutions contribute to innovation, geographic expansion, and service delivery in this space .

The Japan freight forwarding market is poised for significant transformation, driven by technological innovations and evolving consumer preferences. As e-commerce continues to expand, logistics providers will increasingly leverage automation and AI to enhance efficiency. Additionally, sustainability will become a focal point, with companies adopting greener practices to meet regulatory demands and consumer expectations. The integration of advanced technologies, such as blockchain, will further streamline operations, ensuring transparency and security in the supply chain, ultimately shaping the future landscape of the industry.

| Segment | Sub-Segments |

|---|---|

| By Mode of Transport | Air Freight Ocean (Sea) Freight Road Freight Rail Freight Intermodal Freight |

| By Service Type | Freight Forwarding Customs Brokerage Warehousing & Distribution Value-Added Services |

| By End-User Industry | Automotive Electronics & Electricals Pharmaceuticals & Healthcare Retail & E-commerce Food & Beverage Industrial Manufacturing Others |

| By Shipment Size | Full Container Load (FCL) Less than Container Load (LCL) Bulk Shipments Breakbulk Shipments |

| By Logistics Model | First-Party Logistics (1PL) Second-Party Logistics (2PL) Third-Party Logistics (3PL) Fourth-Party Logistics (4PL) |

| By Import/Export Orientation | Domestic Forwarding International Forwarding |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Automotive Freight Forwarding | 60 | Logistics Managers, Supply Chain Managers |

| Electronics Supply Chain Management | 50 | Operations Managers, Procurement Managers |

| Retail Logistics Solutions | 55 | Warehouse Managers, Distribution Supervisors |

| Pharmaceutical Logistics | 40 | Compliance Officers, Logistics Executives |

| E-commerce Freight Solutions | 45 | E-commerce Operations Managers, Fulfillment Specialists |

The Japan Freight Forwarding Market is valued at approximately USD 15 billion, reflecting a significant growth driven by increasing demand for efficient logistics solutions, the rise of e-commerce, and the expansion of international trade.