Region:Central and South America

Author(s):Rebecca

Product Code:KRAA0358

Pages:90

Published On:August 2025

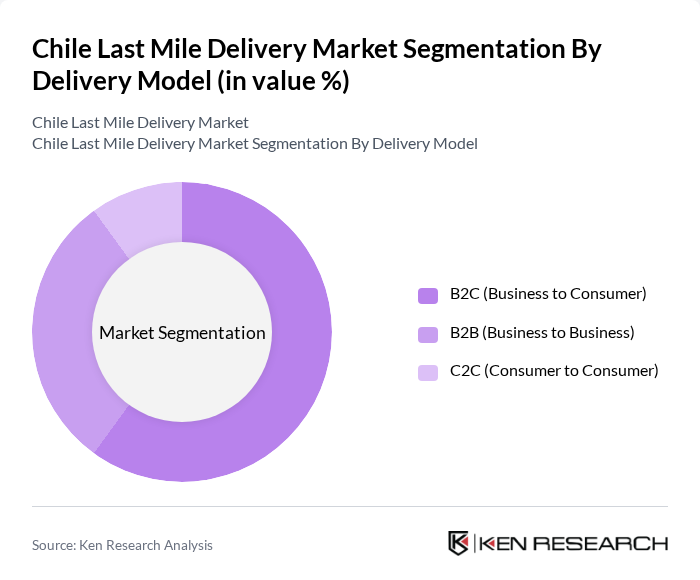

By Delivery Model:

The delivery model segment includes B2C (Business to Consumer), B2B (Business to Business), and C2C (Consumer to Consumer). The B2C segment is currently dominating the market due to the surge in online shopping, particularly during the pandemic, which has led to a significant increase in consumer expectations for fast and reliable delivery. B2B services are also growing, driven by the need for efficient supply chain solutions, while C2C services are gaining traction with the rise of peer-to-peer platforms .

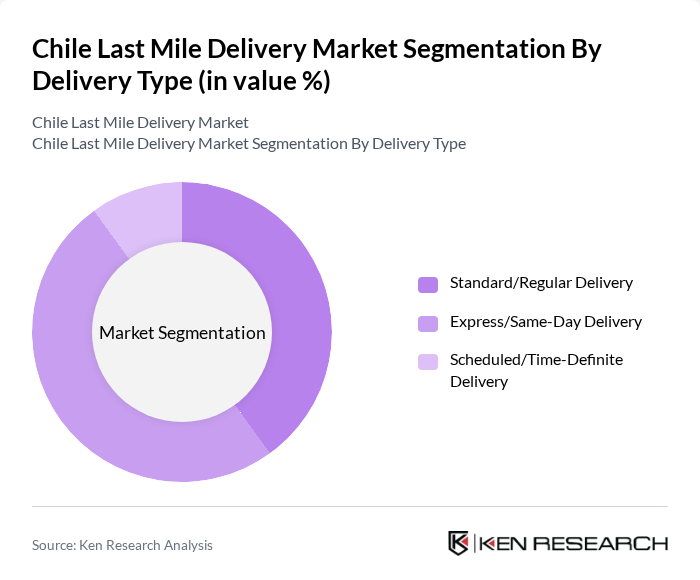

By Delivery Type:

This segment includes Standard/Regular Delivery, Express/Same-Day Delivery, and Scheduled/Time-Definite Delivery. The Express/Same-Day Delivery sub-segment is leading the market, driven by consumer demand for immediate gratification and the convenience of fast delivery options. Standard delivery remains popular for less urgent shipments, while scheduled delivery is gaining traction among businesses that require precise timing for their deliveries .

The Chile Last Mile Delivery Market is characterized by a dynamic mix of regional and international players. Leading participants such as Chilexpress, CorreosChile, Starken, DHL Express, FedEx, UPS, Rappi, Mercado Libre, Linio, Falabella, Ripley, Walmart Chile, Tottus, Jumbo, Unimarc, Easy contribute to innovation, geographic expansion, and service delivery in this space .

The Chile last mile delivery market is poised for significant transformation as e-commerce continues to expand and consumer expectations evolve. Companies are likely to invest in innovative delivery solutions, including drone technology and electric vehicles, to enhance efficiency and sustainability. Additionally, the integration of AI and data analytics will enable businesses to optimize their logistics operations, ensuring faster and more reliable service. As these trends develop, the market will adapt to meet the growing demand for convenient and eco-friendly delivery options.

| Segment | Sub-Segments |

|---|---|

| By Delivery Model | B2C (Business to Consumer) B2B (Business to Business) C2C (Consumer to Consumer) |

| By Delivery Type | Standard/Regular Delivery Express/Same-Day Delivery Scheduled/Time-Definite Delivery |

| By Package Size | Small Packages (e.g., parcels, documents) Medium Packages (e.g., electronics, apparel) Large/Bulky Packages (e.g., appliances, furniture) |

| By Industry Vertical | E-commerce/Retail Food and Grocery Delivery Pharmaceuticals/Healthcare Electronics Others |

| By Customer Segment | Individual Consumers SMEs (Small and Medium Enterprises) Large Enterprises |

| By Geographic Coverage | Metropolitan/Urban Areas Suburban Areas Rural/Remote Areas |

| By Technology Utilization | Mobile Apps and Digital Platforms GPS and Real-Time Tracking Automated Sorting/Dispatch Systems Electric/Green Delivery Vehicles |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Urban Last Mile Delivery Services | 120 | Logistics Managers, Operations Directors |

| Consumer Preferences in Delivery | 140 | Online Shoppers, Retail Customers |

| Small Business Delivery Needs | 100 | Small Business Owners, Retail Managers |

| Technology Adoption in Delivery | 80 | IT Managers, Innovation Officers |

| Environmental Impact of Delivery Services | 70 | Sustainability Managers, Policy Makers |

The Chile Last Mile Delivery Market is valued at approximately USD 600 million, reflecting significant growth driven by the expansion of e-commerce, consumer demand for fast delivery services, and advancements in mobile technology facilitating online shopping.