Region:Asia

Author(s):Rebecca

Product Code:KRAD0263

Pages:88

Published On:August 2025

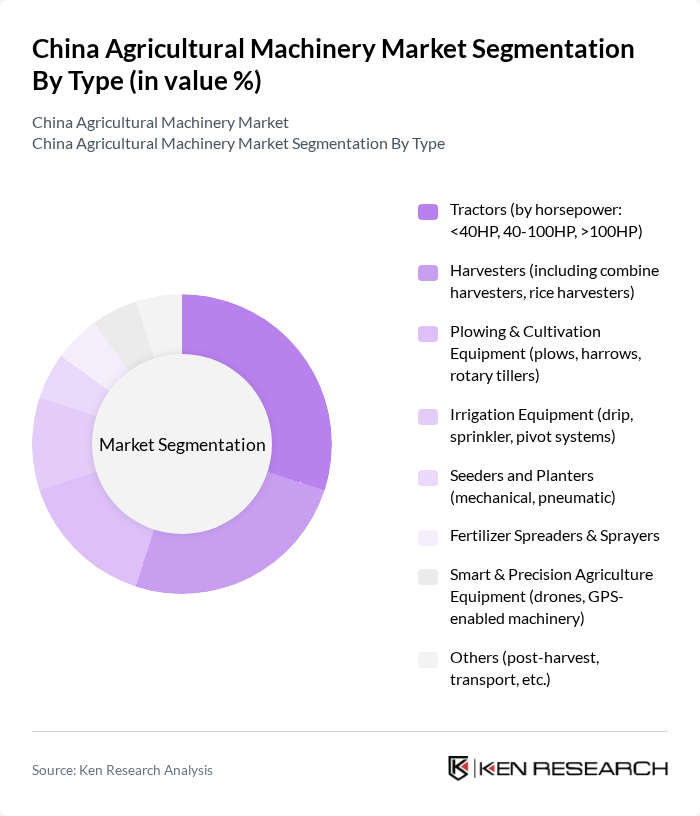

By Type:The market is segmented into various types of agricultural machinery, including tractors, harvesters, plowing and cultivation equipment, irrigation equipment, seeders and planters, fertilizer spreaders and sprayers, smart and precision agriculture equipment, and others. Each sub-segment plays a crucial role in enhancing agricultural productivity and efficiency.

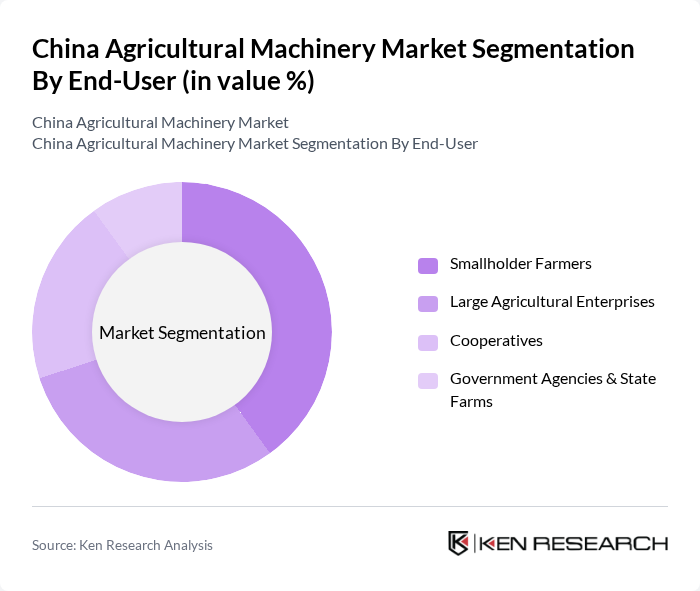

By End-User:The end-user segmentation includes smallholder farmers, large agricultural enterprises, cooperatives, and government agencies & state farms. Each of these segments has distinct needs and purchasing behaviors that influence the types of machinery they invest in.

The China Agricultural Machinery Market is characterized by a dynamic mix of regional and international players. Leading participants such as John Deere, AGCO Corporation, CNH Industrial, YTO Group Corporation, Zoomlion Heavy Industry Science and Technology Co., Ltd., Shandong Shifeng Group Co., Ltd., Weichai Power Co., Ltd., Changfa Agricultural Equipment Co., Ltd., Kubota Corporation, SDF Group (Same Deutz-Fahr), Mahindra & Mahindra Ltd., Escorts Group, TAFE (Tractors and Farm Equipment Limited), CLAAS KGaA mbH, XAG Co., Ltd. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the China agricultural machinery market appears promising, driven by technological advancements and increasing government support. The integration of smart technologies, such as AI and IoT, is expected to revolutionize farming practices, enhancing efficiency and productivity. Additionally, as rural markets continue to expand, there will be a growing demand for affordable and efficient machinery. The government's commitment to food security will further stimulate investments in agricultural technology, ensuring a robust market environment in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Tractors (by horsepower: <40HP, 40-100HP, >100HP) Harvesters (including combine harvesters, rice harvesters) Plowing & Cultivation Equipment (plows, harrows, rotary tillers) Irrigation Equipment (drip, sprinkler, pivot systems) Seeders and Planters (mechanical, pneumatic) Fertilizer Spreaders & Sprayers Smart & Precision Agriculture Equipment (drones, GPS-enabled machinery) Others (post-harvest, transport, etc.) |

| By End-User | Smallholder Farmers Large Agricultural Enterprises Cooperatives Government Agencies & State Farms |

| By Application | Crop Production (grain, rice, corn, etc.) Livestock Farming (feed preparation, manure handling) Horticulture (fruit, vegetable, greenhouse) Aquaculture (pond management, feeding systems) |

| By Sales Channel | Direct Sales (manufacturer to farm) Distributors & Dealers Online Sales & E-commerce Platforms |

| By Distribution Mode | Retail Outlets Wholesale Markets E-commerce Platforms |

| By Price Range | Low-End Machinery (basic, entry-level) Mid-Range Machinery (standard, value-for-money) High-End Machinery (premium, advanced tech) |

| By Policy Support | Subsidies Tax Exemptions Grants for Innovation & Technology Adoption |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Tractor Manufacturers | 90 | Product Managers, Sales Directors |

| Harvesting Equipment Suppliers | 70 | Operations Managers, R&D Managers |

| Farmers and Agricultural Cooperatives | 120 | Farm Owners, Cooperative Leaders |

| Government Agricultural Policy Makers | 40 | Policy Analysts, Program Managers |

| Agri-tech Startups | 60 | Founders, Technology Managers |

The China Agricultural Machinery Market is valued at approximately USD 24 billion, driven by increasing food production demands, technological advancements, and government support for modernizing agriculture. This market has seen significant growth over the past five years.